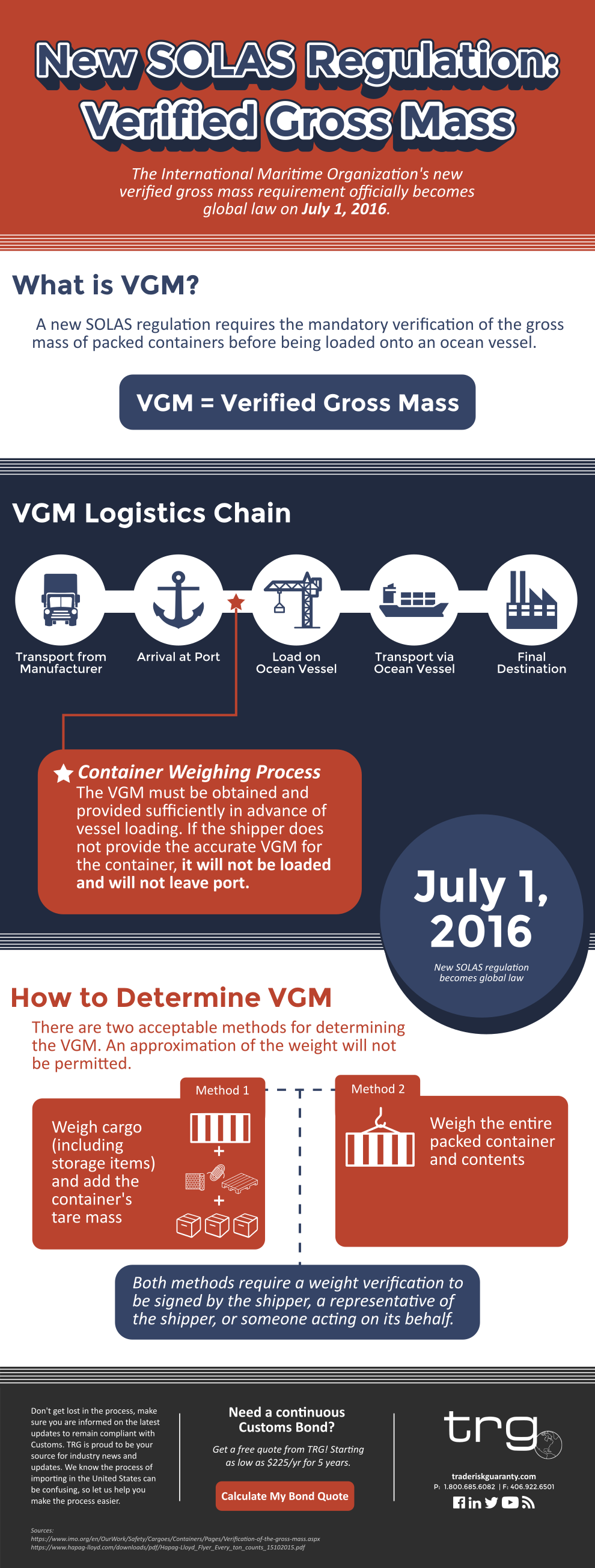

The International Maritime Organization’s new verified gross mass requirement officially became global law on July 1, 2016.

What are the July 1st Requirements?

During the Safety of Life at Sea (SOLAS) Convention in November 2014, the International Maritime Organization (IMO) adopted amendments to the SOLAS regulation VI/2. This regulation, which became global law on July 1, 2016, requires the mandatory verification of the gross mass of packed containers before being loaded onto ships. This applies to all packed containers which are to be loaded to a vessel under SOLAS regime in international maritime traffic.

The shipper will be responsible for obtaining the verified gross mass (VGM) and providing the amount sufficiently in advance of vessel loading. If the accurate VGM is not provided for the container, it will not be loaded and, therefore, will not leave port.

How to Determine the Verified Gross Mass

According to the SOLAS regulations, there are two acceptable methods for determining the verified gross mass of a packed container. An estimation of the weight will not be permitted. Regardless of which method is used, the weight verification must be “signed” by the shipper, someone representing the shipper, or someone acting on its behalf.

- The packed container may be weighed by properly calibrated and certified equipment.

- The weight of the packages and storage items (including the mass of pallets, dunnage, and other securing material) may be added to the weight of the tare mass of the container. This process must use a certified method approved by the competent authority of the State in which the packing of the container was completed.

How VGM Regulations Could Affect Your Marine Cargo Insurance

To ensure that your cargo continues to safely and efficiently make its way to its final destination, there are a few issues to keep in mind:

- Delay may not be Covered by Marine Insurance: It is important to allow ample time for the verified gross mass to be calculated and submitted before the shipping date. If the VGM is not determined, the container will not be loaded and, consequently, shipped. This can lead to delays in delivery dates which may not be covered by marine cargo insurance policies. Contact your insurance provider to confirm if this is the case for your coverage, for example, TRG’s marine insurance policies do not cover delay.

- Change in Transit Type: If it is determined that the cargo will not be allowed to ship via a marine vessel, the decision to ship via air freight could be made. This change in transit could affect your marine insurance coverage. Contact your provider to confirm if air freight is included in your policy. If your policy with TRG was originally written for only ocean vessel transit, the policy will need to be changed before the cargo leaves the airport.

- Route Diversion: In the event that the cargo is arriving at a port that is not VGM friendly, the route may need to be diverted. A diversion in route will need to be reported to your insurance carrier in order to ensure that it is covered in your policy.

Prevent A Lapse in Your Marine Cargo Insurance

In order to ensure there is no lapse in your marine cargo insurance, it is important to stay informed and know the rules. Make sure to plan ahead for your entire supply chain and ensure that all ports are VGM friendly. As this new regulation is implemented, it is advised that you directly contact each port your shipment will be moving through to check on their restrictions and make sure there will be no delay at the port.

If there are any changes to the supply chain, let your insurance provider know before the container is shipped. If a change to your policy has to be made, it must be made prior to the goods leaving to maintain coverage.