When your bond is deemed insufficient by Customs, an importer will receive an insufficiency letter informing them. But what does it mean and what should you do?

U.S. Customs and Border Protection periodically reviews each bond on file to determine whether the bond is adequate to protect the revenue and ensure compliance with applicable laws and regulations. If CBP determines that a bond is inadequate, the principal and surety will be promptly notified in writing.

This is known as an insufficiency letter. This letter will inform the importer on what the minimum bond increase must be, when the bond will be deemed insufficient, and a general reason for the insufficiency.

Receiving an Insufficiency Letter

In an insufficiency letter, Customs will notify an importer of the current status of the bond currently on file. The following are two of the potential statuses:

- Bond has been rendered insufficient

The bond has been deemed immediately insufficient, you will not be able to import into the United States until a new bond has been placed. The current bond still must be terminated before a new bond is placed. - Bond must be terminated within 15 (or 30) days from the date of this letter

Imports will still be allowed under that bond until the allotted time has passed at which point the bond will be deemed insufficient.

It takes 15 calendar days to terminate a bond with CBP and get a new one on file. So an importer will need to act quickly in order to mitigate the impact of having their bond deemed insufficient.

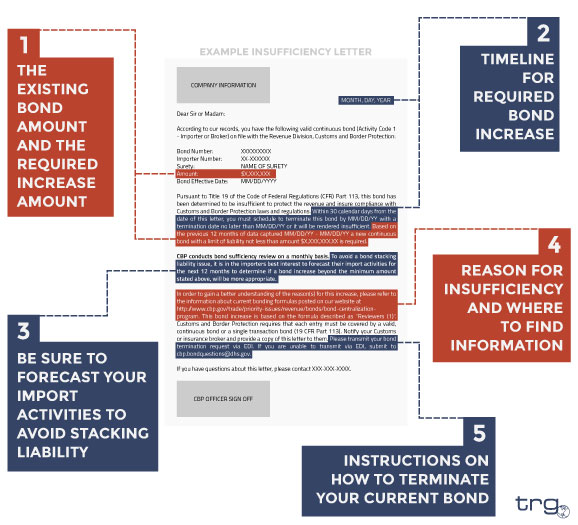

Understanding an Insufficiency Letter

1. The Existing Bond Amount and the Required Increase Amount

At the top of the insufficiency letter is the information about the importer’s current bond on file with Customs and Border Protection including the bond amount. After stating that this current bond has been deemed insufficient, CBP will state the MINIMUM bond amount for the increase.Since CBP is only able to look at data over the past 365 days, the minimum bond amount stated here will not take into consideration the future trends of an importer’s import practices. More on this in #3 of this section.

2. Timeline for Required Bond Increase

In this part of the insufficiency letter, CBP will give the importer a timeline for when the current bond needs to be terminated so that a new bond with an increased bond amount can be placed by the required date. This timeline is always based on the date stated on at the top of the letter, regardless of when the importer physically received the notice.The reason the current bond must be terminated by a certain date is due to the fact that it takes 15 calendar days to get a new bond in place. Therefore, an importer must take the necessary steps quickly to ensure that there is no lapse in coverage. Remember: once a bond is officially rendered insufficient, no entries will be allowed under that bond.

3. Be Sure to Forecast Your Import Activities to Avoid Stacking Liability

This section of the insufficiency letter was added to remind importers that CBP is not able to forecast the future of an importer’s importing practices. Therefore, they will only be requiring the minimum increase based on the past data they have access to. Only the importer knows what the plan is for their future importing.If an importer places a new bond at the required minimum but then continues to import with a much higher duty rate, the new bond could quickly become insufficient. CBP will require another increase to the importer’s bond amount which will lead to stacking the liability of multiple bonds.

4. Reason for Insufficiency and Where to Find Information

In this section of the insufficiency letter, CBP will provide a reason for the increase and a link to access a more indepth explanation of the reason. A formula is also specified as either ‘Reviewers (1)’ or ‘Analytical (2)’.

-

- Reviewers (1): The importer has imported more in terms of duties, taxes, and fees than the current bond’s capacity.

- Analytical (2): The importer has outstanding money owed to Customs and Border Protection.

5. Instructions on How to Terminate Your Current Bond

Customs Bond termination requests must be submitted via the Electronic Data Interface (EDI). If an importer works directly with the Surety handling the bond, the Surety will process the termination of the current bond and the placement of a new one.

![[Video] What Are Antidumping and Countervailing Duties?](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2024/03/what-are-antidumping-countervailing-duties-YT-400x250.png)