In an educational video, Trade Risk Guaranty explains the basics of bond sufficiency and how an importer must forecast their importing when an increase is necessary.

Although U.S. Customs Bond Sufficiency has always been a focus for U.S. Customs and Border Protection, the topic has become a much bigger issue for many U.S. businesses as their duties, taxes, and fees have increased due throughout development of the trade war. However, despite the growing concern, bond sufficiency is a very complicated topic with many moving pieces that can hard to comprehend without some explanation.

To help grow this understanding, Trade Risk Guaranty has launched the first video in their educational video series on bond sufficiency. And to get started, the first video covers the basics: What is Bond Sufficiency?

What is Bond Sufficiency?

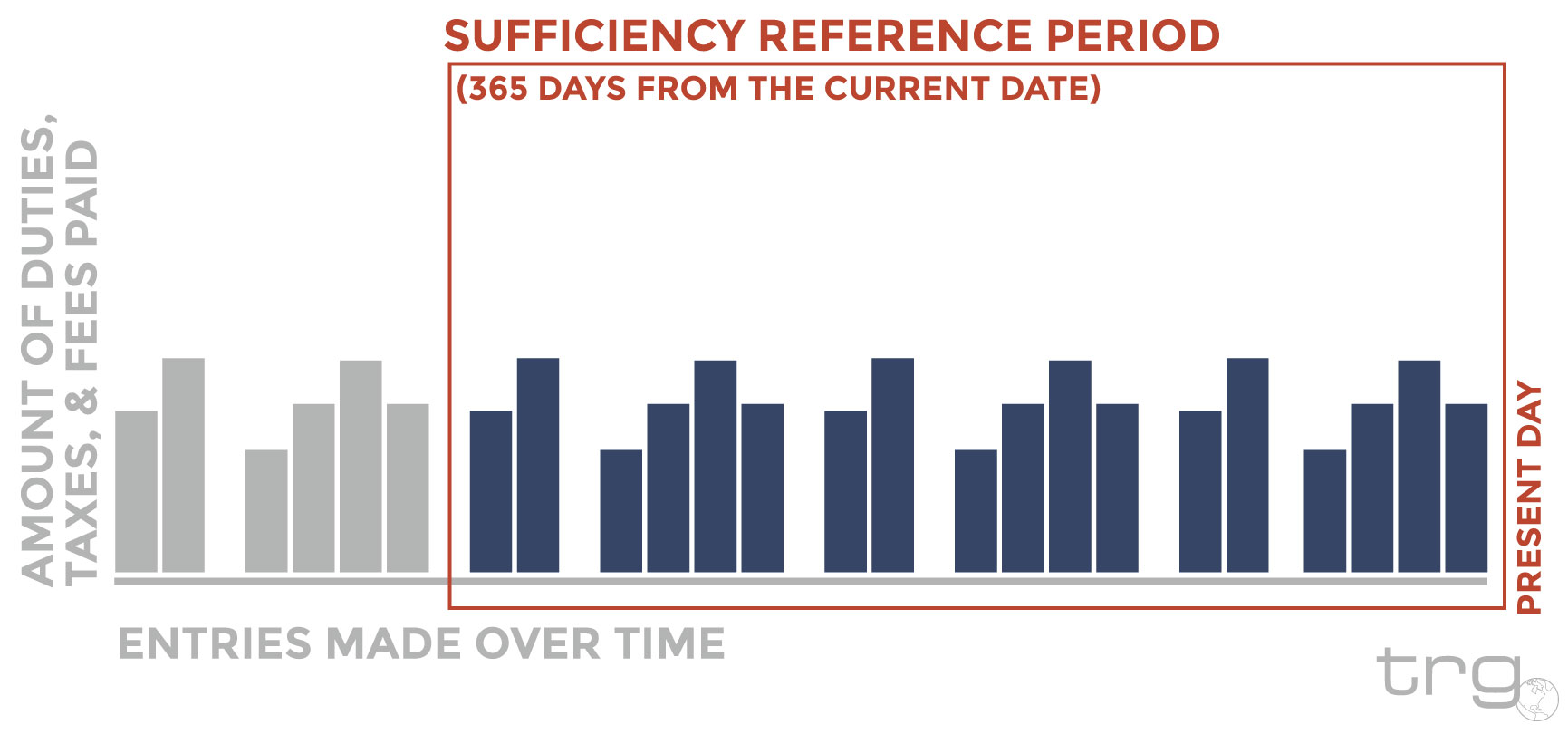

Bond sufficiency refers to whether or not the bond amount is adequate to protect U.S. Customs’ revenue and ensure compliance with laws and regulations. Customs considers a period of the past 365 days from the current date, on a rolling basis, when calculating bond sufficiency.

