You know you need a Customs bond, but do you know your responsibilities as the principal on the bond? TRG breaks down the top four Customs bond conditions to help you better understand and avoid a claim.

For many importers, a Customs bond is just a required piece of the process when importing in the United States. However, like any other legal contract, there are conditions that are agreed to when the bond goes on file with U.S. Customs and Border Protection.

As the principal on the bond, importers should familiarize themselves with these Customs bond conditions to understand their part in the agreement with CBP and what they are ultimately responsible for while importing. Understanding the bond conditions will help you be proactive and ultimately avoid a liquidated damages claim.

Customs Bond Conditions

There are 13 different Customs bond conditions outlined in the Code of Federal Regulations (19CFR§113.62) that are included in every Customs bond for basic importation and entry, single transaction bonds and continuous bonds alike. The following are the top four bond conditions that lead to claims, but having an understanding of all 13 conditions is recommended to be a fully informed importer.

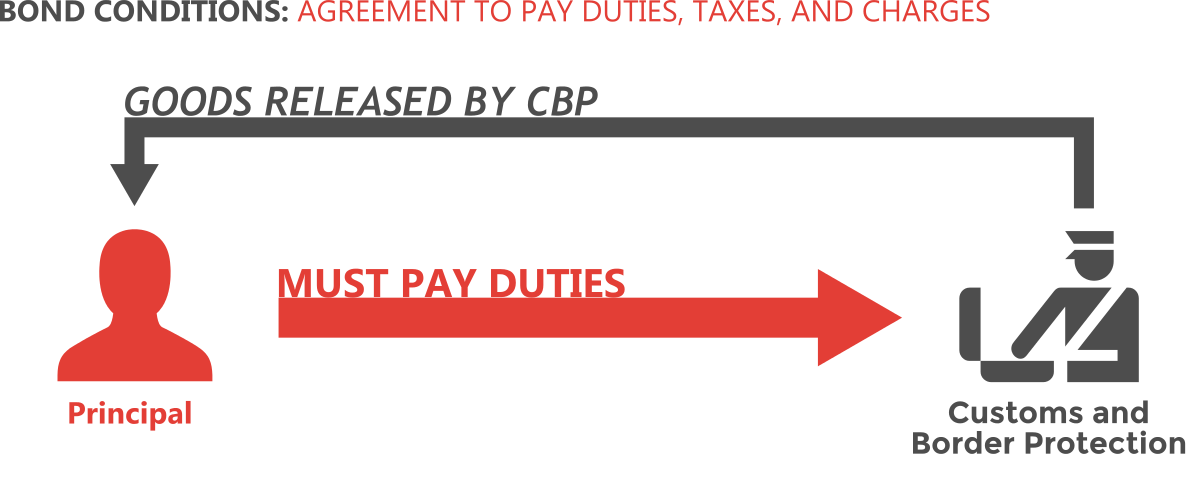

Agreement to Pay Duties, Taxes, and Charges

This condition of the Customs bond may seem like the most apparent part of the agreement between the principal and CBP. However, it is a very common claim encountered by importers.

There are three parts to this agreement that outline the details of paying all duties, taxes, and fees to CBP:

- At the time that imported merchandise is released from CBP custody or withdrawn from a CBP bonded warehouse to enter U.S. commerce, all imposed or estimated duties, taxes, and charges will be paid. After goods have been liquated, any additional duties, taxes, and charges found due will be paid by the principal.

- If the imported commodities are held in a CBP bonded warehouse, all duties, taxes, and charges must be paid when the warehousing time limit of 5 years has expired. At this time, the duties must be paid even if the items are not removed from the CBP bonded warehouse.It is also important to remember that these duties, taxes, and charges must be paid regardless of how or who removes the goods from the warehouse. If payment is not received, the bond principal holds the obligation to pay and is liable for the amount due.

- The final part of this bond condition states that the bond the goods are entered with takes responsibility of the goods unless a superseding bond establishing ownership is filed.

For full details on this condition, refer to the CFR Chapter 19 §113.62 (a).

