TRG has broken down what it means to give someone the power of attorney when entering your goods at a U.S. port of entry to help you remain compliant with customs.

During the process of importing in the United States, many importers will make the decision to use a licensed Customs Broker to clear goods through customs and ensure all documentation is filed correctly. Brokers are regulated by U.S. Customs and Border Protection and are therefore authorized to assist importers in meeting the Federal requirements governing imports and exports.

However, when an entry of imported goods is made by a Customs Broker, a CBP power of attorney (POA) must be made in the name of that Customs Broker (19CFR 141.46).

Establishing Power of Attorney for a Customs Broker

Before conducting any importing transactions, the power of attorney must be established by the person or firm for whom the Customs Broker is working as an agent. Any person named in a power of attorney must be a resident of the United States and must have been authorized to accept service of process for the person or firm that has issued the POA.

After retaining a POA, a Customs Broker does not have to file it with the port director. Instead, they must retain the power of attorney with their own books and papers, and make it available to the Department of the Treasury.

In the most simplified terms, a POA can only be granted to a United States resident and must be granted directly from the person or firm. Once granted, the power of attorney will allow the Broker to act on behalf of the person or firm and give them the right to make entry.

The Limits of a Power of Attorney in Partnerships

For the majority of business types, powers of attorney may be granted for an unlimited period. However there is one situation in which this differs, a partnership.

A POA issued by a partnership must be limited to a period of no more than two years from the date of execution. and must state the names of all members of the partnership. If a change of membership occurs resulting in a new firm, the POA will no longer be effective for customs business.

How to Name Power of Attorney when Importing

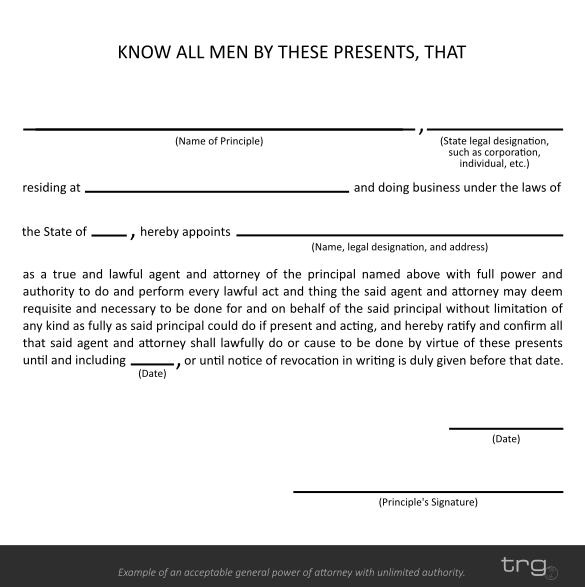

In most cases, a Customs Broker will provide their own form to establish a power of attorney. However, in the event that they do not, a Customs Form 5291 or a document with similar language may be used. The following image is an example of the language for an acceptable general POA with unlimited authority (19CFR 141.32).

Establishing a POA is a necessary step in the process of importing in the United States. Whether you are using a Customs Broker, a member of your staff, or different third-party to complete your transactions with Customs, a power of attorney will be required in most cases to establish the right to make entry.

![[Webinar] How Could Changes to De Minimis Impact Your Company?](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2025/05/trg-how-de-minimis-impacts-customs-bond-webinar-400x250.png)