The trade war between China and the U.S. continues as the additional tariffs on Chinese goods included on List 3 raises from 10% to 25%.

After negotiations failed between the United States and China, the trade war continues to escalate with both countries taking further action. As of May 10, the United States Trade Representative has announced that the additional tariffs on Chinese goods included on List 3 of Section 301 will be increasing from 10% to 25%.

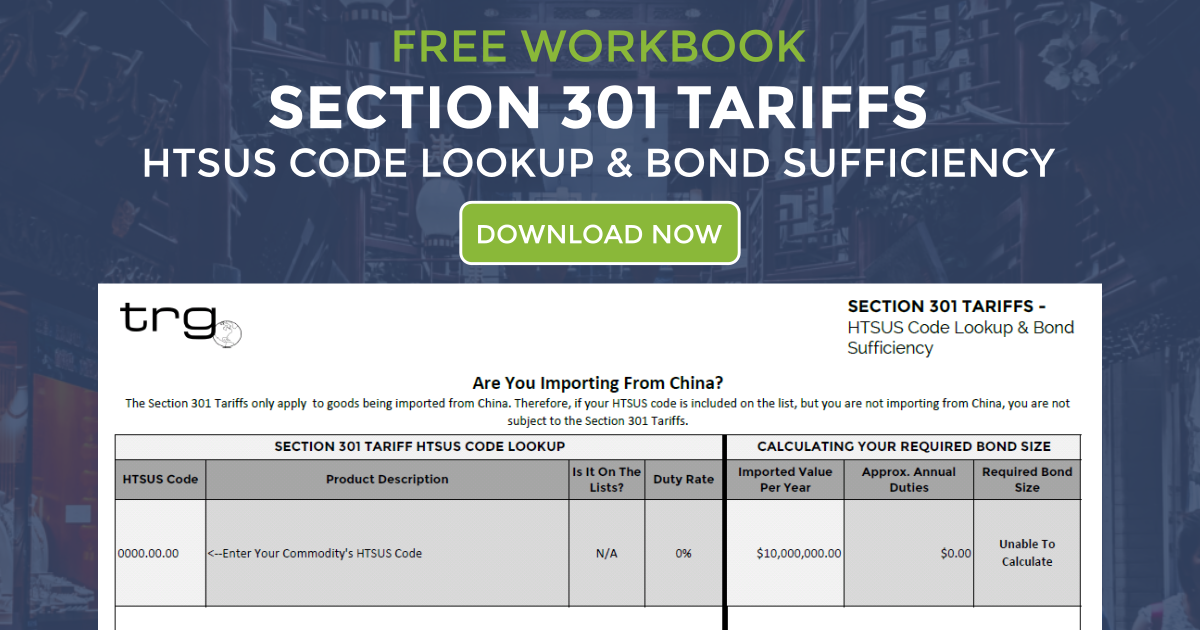

This increase is on the largest of the three Section 301 Lists, containing $200 billion in goods imported by U.S. Importers from China. For a full list of all the goods included on this list, download the Section 301 List 3 PDF from TRG or use TRG’s Section 301 HTSUS Lookup Tool to find out if your HTSUS code is included in any of the three lists currently enforced.

When Does the 25% Tariffs on Chinese Goods Take Effect?

Although the announcement was made official on May 10, 2019, there is now a June 1 deadline for Chinese-origin goods included on List 3 to be entered into the U.S. to avoid a tariff increase.

U.S. Customs and Border Protection states that such goods must be reported under HTSUS 9903.88.03 or 9903.88.04. And the announcement states that the increase will take place on goods:

- (a) entered for consumption, or withdrawn from warehouse for consumption, on or after 12:01 a.m. EST on May 10

- (b) exported to the U.S. on or after May 10.

Additionally, List 3 goods exported from their country of origin before May 10 and entered into the U.S. on or after May 10, but before June 1 will remain subject to the 10% tariff and must be reported under new HTSUS 9903.88.09 to distinguish them from goods subject to the 25 percent rate.

What About Goods in a Foreign Trade Zone?

The USTR has announced that List 3 goods admitted into a U.S. foreign-trade zone in privileged foreign status will retain that status. When entered for consumption, those goods will be subject to the Section 301 additional tariff rate in effect at the time of FTZ admission.

What to do if You Are Subject to the Increase?

If you are an importer bring in commodities included on List 3, there are a few things that may happen as a result of the increase to 25% that you should be aware of:

- Avoid Bond Insufficiency

This is a topic that TRG has covered extensively, but it continues to impact importers. An increase in the duty rate that you pay to Customs can result in your Customs Bond being deemed insufficient by Customs. Once your bond is deemed insufficient, you will have to place a new bond before you can continue importing into the United States. For a more comprehensive breakdown on how this works, watch our webinar on How Chinese Tariffs Impact Bond Sufficiency. - Stay Updated on Customs

It may seem obvious, but in these turbulent times in the world of international trade, staying updated on news from Customs is more important than ever. It is also important to remember that an announcement is not official until if has been added to the Federal Registrar. So make sure to check for the newest publication there whenever news comes out.

![[Webinar] 2023 Q2 International Trade Update](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2023/08/2023.07_Q2-International-Trade-Update_Page_01-400x250.png)

![[Webinar] 2023 Q1 International Trade Update](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2023/03/trg-2023-q1-international-trade-update-webinar-400x250.png)