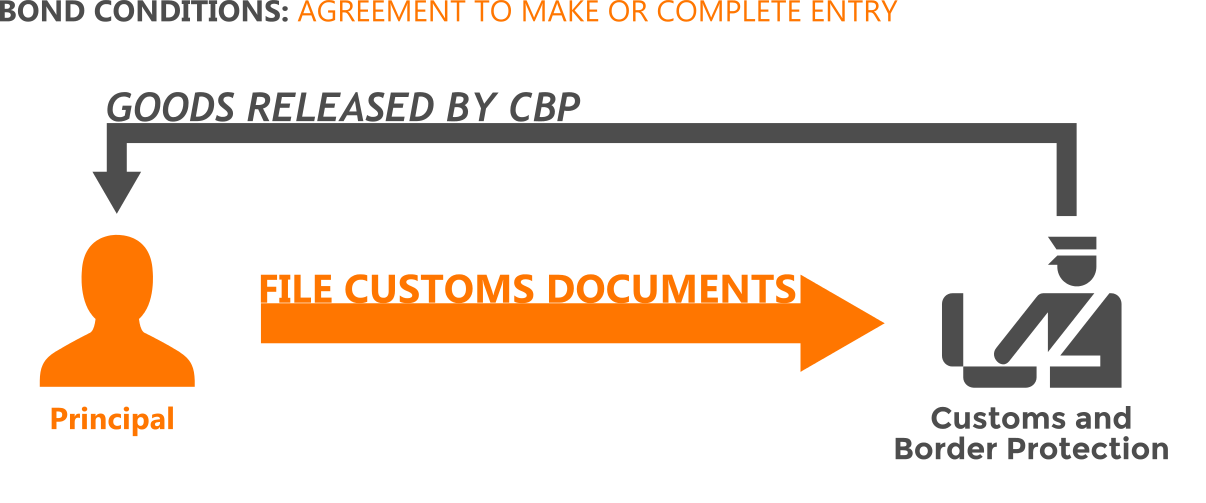

Agreement to Make or Complete Entry

Of all the Customs bond conditions, this agreement can lead to the most confusion for importers especially if they are relatively new to the process. It states that if the imported goods are released before all entry documentation has been filed, it is the principal’s responsibility to ensure that all documents are filed within the timeframe outlined in the federal regulation. This is especially relevant in the case of filing an Entry Summary (CBP 7501) after the goods have been released which needs to happen with 10 business days. In many cases, a claim will occur when the Entry Summary is filed late.

In many cases, importers assume that this agreement is the responsibility of the Customs Broker or Freight Forwarder they have hired since they handle filing all entry documentation as part of their services. However, in the event there is a missing piece of documentation or something is filed late, the principal on the bond is held responsible by CBP and must pay the charges associated with this mishap.

For full details on this condition, refer to the CFR Chapter 19 §113.62 (b).

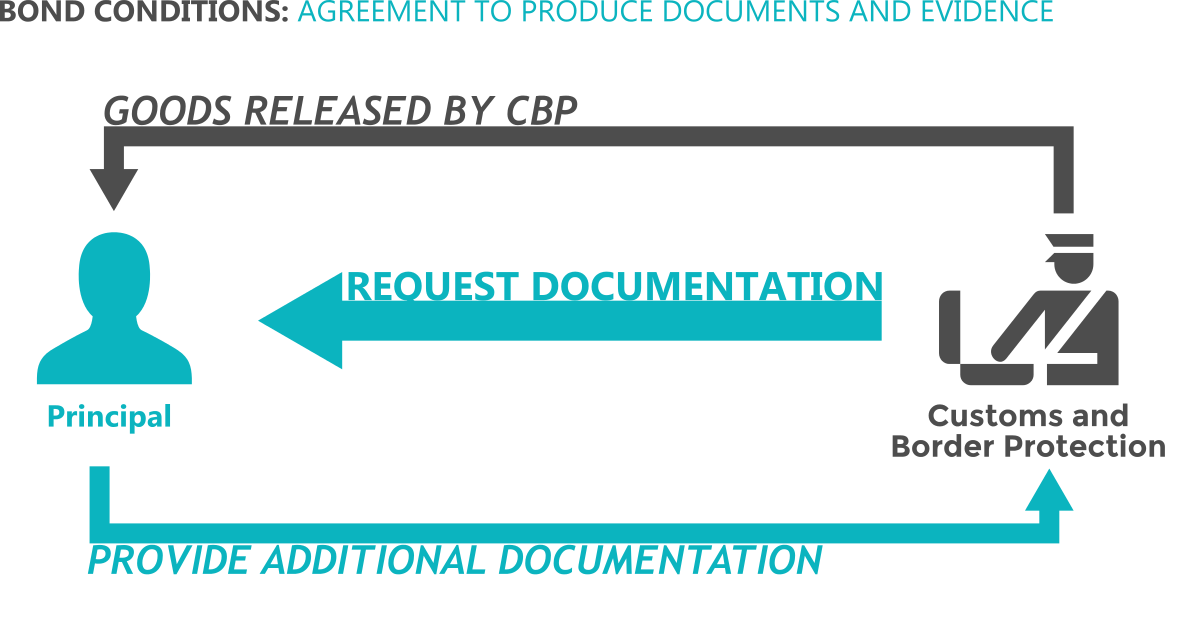

Agreement to Produce Documents and Evidence

The third agreement outlined in the Customs bond conditions is relatively simple. Basically, if the imported commodities are released conditionally before all required documents and evidence have been provided to CBP, the principal must produce any additional documents CBP may require. For example, if the importer says they are NAFTA eligible, the goods are conditionally released, and then CBP requests documentation establishing NAFTA eligibility the principal must provide the requested documentation.

