Ever since the Chinese tariffs have gone into effect, importing into the United States has become increasingly complicated.

The additional tariffs imposed on goods from China have impacted the international trade community in a wide variety of ways. Many of these ways are parts of the importing process that the importer of record does not take part in. However, even a little deeper understanding of these processes can help an importer get some insight into how the Chinese tariffs are affecting their shipments into the United States.

Additional Codes to File Entries with Chinese Tariffs

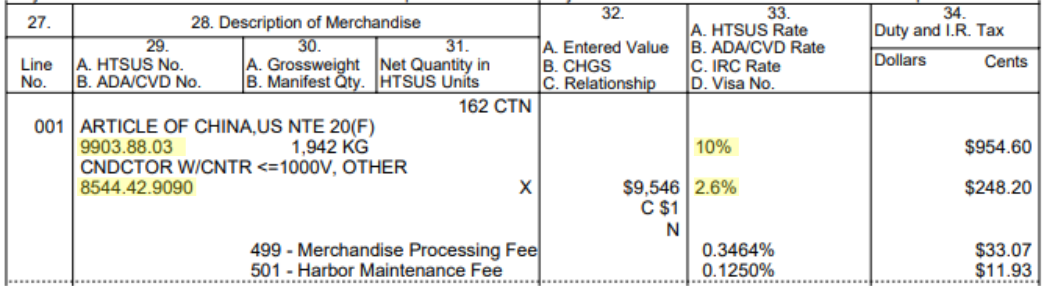

A key component of your Entry Summary (CBP Form 7501) is declaring the correct HTSUS code for the commodities you are importing into the United States. In most scenarios, a Customs Broker handles the classification of goods for an importer and files all the paperwork for a given entry including the Entry Summary. Therefore, most importers do not regularly look over how their Entry Summary is filled and what HTSUS codes were used.

If you are importing goods subject to the additional tariffs on imports from China and you have looked over a recent entry summary, you may be wondering ‘What are these other HTSUS codes on my entry?’ or ‘Did my HTSUS code change?’. Since the Chinese tariffs have been imposed as a negotiation tactic during talks between the U.S. and China, Customs and Border Protection has taken the following approach to enforcing the additional tariffs.

While these tariffs are active, you (or your Customs Broker) must use an additional filing code to classify your goods. This additional code declares to CBP that your entry has a Country of Origin of China and is subject to the additional duty rate. The following is a list of the additional HTSUS codes that need to be included depending on what list your item is on.

Harmonized Tariff Schedule for Chinese Tariffs

This information was pulled from the Harmonized Tariff Schedule on 1/9/19 (The ‘List? column was added by TRG)

| Heading/ Subheading |

Article Description | Rate of Duty | List? |

|---|---|---|---|

| 9903.88.01 | Articles the product of China, as provided for in U.S. note 20(a) to this subchapter and as provided for in the subheadings enumerated in U.S. note 20(b) [to this subchapter] | The duty provided in the applicable subheading plus 25% | List 1 |

| 9903.88.02 | Articles the product of China, as provided for in U.S. note 20(c) to this subchapter and as provided for in the subheadings enumerated in U.S. note 20(d) | The duty provided in the applicable subheading + 25% | List 2 |

| 9903.88.03 | Articles the product of China, as provided for in U.S. note 20(e) to this subchapter and as provided for in the subheadings enumerated in U.S. note 20(f) | The duty provided in the applicable subheading + 10% | List 3 |

| 9903.88.04 | Articles the product of China, as provided for in U.S. note 20(g) to this subchapter and as provided for in the subheadings enumerated in U.S. note 20(g) | The duty provided in the applicable subheading + 10% | List 3 Exclusions |

| 9903.88.05 | Articles the product of China, as provided for in U.S. note 20(h) to this subchapter, each covered by an exclusion granted by the U.S. Trade Representative | The duty provided in the applicable subheading | List 1 Exclusions (round 1) |

