The U.S.T.R. announced additional rounds of Section 301 exclusions to goods included on List 1, 2, and 3. These items will be excluded from the current 25% tariff which will be raised to 30% on October 15th.

On September 20, 2019, the United States Trade Representative released a series of announcements about new exclusions to List 1, 2, and 3 for the Section 301 tariffs on goods imported from China. You can find the official announcements here: Round 7 List 1 Exclusions, Round 2 List 2 Exclusions, Round 2 List 3 Exclusions.

These exclusions cover a total of 437 specially prepared product descriptions that reflect 1,170 exclusion requests. The scope of each exclusion is governed by the scope of the product descriptions set forth in the attached notice and not by the product descriptions in any particular request.

The exclusions will be effective on the following dates:

- exclusions for List 1 goods will be retroactive to July 6, 2018, and remain in place through Sept. 20, 2020, and must be claimed using new HTSUS subheading 9903.88.14

- exclusions for List 2 goods will be retroactive to Aug. 23, 2018, and remain in place through Sept. 20, 2020, and must be claimed using new HTSUS subheading 9903.88.17

- exclusions for List 3 goods will be retroactive to Sept. 24, 2018, and remain in place until Aug. 7, 2020 (which are now the uniform beginning and expiration dates for all List 3 exclusions that have been or may be granted) and must be claimed using new HTSUS subheading 9903.88.18

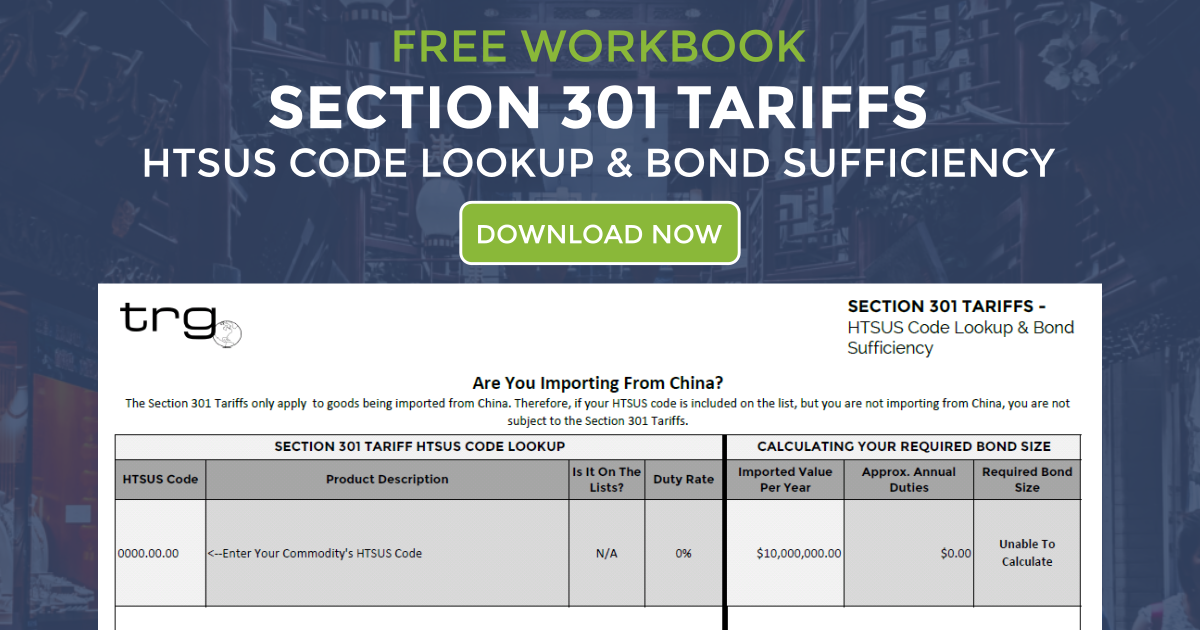

To see a full list of the HTSUS codes from all the list that have been granted an exclusion in all rounds, view this PDF from Trade Risk Guaranty.

![[Webinar] 2023 Q2 International Trade Update](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2023/08/2023.07_Q2-International-Trade-Update_Page_01-400x250.png)

![[Webinar] 2023 Q1 International Trade Update](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2023/03/trg-2023-q1-international-trade-update-webinar-400x250.png)