For full details on this condition, refer to the CFR Chapter 19 §113.62 (c).

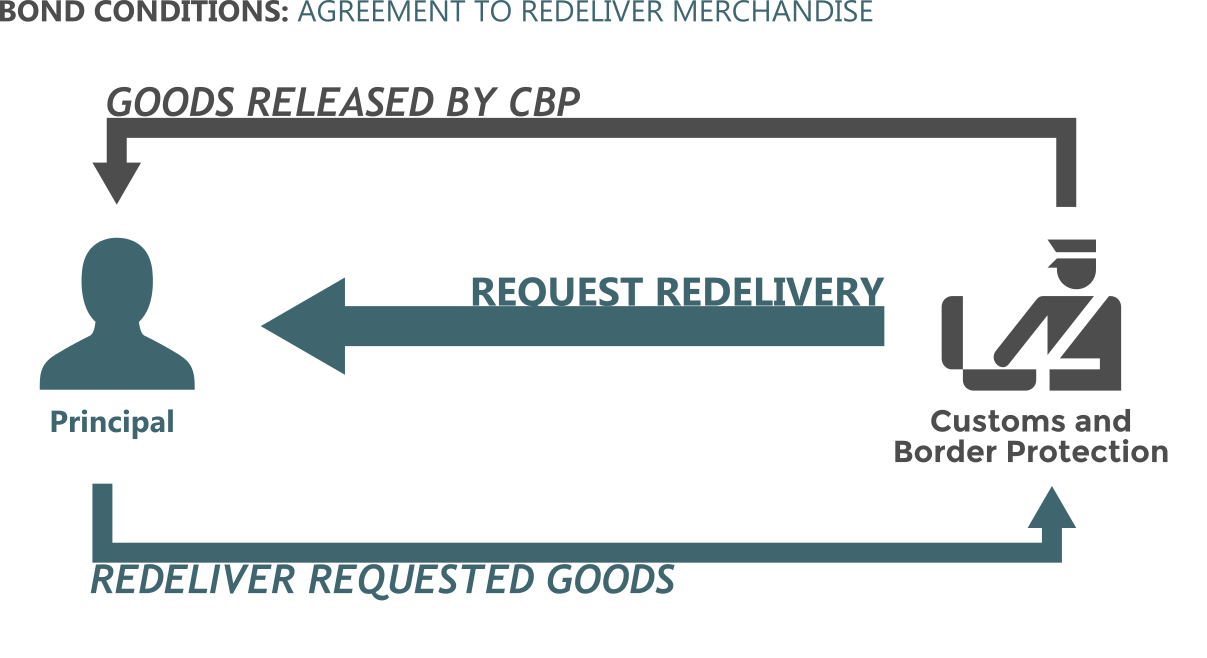

Agreement to Redeliver Merchandise

This fourth agreement can prove to be confusing for many importers. When goods are conditionally released from CBP custody, the principal may be required to return the goods to Customs for the following reasons:

- Fails to comply with the laws or regulations governing admission into the United States: CBP enforces the laws and regulations of a number of other government bodies such as the FDA. In the case of the FDA, they have a specific timeframe in which they can demand certain commodities be removed from U.S. commerce. Meaning CBP would enforce this demand through this agreement to redeliver merchandise.

- Must be examined, inspected, or appraised as required by 19 U.S.C. 1499

- Must be marked with the country of origin as required by law or regulation: If CBP sees that the incorrect country of origin is named or that the country of origin is missing completely, they will demand the redelivery of the goods to correct the information.

A common example of these three that would require delivery of imported goods is a marking violation such as naming the incorrect country of origin. However, CBP must make their demand for redelivery no later than 30 days after the date merchandise was released, or 30 days after the end of the conditional release period (whichever date is later).

For full details on this condition, refer to the CFR Chapter 19 §113.62 (d).

Responsibilities of the Customs Bond Principal

As the principal named on a U.S. Customs bond, it is most important to remember that you are the one held liable by CBP. Even if a Customs Broker or Freight Forwarder has been hired to aid in the entry and logistics of your goods, they are not a named party on the bond and therefore do not have a vested interest if a claim occurs. Although you may hold them responsible for any mistake in the process, CBP will hold you as the bond principal responsible.

![[Video] What Are Antidumping and Countervailing Duties?](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2024/03/what-are-antidumping-countervailing-duties-YT-400x250.png)