value

Locked-in Pricing for

FIVE

YEARS

+Installment Options

Entry Monitoring

Claims Assistance

Multi-Year Billing Cycle

as low as

$225.00/year for 5 years*

$1124.99 due upfront, standard terms & rates apply at renewal

Locked-in Pricing for

THREE

YEARS

Entry Monitoring

Claims Assistance

Multi-Year Billing Cycle

as low as

$250.00/year for 3 years*

$749.99 due upfront, standard terms & rates apply at renewal

LOW

VOLUME

Entry Monitoring

Claims Assistance

Annual Customs Bond

Restrictions Apply

*Pending underwriting review and approval. Pricing provided is for a continuous $50,000 Activity Code 1, Importer/Broker bond. Pricing for other bond types and sizes varies. To obtain accurate pricing for your bond click here to get a quote or call 800-685-6082

GET A U.S. CUSTOMS BOND QUOTE

WHO NEEDS A U.S. CUSTOMS BOND?

Any business or entity that ships goods and/or products into the United States from another country needs to have a U.S. Customs Bond on file in order to import. This includes manufacturers, wholesalers, store owners, etc.

TRG’s MULTI-YEAR U.S. CUSTOMS BOND PRICING OPTIONS

TRG offers billing cycles of 1, 2, 3, or 5 years to meet the needs of importers from any business size. The longer the billing cycle selected, the more savings we are able to pass on directly to our client.

HOW MULTI-YEAR U.S. CUSTOMS BOND PRICING WORKS

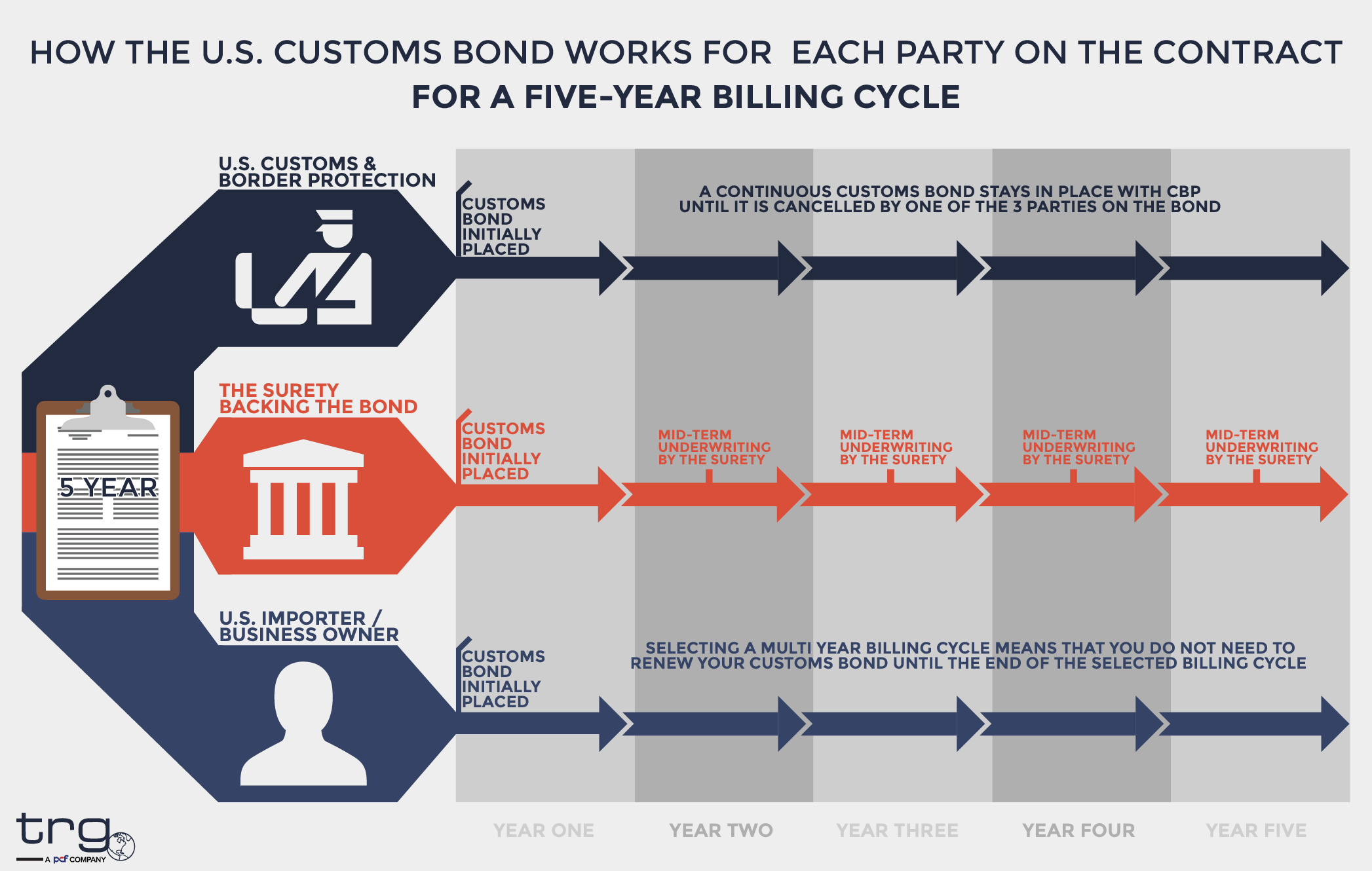

Trade Risk Guaranty gives access to a multi-year pricing structure that can only be offered directly from a surety agent like Trade Risk Guaranty. Multi-year pricing decreases our administrative costs and we pass the savings along to you.

