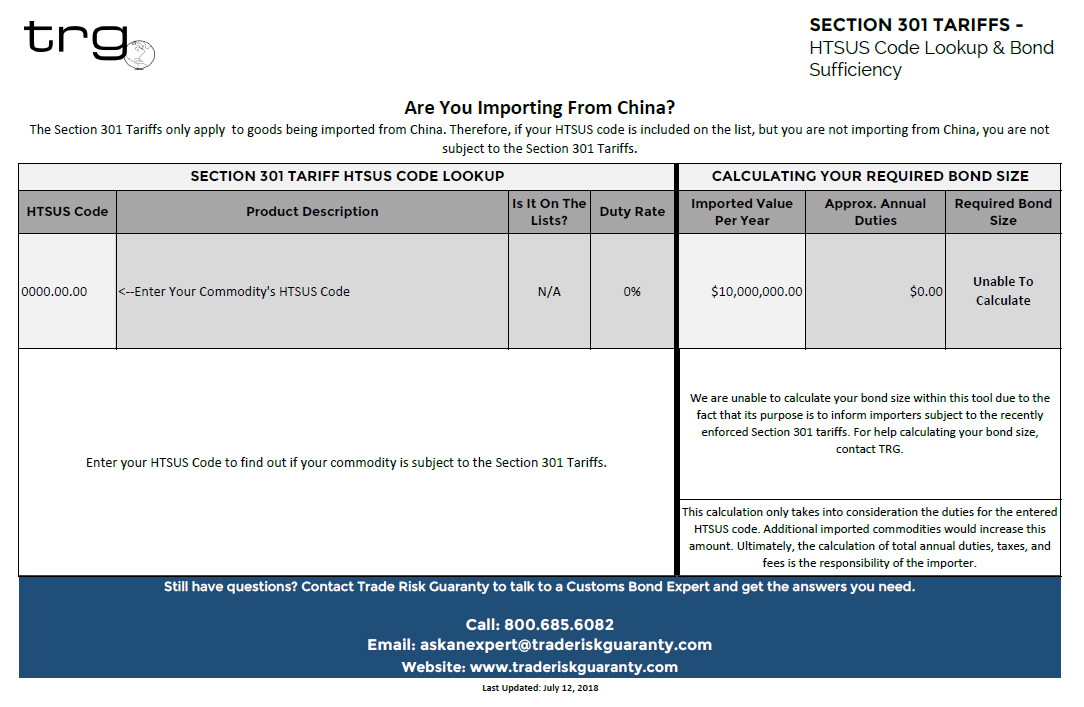

SECTION 301 TARIFFS

HTSUS Code Lookup & Bond Sufficiency

Free Excel Workbook

Double Check your HTS Codes for Section 301 Tariffs on China

This workbook from Trade Risk Guaranty will allow you to easily look up your HTSUS code and immediately see if it is included on one of the product lists subject to the Section 301 tariffs.

Download this free resources to check the following:

- See if your HTSUS Code is included in List 1, 2, 3, 4A, or 4B

- Determine what the new or proposed duty rate is for that list

- See how the new duty rate affects your Customs Bond

April 19, 2022 - Version 18 Updates Now Included

As more decisions are made around the Section 301 tariffs, changes go into effect for the products included in the Section 301 Lists. As of April 19, 2022, the Section 301 - HTSUS Lookup Tool has been updated to reflect these changes.

Certain Exclusions Extended:

One December 13, 2019, the President announced that a Phase One agreement was reached with China. As a result, the following changes were made to the Section 301 tariffs:

- Decreased Tariff Rate for List 4A: The additional 15% tariff on commodities included on List 4A has been halved to 7.5%.

- No Additional Tariff on List 4B: The additional 15% tariff that was planned to go into effect on December 15, 2019 was put on hold and no additional tariff will be imposed at this time.