Understanding how antidumping and countervailing affect the stacking liability on your Customs bond can help you understand the risk your have open with U.S. Customs.

Having a U.S. Customs bond on file is a requirement for any business that imports into the United States. For many importers, once this bond is in place, it can be all but ignored until it is time to renew it. However, a U.S. Customs bond does represent an amount of open liability for the surety that has backed the bond and this open liability can impact the importer if that liability begins to stack over the years.

What is Stacking Liability?

Stacking Liability occurs when a surety company has open exposure over multiple bond periods for a particular importer. The liability of the bond remains open as long as there are entries that were made during that bond term that remain unliquidated.

To learn more, read our full blog post explaining stacking liability.

Understanding Stacking Liability on Antidumping and Countervailing Entries

One factor that has a very big impact on the stacking liability on your Customs bond is if you import goods subject to antidumping and/or countervailing. Antidumping/countervailing entries carry a greater amount of risk due to the fact that the AD/CV duty rate can be incredibly high with no cap and the fact that these entries do not liquidate in the standard timeframe.

The liquidation timeframe remains suspended for entries made that are subject to antidumping/countervailing. Therefore, those entries remain unliquidated for an extended period of time.

The following three graphics illustrate the tail of liability, how it extends for antidumping/countervailing entries, and how that impacts the stacking liability on your Customs bond.

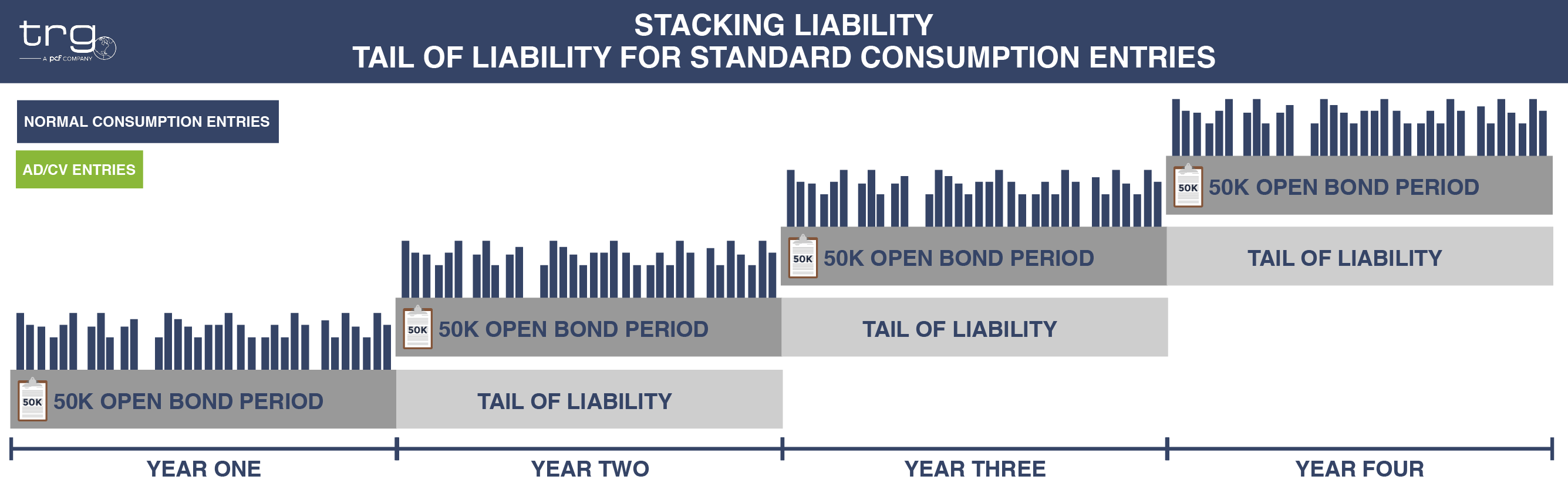

Figure 1: The Tail of Liability for Standard Consumption Entries

When a business makes a standard consumption entry into the the United States, the liability associated with that entry remains open until that entry has been liquidated by U.S. Customs and Border Protection. The liquidation timeline for a standard consumption entry is typically 314 days or the entry will auto-liquidate 1 year after it was made.

This liability is the risk that remains open on the U.S. Customs Bond that was in place when the entry is made. Therefore, the importer and the Surety that placed that bond remain liable for any additional money owed on those entries until the entries have liquidated.