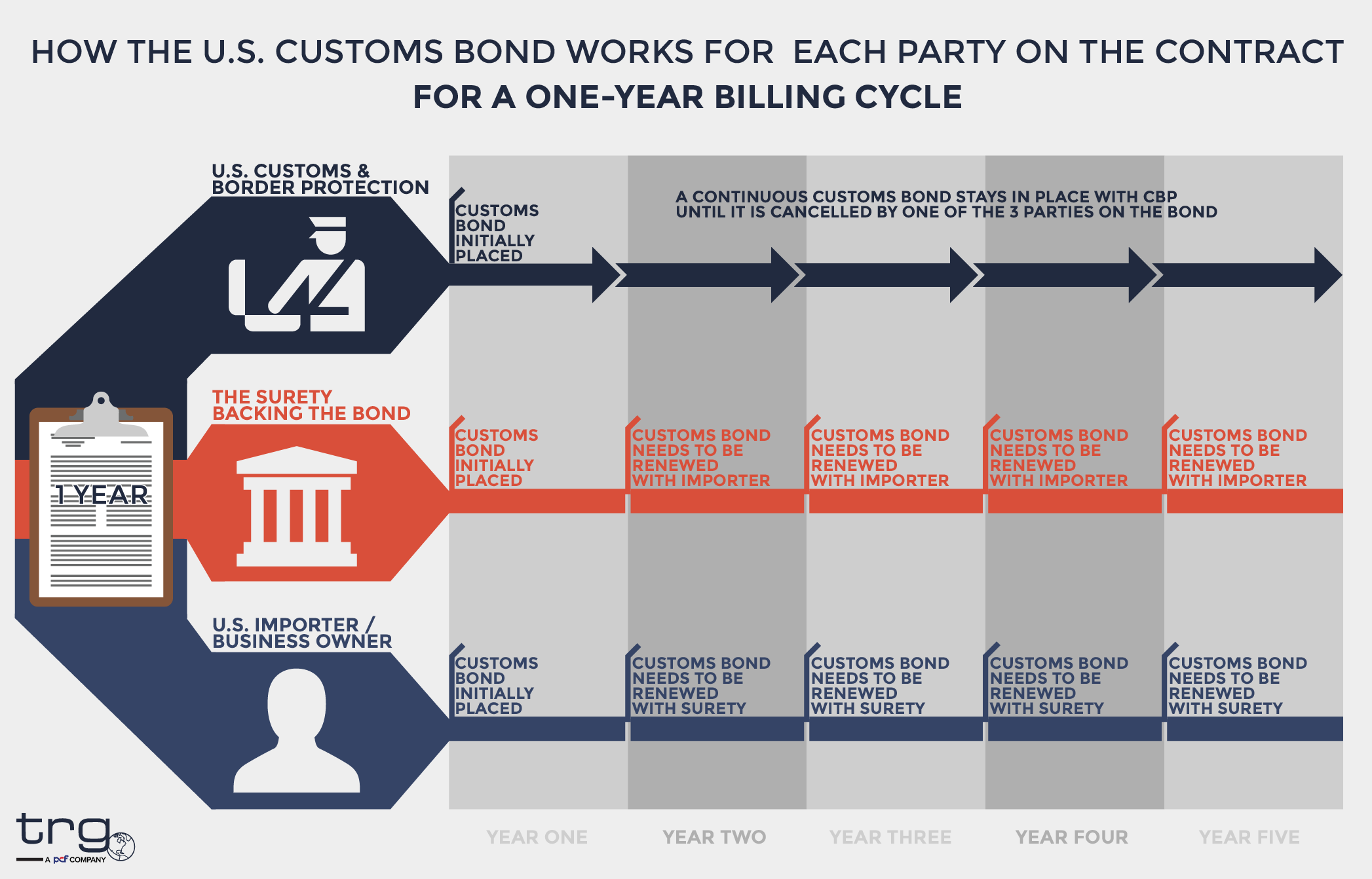

As per CBP regulations, a continuous import bond remains on file with U.S. Customs until it is terminated by one of the parties involved in the agreement (the Insurance/Surety Company, the Principal/Importer of Record, and Customs & Border Protection). This means that a U.S. Customs bond automatically renews at the end of the bond term as long as one of those parties does not terminate it.

Trade Risk Guaranty’s Multi-Year Pricing Structure does not affect the renewal of the bond, but instead allows a client to pay for multiple years of their required bond at one time, resulting in an overall savings on the Customs bond pricing for the importer.

WE DO IT ALL!

TRG issues your bond in accordance with CBP requirements –AND– handles any and all bond changes at no additional charge. We also handle address changes, name changes, importer number changes, as well as addition and deletion of trade names.

All Trade Risk Guaranty customers receive the benefits of TRG’s Custom Reporting and Customer Service team which includes in-house claims assistance, access to our web-based Customs Reporting system Eagle Eye, manifest confidentiality assistance, and other specialty discounts! You also have unlimited access to our Customer Loyalty Advocate, who brings excellence to every client interaction and will assist you with any needs you have.

10 MINUTES iS ALL iT TAKES TO APPLY AND MAKE A SEAMLESS TRANSITION TO TRG!

The quick 10-minute application process is simple and available online. For your convenience, a TRG licensed Insurance Producer will complete it with you over the phone and answer any questions you may have about the application.

After a brief underwriting process, TRG files your bond with Customs & Border Protection prior to your renewal date so that there is no lapse in coverage. The new effective date for the Customs bond stays the same and nothing changes in your importing practices. The only difference is the benefits you now receive from TRG’s Custom Reporting and Customer Service team!