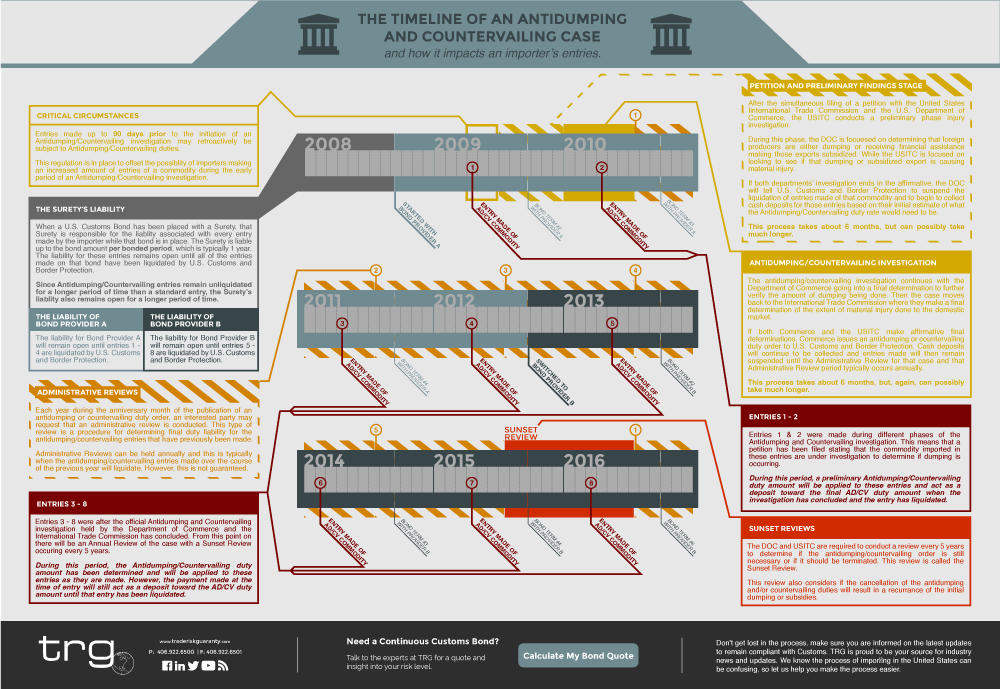

Trade Risk Guaranty illustrates how the timeline for an antidumping and countervailing investigation impacts the entries an importer makes throughout the different phases.

If your business requires the importation of goods subject to antidumping and/or countervailing, it can be stressful to ensure that your business is complying with all of the rules and regulations involved in the process. And for many importers, it can be hard to determine where to even start when it comes to the topic of antidumping and countervailing.

At TRG, we have found that one of the best places to start is familiarizing yourself with the specific antidumping and countervailing investigation your goods may be subject to. Tracking the case will help you understand why these duties have been put into place. However, more importantly, it will help you keep track of what duty amount is due at the time of import and help you have an approximation of when your antidumping and countervailing entries may liquidate.

How To Find Your Antidumping and Countervailing Case Number

If you are not sure what your antidumping and countervailing case number is, you can use the AD/CV Search Tool to look it up. This search allows you to search using a keyword or case number. Once you locate the correct case number, you can also use this tool to find out updates of where this investigation is in the process.

An Infographic of the Timeline of an Antidumping and Countervailing Investigation

Once you know the ADCVD case number for your commodity, you can begin tracking the investigation process. The infographic below illustrates the timeline of an antidumping and countervailing investigation and explains what can be expected for entries made throughout that investigation.

Click the image below to view the full-sized PDF

A Breakdown of the Antidumping and Countervailing Investigation Process

- Critical Circumstances

Entries made up to 90 days prior to the initiation of an Antidumping/Countervailing investigation may retroactively be subject to Antidumping/Countervailing duties.This regulation is in place to offset the possibility of importers making an increased amount of entries of a commodity during the early period of an Antidumping/Countervailing investigation.

- Petition and Preliminary Findings Stage

After the simultaneous filing of a petition with the United States International Trade Commission and the U.S. Department of Commerce, the USITC conducts a preliminary phase injury investigation.During this phase, the DOC is focused on determining that foreign producers are either dumping or receiving financial assistance making those exports subsidized. While the USITC is focused on looking to see if that dumping or subsidized export is causing material injury.

If both departments’ investigation ends in the affirmative, the DOC will tell U.S. Customs and Border Protection to suspend the liquidation of entries made of that commodity and to begin to collect cash deposits for those entries based on their initial estimate of what the Antidumping/Countervailing duty rate would need to be.

This process takes about 6 months, but can possibly take much longer.

- Antidumping/countervailing Investigation

The antidumping/countervailing investigation continues with the Department of Commerce going into a final determination to further verify the amount of dumping being done. Then the case moves back to the International Trade Commission where they make a final determination of the extent of material injury done to the domestic market.If both Commerce and the USITC make affirmative final determinations, Commerce issues an antidumping or countervailing duty order to U.S. Customs and Border Protection. Cash deposits will continue to be collected and entries made will then remain suspended until the Administrative Review for that case and that Administrative Review period typically occurs annually.

This process takes about 6 months, but, again, can possibly take much longer.

- Administrative Reviews

Each year during the anniversary month of the publication of an antidumping or countervailing duty order, an interested party may request that an administrative review is conducted. This type of review is a procedure for determining final duty liability for the antidumping/countervailing entries that have previously been made.Administrative Reviews can be held annually and this is typically when the antidumping/countervailing entries made over the course of the previous year will liquidate. However, this is not guaranteed.

- Sunset Reviews

The DOC and USITC are required to conduct a review every 5 years to determine if the antidumping/countervailing order is still necessary or if it should be terminated. This review is called the Sunset Review.This review also considers if the cancellation of the antidumping and/or countervailing duties will result in a recurrance of the initial dumping or subsidies.

![[Video] What Are Antidumping and Countervailing Duties?](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2024/03/what-are-antidumping-countervailing-duties-YT-400x250.png)