What is General Average, and why would an importer need to consider it in their risk management portfolio? If you are looking for more information about this policy, or if you are wondering why this protection is important, read the content below.

What does General Average mean?

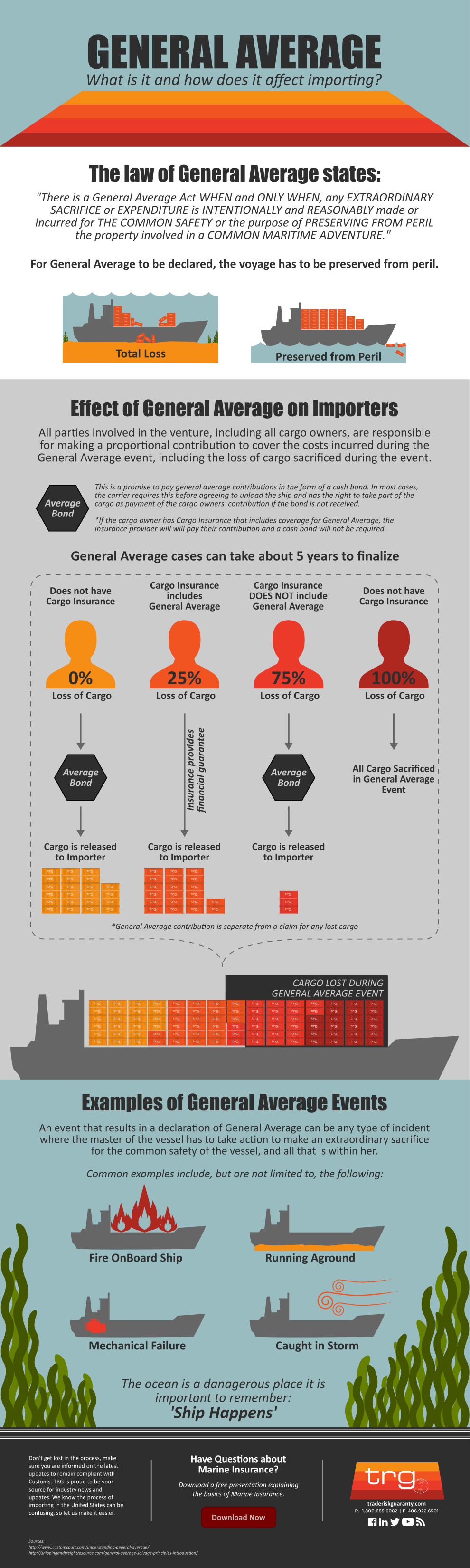

The law of General Average states that cargo owners are jointly responsible for losses or costs associated with protecting the whole of the ships cargo. If a cargo ship’s master voluntarily sacrifices the cargo, equipment, or funds from the ship to save the voyage in the event of an emergency, then all parties involved in the venture (which includes all cargo owners) are required to make a proportional contribution to cover the costs incurred.

There is no effective way to determine beforehand which pieces of cargo will be jettisoned or sacrificed if trouble on the high seas occurs, and there is no way to guess when and/or where that trouble might arise. Therefore, the risk is spread among all the owners of the cargo.

How does General Average effect Importers?

The result for importers when General Average is posted can be a loss of cargo or extreme delays in delivery. One result that can have a large effect on an importer immediately is the obligation to post an Average Bond if the importer does not have Marine Cargo Insurance in place. Until the bond is posted, the importer will not be able to receive the cargo that survived the General Average Event.

An Average Bond can range widely in amount and is sometimes based on a percentage of the CIF value of the importer’s cargo. So, for instance, if the importer’s cargo is valued at $50,000 USD, and the Average Bond is quantified as 10% of the valued goods, the importer would have to pay $5,000. The cargo would not be released until the cargo owners put up this cash bond or, if Marine Cargo Insurance is in place, the insurers put up a guarantee.

Once the General Average claim has been finalized, a process that usually takes around 5 years, the importer will have to pay the amount of their contribution. This can range widely as the percentage each party must contribute is based on the total value of the ship and all of the cargo on board. So even if your cargo has a low CIF value, the cargo in the container next to you might have a very high one.

See the example below for a breakdown of each party’s contribution to the General Average Claim.

Example of General Average Claim adjustment for a piracy event

This example is sourced from Allianz Global

| Amount | |

|---|---|

| Contributory Value | |

| Ship Sound Value per certificate | US$ 13,000,000 |

| Cargo CIF Value of all cargo on board | US$ 12,000,000 |

| TOTAL | US$ 25,000,000 |

| Summary of GA Disbursements | |

| Ransom payment | US$ 2,500,000 |

| Delivery and success fee | US$ 250,000 |

| Negotiation fees | US$ 300,000 |

| Lawyers fees | US$ 100,000 |

| Bank charges | US$ 10,000 |

| Adjustors fees | US$ 40,000 |

| TOTAL | US$ 3,200,000 |

| Appointment of General Average | |

| Ship US$ 13,000,000 (pays 52%) | US$ 1,664,000 |

| Cargo Owner 1 US$ 5,000,000 (pays 20%) | US$ 640,000 |

| Cargo Owner 2 US$ 4,000,000 (pays 16%) | US$ 512,000 |

| Cargo Owner 3 US$ 2,000,000 (pays 8%) | US$ 256,000 |

| Cargo Owner 4 US$ 1,000,000 (pays 4%) | US$ 128,000 |

Do I need to worry about General Average?

The short answer to this is a resounding “Yes”. Statistics show that importers will be involved in a General Average claim once every 8 years. History has repeatedly shown the most powerful oceangoing vessels piloted by expert captains can run into unforeseen trouble on a voyage.

So the best way to protect your investment in your imported goods is to be prepared for the unpredictable with cargo insurance.

Click the Image for a Full PDF

Does your Marine Cargo Insurance Cover General Average Claims?

Not all marine cargo insurance policies offer this protection. If a General Average situation should occur, the insured party’s portion of the claim is covered. Without the proper protection, the cargo’s owner is fully liable for their portion of the claim. Therefore, before purchasing a cargo insurance policy it’s imperative to know what you’re covered for and if General Average is included.

Editor’s Note: This post was originally published in November 2015 and has been edited by Meredith Lambert to include infographics and updated information.