| 9903.88.06 | Articles the product of China, as provided for in U.S. note 20(i) to this subchapter, each covered by an exclusion granted by the U.S. Trade Representative | The duty provided in the applicable subheading | List 1 Exclusions (round 2) |

| 9903.88.07 | Articles the product of China, as provided for in U.S. note 20(j) to this subchapter, each covered by an exclusion granted by the U.S. Trade Representative | The duty provided in the applicable subheading | List 1 Exclusions (round 3) |

| 9903.88.08 | Articles the product of China, as provided for in U.S. note 20(k) to this subchapter, each covered by an exclusion granted by the U.S. Trade Representative. | The duty provided in the applicable subheading | List 1 Exclusions (round 4) |

| 9903.88.10 | Articles the product of China, as provided for in U.S. note 20(m) to this subchapter, each covered by an exclusion granted by the U.S. Trade Representative. | The duty provided in the applicable subheading | List 1 Exclusions (round 5) |

| 9903.88.11 | Articles the product of China, as provided for in U.S. note 20(m) to this subchapter, each covered by an exclusion granted by the U.S. Trade Representative. | The duty provided in the applicable subheading | List 1 Exclusions (round 6) |

| 9903.88.12 | Articles the product of China, as provided for in U.S. note 20(o) to this subchapter, each covered by an exclusion granted by the U.S. Trade Representative. | The duty provided in the applicable subheading | List 2 Exclusions (round 1) |

| 9903.88.13 | Articles the product of China, as provided for in U.S. note 20(p) to this subchapter, each covered by an exclusion granted by the U.S. Trade Representative. | The duty provided in the applicable subheading | List 3 Exclusions (round 1) |

| 9903.88.14 | Articles the product of China, as provided for in U.S. note 20(p) to this subchapter, each covered by an exclusion granted by the U.S. Trade Representative. | The duty provided in the applicable subheading | List 1 Exclusions (round 7) |

| 9903.88.17 | Articles the product of China, as provided for in U.S. note 20(p) to this subchapter, each covered by an exclusion granted by the U.S. Trade Representative. | The duty provided in the applicable subheading | List 2 Exclusions (round 2) |

| 9903.88.18 | Articles the product of China, as provided for in U.S. note 20(p) to this subchapter, each covered by an exclusion granted by the U.S. Trade Representative. | The duty provided in the applicable subheading | List 3 Exclusions (round 2) |

| 9903.88.19 | Articles the product of China, as provided for in U.S. note 20(p) to this subchapter, each covered by an exclusion granted by the U.S. Trade Representative. | The duty provided in the applicable subheading | List 1 Exclusions (round 8) |

| 9903.88.20 | Articles the product of China, as provided for in U.S. note 20(p) to this subchapter, each covered by an exclusion granted by the U.S. Trade Representative. | The duty provided in the applicable subheading | List 2 Exclusions (round 3) |

| 9903.88.33 | Articles the product of China, as provided for in U.S. note 20(p) to this subchapter, each covered by an exclusion granted by the U.S. Trade Representative. | The duty provided in the applicable subheading | List 3 Exclusions (round 3) |

How Are Chinese Tariffs Filed on a CBP Form 7501 (Entry Summary)?

When you are bringing in goods subject to the Section 301 tariffs on imports from China, you or your Customs Broker must include the HTSUS codes listed above on the entry summary for each shipment. This additional code must be included before the HTSUS code classifying your commodity in order to denote that it has a country of origin of China and to indicate which list this item is included on.

Entries subject to the Chinese tariffs that are not filed in this manner will result in a Supplemental Duty Bill being issued and additional monies will be due to Customs. Below is an example of an entry summary that includes the additional HTSUS code and the HTSUS code that classifies the commodity.

This example also illustrates the fact that these tariffs are IN ADDITION to the normal duty rate due for that commodity.

![[Webinar] 2023 Q2 International Trade Update](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2023/08/2023.07_Q2-International-Trade-Update_Page_01-400x250.png)