On March 23, 2022 the USTR announced that the section 301 exclusions for 352 HTSUS codes would be reinstated through December 31, 2022.

Back in October 2021, the United States Trade Representative began the “targeted tariff exclusion process” which has resulted in the reinstatement of certain tariff exclusions that had previously expired. During this process, the USTR allowed interested parties to request this reinstatement of 549 tariff exclusions that had expired between December 31, 2020 and April 18 2021.

These 549 exclusions were the only ones eligible for reinstatement as the USTR did not consider requests concerning other exclusions nor did they consider any requests for new product exclusions.

Which Section 301 Exclusions Were Reinstated?

For a full list of Section 301 exclusions that have been reinstated, refer to the annex section of the USTR’s Federal Registrer notice. However, the reinstated tariff exclusions include HTSUS codes for certain types of machinery, motors, electrical equipment, chemicals, plastics, textiles, bicycles, motorcycles, and automotive parts, among other items.

The reinstated tariff exclusions will apply retroactively to October 12, 2021 and will extend through December 31, 2022, although the USTR may consider further extensions if appropriate. As with all Section 301 tariff exclusions, the reinstated exclusions are available for any product that meets the description in the product exclusion, regardless of whether the importer filed an exclusion request with USTR.

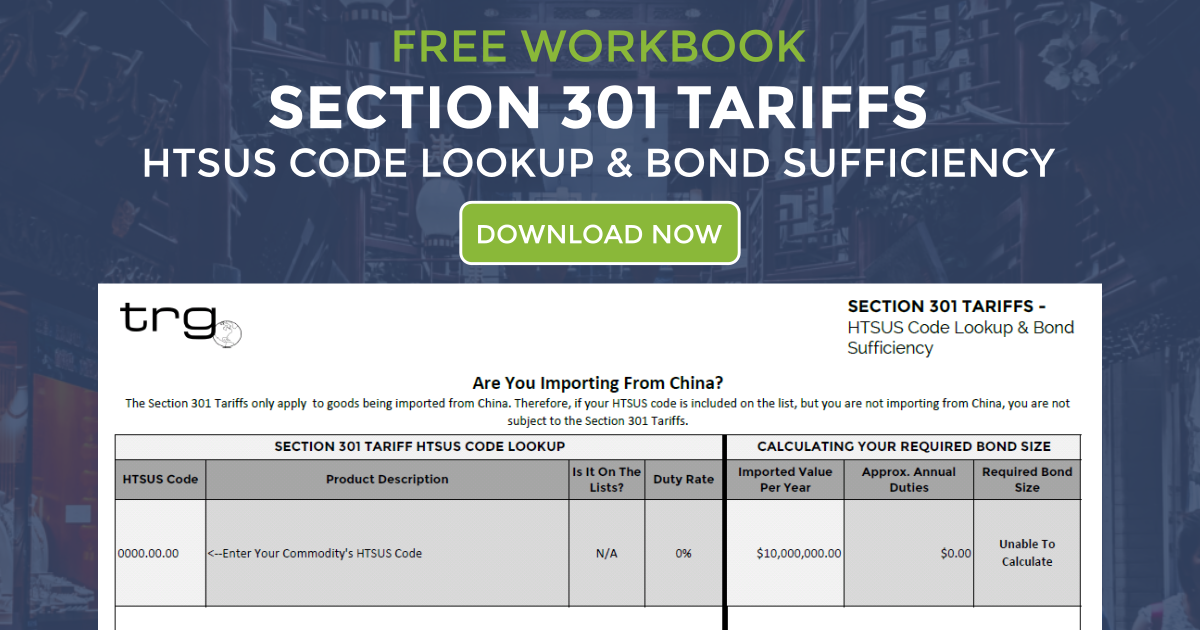

Download TRG’s Section 301 Tariff HTSUS Lookup Tool

If you are not sure if a new product you are importing from China is subject to the Section 301 tariffs or if you want to doublecheck if there is an exclusion on your HTS, download the free workbook TRG created to help you make that determination quickly. Just enter the first 8 digits of your HTSUS code into the available field and ensure that your entry is following the stated format. This tool will then quickly tell you if the code you entered is subject to the Section 301 tariffs and if there are any exclusions available.

REMINDER: This tool is intended to be used as a starting point to your research. TRG recommends that you double-check your HTSUS code with the official lists provided by the USTR to ensure that you are subject to the additional tariffs and what exclusions are available. This information can be found on the USTR’s website page title China Section 301-Tariff Actions and Exclusion Process.

![[Webinar] 2023 Q2 International Trade Update](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2023/08/2023.07_Q2-International-Trade-Update_Page_01-400x250.png)