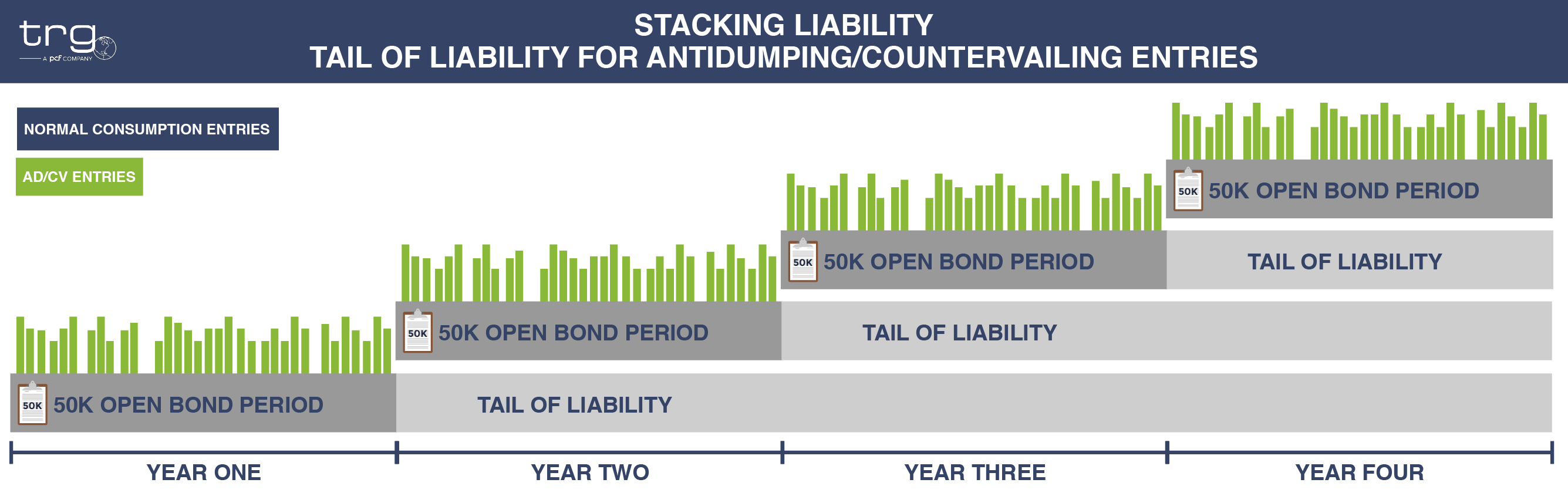

Figure 2: The Tail of Liability for Entries Subject to Antidumping/Countervailing

When a business imports goods that are subject to antidumping and/or countervailing, the liquidation timeline will be suspended for the entry made for those goods. This means that this entry will not liquidate in the standard 1-year timeframe, but will instead remain unliquidated until U.S. Customs makes a certain determination in the lifecycle of the antidumping case.

This means that the tail of liability stretches beyond 1-year and begins to “stack” with the open liability of the following years. This liability continues to stack over the years until all of the entries made within a particular bond period close. The Surety that placed the bond will closely track these entries and when they close in order to mitigate the amount of risk they represent to the surety.

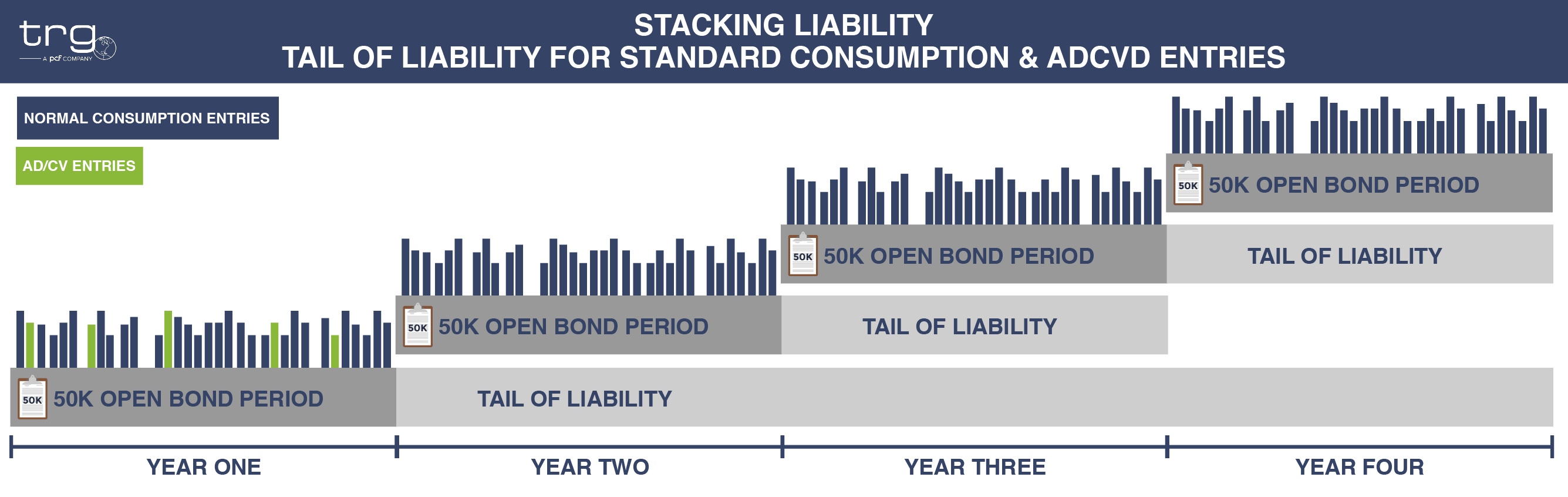

Figure 3: The Tail of Liability for a combination of AD/CV and Standard Entries

Since antidumping/countervailing entries can typically take 5 or more years to liquidate, this tail of liability will remain open for that entire time. Therefore, even if it has been multiple years since you made an entry that is subject to antidumping and/or countervailing, the risk introduced when those entries were made could still be open.

How Does Stacking Liability Affect the Placement of Your Current Bond

When a business has liability stacking from multiple bond periods, it can begin to impact the placement of a new bond with their surety. This is due to the fact that the surety would be concerned about the amount of liability that is currently open and if the business is able to financially handle the potential of owning U.S. Customs additional money from past years. In order to have some added protection, the surety will typically require a business in this position to place collateral in order to secure the bond.

This collateral could be in the form of an irrevocable letter of credit (ILOC) or a cash bond placed with the surety. Once placed, the collateral will stay on file until all of the entries made on any open bond with that surety have liquidated.

If you want to avoid placing collateral, Trade Risk Guaranty has introduced a new program available to select qualifying antidumping/countervailing importers. This program allows qualified importers to avoid placing collateral by paying a higher premium for the bond, which frees up cash flow while ensuring that the bond remains in place. Apply with us to see if you qualify.

![[Webinar] How Could Changes to De Minimis Impact Your Company?](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2025/05/trg-how-de-minimis-impacts-customs-bond-webinar-400x250.png)