Visualizing Bond Sufficiency

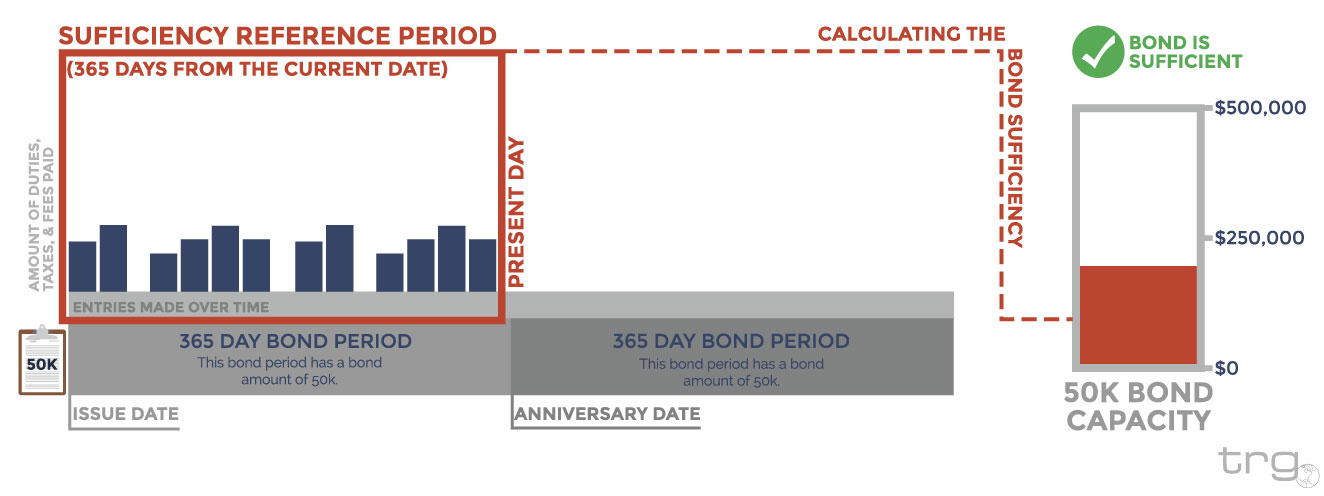

In the below graphic example, the importer in question has a 50K bond on file. That 50K bond has the capacity to cover up to $500,000 in annual duties, taxes, and fees. So if that importer makes a certain number of entries within a period of 365 days and the duties, taxes, and fees for those entries add up to a total that is less than $500,000, the 50K bond on file would be considered sufficient.

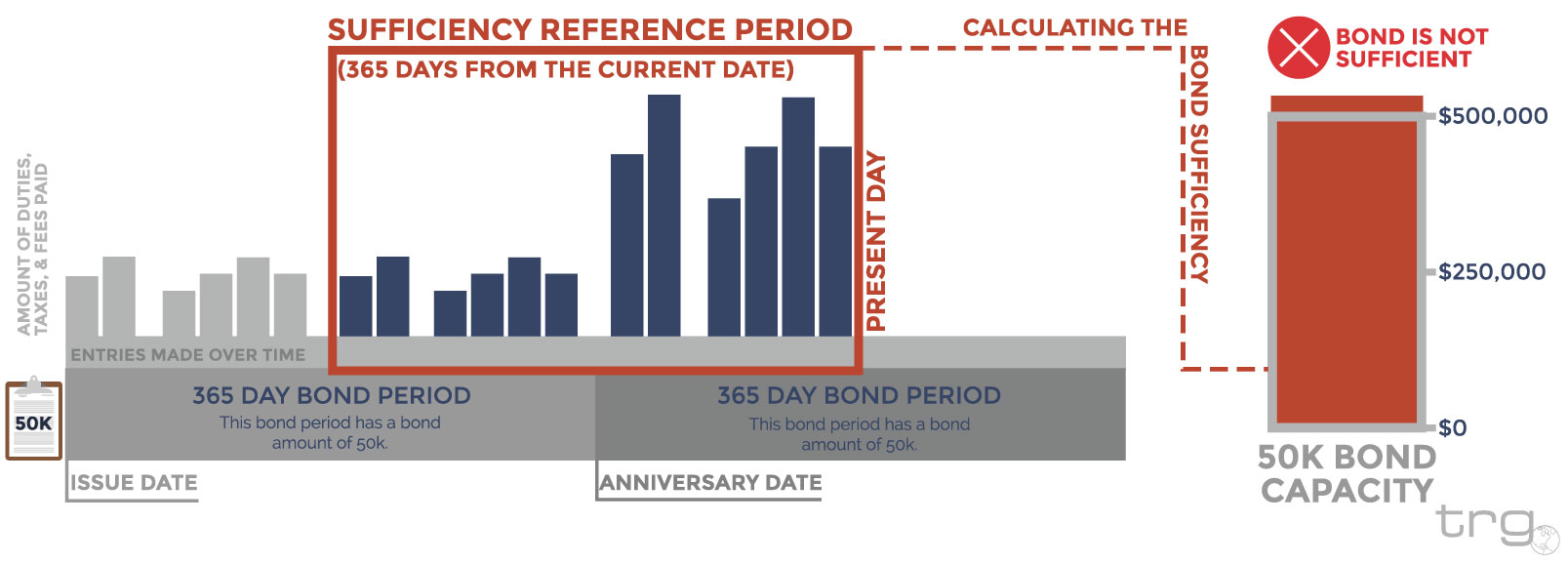

Now let’s say that same importer continues to make entries, but the duty rate they pay has increased. In the example below, the increased duty rate has resulted in the importer paying more than $500,000 in duties, taxes, and fees within a 365 day period. This means that their duties paid has exceeded the capacity of their bond and their U.S. Customs Bond would no longer be considered sufficient.

It is important to note that although the higher duties are in a separate bond period, Customs is still looking back 365 days.

Learn the Basics of Bond Sufficiency

Watch the video below for a more in-depth breakdown on the topic and how sufficiency is calculated by U.S. Customs and Border Protection.

Did you like that video? Subscribe to our YouTube Channel for instant access to the next videos in the Bond Sufficiency series.

![[Webinar] How Could Changes to De Minimis Impact Your Company?](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2025/05/trg-how-de-minimis-impacts-customs-bond-webinar-400x250.png)