There are a number of ways for an importer to find their importer number, however, many businesses believe this is a hidden number that needs to stay that way. TRG helps remove the mystery behind this important aspect of importing.

An importer number is a required part of the United States importing process. It is a designated number that is assigned to the importer of record by U.S. Customs and Border Protection and is used to identify your entries. Read more about what an importer number is and who needs one.

Where Can You Find Your Importer Number?

There are quite a few ways to find your importer number. All of these methods are part of the public record making it relatively simple to search through them to locate your assigned number.

- Your Company’s Tax ID Number / EIN

The most common method used to identify this number is using your Tax ID Number (also known as your EIN). By adding two zeros at the end of your Tax ID, it becomes the importer number Customs has assigned you. - Social Security Number (Sole Proprietorships)

In the case that your company is a Sole Proprietorship, you may not have an EIN. Instead, the owner’s social security number is using as the company’s Tax ID/ EIN. When this is the case, that number becomes a part of the public record on your company and it is used as your importer number (with two zeros added on the end). - W-2’s issued by Your Company

Every W-2 issued by your company has the company’s Tax ID / EIN listed on it. Simply add two zeros on the end and you have your importer number. - Commercial Invoices

During international trade, the commercial invoice is used as customs declaration and must include a few specific pieces of information. Since this document is used to calculate the duties, taxes, and fees of an entry, it must also include the importer number of the company bringing in the goods. - Secretary of State Website

Some states, such as Florida, have a Secretary of State website where the public information can be found for every business established within that state. This public information includes a company’s Tax ID / EIN which can be converted into what you are looking for with the instructions above. - Entry Summary (CBP 7501)

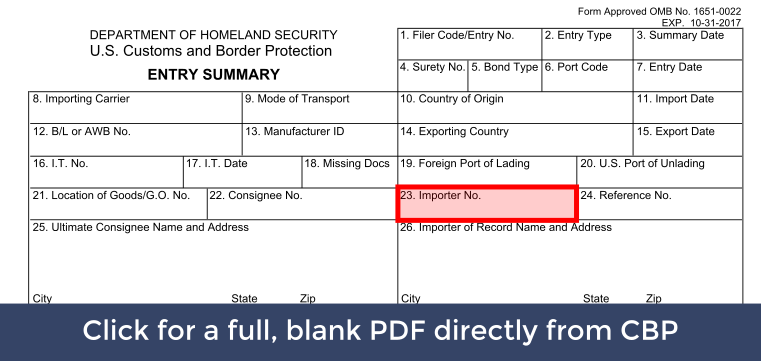

When you bring goods into the United States, an Entry Summary (also know as CBP Form 7501) is a required document in the process. This document includes a declaration of many important pieces of information Customs needs to liquidate your entry. The importer number can be found on line 23 of this document (see image below) and this document exist for every entry your company has made into the United States.

Why do You Need to Find Your Importer Number?

As a business that imports goods into the United States, you will be required to have an importer number on file with U.S. Customs and Border Protection. Since it is the primary way CBP will identify your company and your entries, this number will be required at many stages of the importing process. This also means that it will be used to identify your company throughout the importing industry.

For example, if you wanted to find out any details concerning your U.S. Customs Bond, you would run a query through CBP using your importer number. Without this number, Customs would not be able to provide you with information concerning your Customs Bond.