The unpredictability of international trade continues with the potential of Section 301 tariffs on EU goods. Make sure your business is prepared for the next couple of months.

On April 8, 2019, the office of the United States Trade Representative released a preliminary list of goods from the European Union that will be affected by additional tariffs imposed in retaliation to subsidies received by Airbus. The USTR announced the initiation of the investigation and is currently accepting public comments. The proposed additional tariffs may be up to 100% and include $11 billion worth of EU imports.

What EU Goods will be Affected by Section 301?

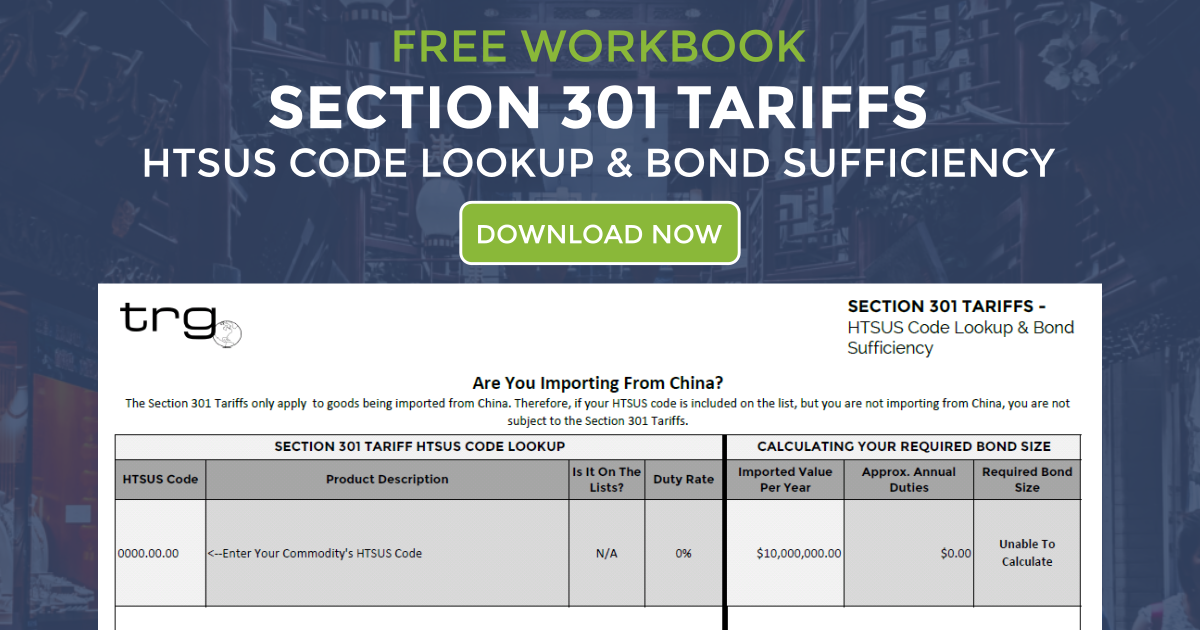

The items included on the preliminary list published by the USTR include a variety of items from aircraft components to cheese and seafood. Download TRG’s PDF of all the HTSUS codes included in the preliminary list of Section 301: EU Goods to read through them all.

The original estimated value of the goods to be included on the list was $21 billion in 2018, but the list released on April 8, 2019, includes $11.2 billion worth of imports from the EU. Although the additional duty rate has not yet been determined, it may be as high as 100%. So importers that may be subject should begin preparing for the increase in duties.

Why Would Tariffs on EU Goods be Imposed?

The potential Section 301 tariffs on EU goods is in retaliation to a long-standing dispute over the number of subsidies being given to Airbus by countries in the European Union. According to the USTR, after more than a decade of litigation, the World Trade Organization’s Appellate Body ruled in May 2018 that the EU had failed to fully withdraw subsidized financing to Airbus previously found to be inconsistent with WTO rules and harmful to U.S. interests. Following that decision, the U.S. requested the authority to impose $11.2 billion worth of countermeasures, a figure that the EU immediately challenged. A decision on this request is expected from the WTO this summer.

In order to get the process started so that the U.S. can respond immediately when the decision is released, the preliminary list was announced. The USTR is now working on identifying the items that will be included on the final list and which will have specific duty rates.

If you want to learn more about what Section 301 is and why it would be used in this case, take a look at our previous post about when they were first imposed on goods from China.

What Can You Do?

At this point in the process, you can still take part in the process leading up to the imposition of the additional tariffs on EU goods. The following are a few important dates:

- May 6, 2019: Due date for submission of requests to appear at the public hearing and summary of testimony.

- May 15, 2019: The Section 301 Committee will convene a public hearing in the Main Hearing Room of the U.S. International Trade Commission, 500 E Street SW Washington DC 20436 beginning at 9:30 am.

- May 28, 2019: Due date for submission of written comments, including post-hearing rebuttal comments.

Written comments should be submitted through the Federal eRulemaking Portal under the docket number USTR-2019-0003.

The USTR invites comments with respect to any aspect of the proposed action, including:

- The specific products to be subject to increased duties, including whether products listed in the Annex should be retained or removed, or whether products not currently on the list should be added.

- The level of the increase, if any, in the rate of duty.

- The appropriate aggregate level of trade to be covered by additional duties.

- Whether increased duties on particular products might have an adverse effect upon U.S. stakeholders, including small businesses and consumers.

![[Webinar] 2023 Q2 International Trade Update](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2023/08/2023.07_Q2-International-Trade-Update_Page_01-400x250.png)

![[Webinar] 2023 Q1 International Trade Update](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2023/03/trg-2023-q1-international-trade-update-webinar-400x250.png)