In September 2018, the Miscellaneous Tariff Bill was signed but what is it? And what is the intended purpose?

The Miscellaneous Tariff Bill Act of 2018 (also referred to as MTB) was signed by President Trump on September 23, 2018. This bill removes or reduces tariffs on over 1,600 different HTSUS codes designated as raw materials or intermediate products that couldn’t be sourced domestically, for use in manufacturing. The intended purpose of this bill is to ensure that U.S. manufacturers are not at a disadvantage to their foreign competitors when sourcing manufacturing components.

As of now, the current MTB petition cycle is complete with the duty suspensions and reductions going into effect for goods entered on or after October 13, 2018 (which is 30 days after the date of the enactment). These suspensions and reductions will last until December 31, 2020, and the next MTB petition cycle (for 2021 through 2023) will begin no later than October 15, 2019.

Download the Full List of Goods Included in the Miscellaneous Tariff Bill

What is the Overlap Between Section 301 & the Miscellaneous Tariff Bill?

Of the over 1,600 items included in the Miscellaneous Tariff Bill, roughly half are produced in China. Therefore, there is quite a bit of overlap between these items and those included on one of the Section 301 lists.

Goods included on the MTB list that originates in China are still subject to any relevant Section 301 tariffs. This bill does not absolve you of your duty to pay tariffs as a result of Section 301, 232, 201, or otherwise. Meaning that even though the initial duty rate may have been reduced, you will be required to pay the additional tariff.

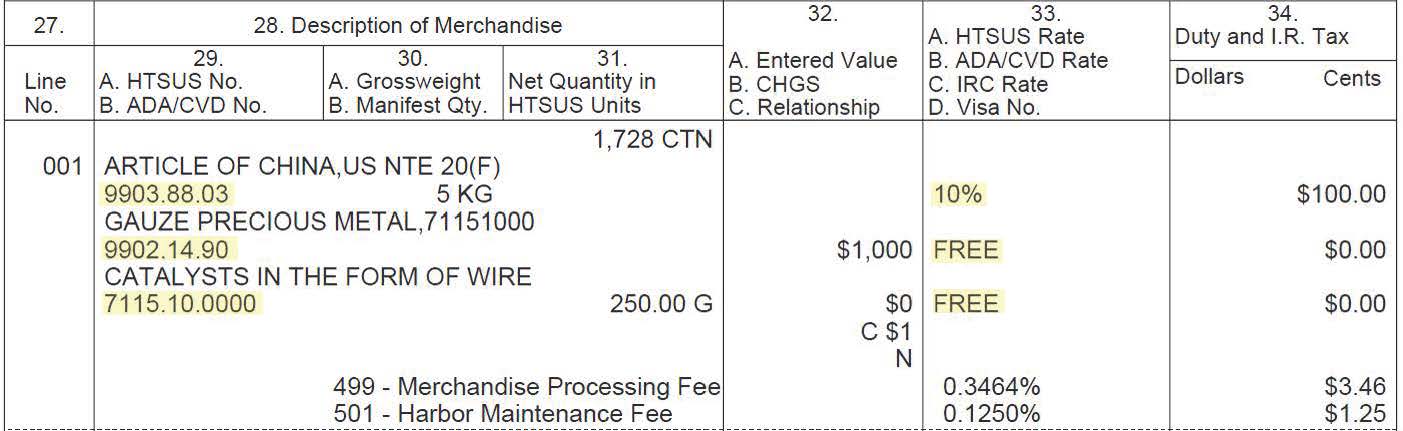

The following image is an example of how these tariff rates stack and how they appear on a CBP Form 7501 when the entry is filed by your Customs Broker.

As you can see in the example, a total of 3 HTS codes are used when classifying this one commodity. And in the end, a 10% duty is paid on the entry even though the ‘initial duty’ has been reduced to ‘Free’.

- 7115.10.0000 – This is the 10-digit HTSUS code used to classify this particular commodity. As you can see, the corresponding duty rate for this commodity is ‘Free’ due to the fact that it is included on the list of MTB goods.

- 9902.14.90 – This is the 8-digit HTSUS code used to declare that the commodity 7115.10.0000 is included on the list of MTB goods. The corresponding duty rate remains ‘Free’ on this one.

- 9903.88.03 – This is the 8-digit HTSUS code used to declare that the commodity 7115.10.0000 is included on list 3 of Section 301. As you can see, that results in a 10% tariff being added to this entry.

![[Video] What Are Antidumping and Countervailing Duties?](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2024/03/what-are-antidumping-countervailing-duties-YT-400x250.png)