In June 2018, it was announced that an additional 25% duty will be imposed on certain goods imported from China. But what are these goods and why has this gone into effect?

On June 20, 2018, the U.S. Trade Representative (USTR) announced that an additional 25% duty will be imposed on certain products imported from China. There are two lists that have been released naming the commodities that will be affected. The first list contains 818 items valued at $34 billion worth of imports from China. The additional 25% duty will go into effect for this first list on July 6th.

List 1 of Products Effected by Section 301

- Contains 818 items valued at $34 billion worth of imports from China.

See the full breakdown of commodities included in List 1. - Additional 25% Duty Imposed

- Went into effect July 6, 2018

List 2 of Products Effected by Section 301

- Contains 284 items valued at $16 billion worth of imports from China.

See the full breakdown of commodities included in List 2. - Additional 25% Duty Imposed

- Went into effect August 23, 2018

List 3 of Products Effected by Section 301

- Contains 5,745 items valued at $200 billion worth of imports from China.

See the full breakdown of commodities included in List 3. - Additional 10% Duty Imposed, but this may go up to 25% on March 1st.

- Went into effect September 24, 2018

Watch the Full Webinar for an Update on the Tariffs on Imports from China

What is Section 301?

Section 301 is a piece of U.S. government legislation that is granted it’s power from the Trade Expansion Act of 1974. Under Chapter 1 of this act is Section 301 which speaks specifically about restrictions to trade imposed by foreign governments (foreign tariffs, subsidies, etc.) and it can be enacted and/or redacted by the President of the United States.

“The Section 301 provisions of the Trade Act of 1974 are intended to address foreign unfair trade practices affecting U.S. trade. Section 301 may be used to respond to violations under bilateral and multilateral trade agreements that deny U.S. rights under those agreements. Section 301 also may be used to respond to unreasonable, unjustifiable, or discriminatory foreign government practices that burden or restrict U.S. commerce even if those practices do not violate the explicit terms of an international agreement.”

For a full look at this legislation, read the 200-page report from the Office of the United States Trade Representative.

How Will The Section 301 Tariffs Effect Your Importing Practices?

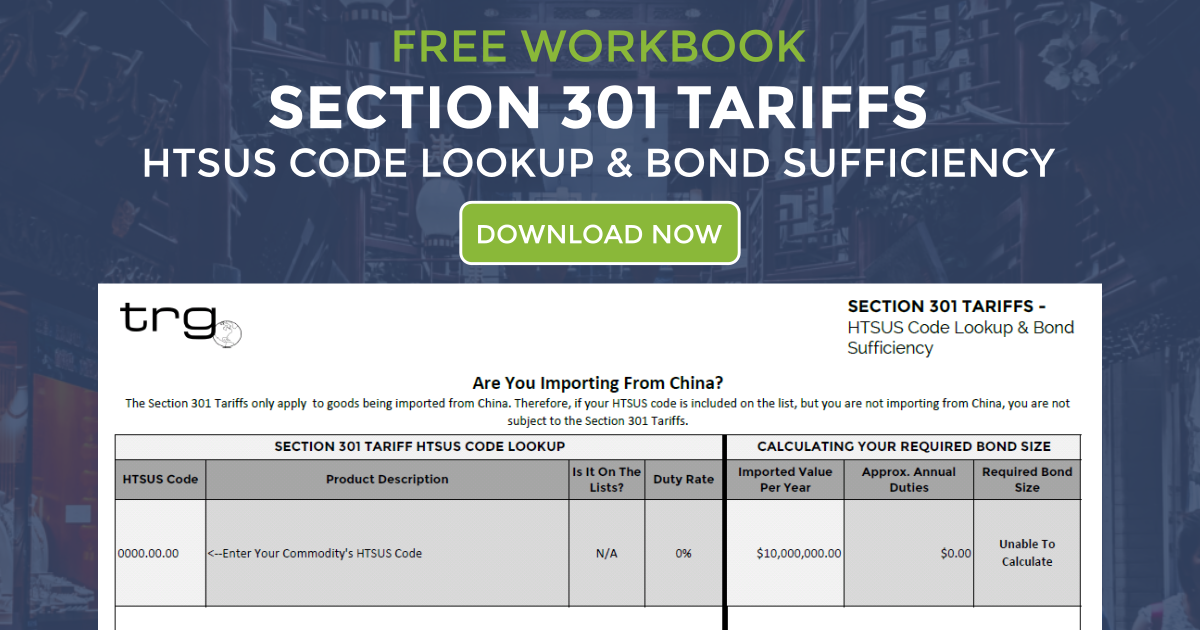

When additional duties are imposed on any commodities coming into the United States, the importer will be immediately affected by the higher cost of their total duties, taxes, and fees for the year. However, many importers do not consider how this increase will also affect the size of their U.S. Customs Bond.

The bond amount is 10% of the total duties, taxes, and fees an importer brings into the United States annually. Therefore, if that amount increases dramatically, the bond amount will have to increase respectively. For advice on the priority updates an importer should consider in response to these additional tariffs, see our previous post about Section 232 Priority Updates: How It Affects Your Customs Bond.

![[Webinar] How to Lower the Cost to Protect Your Warehouse](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2023/10/2023.10_Warehouse-and-Property-Insurance_Page_01-400x250.png)