The difference between HTSUS Codes and HS Codes can be unclear for many small business owners. Learn their distinctive differences to identify when each of these codes is necessary.

Knowledge regarding a list of important acronyms is helpful for anyone participating in the global trade arena. Having a good working vocabulary of these terms can make it much easier to keep up with international trade issues. Some of these acronyms are more complicated than others, but rather than the longest being the most difficult to understand, it is often the acronyms that are most closely related to one another that cause the most confusion, regardless of their length. Take HS and HTS codes, for example. Both are intrinsically related, and a single letter apart, but HTS codes and HS codes are not one in the same.

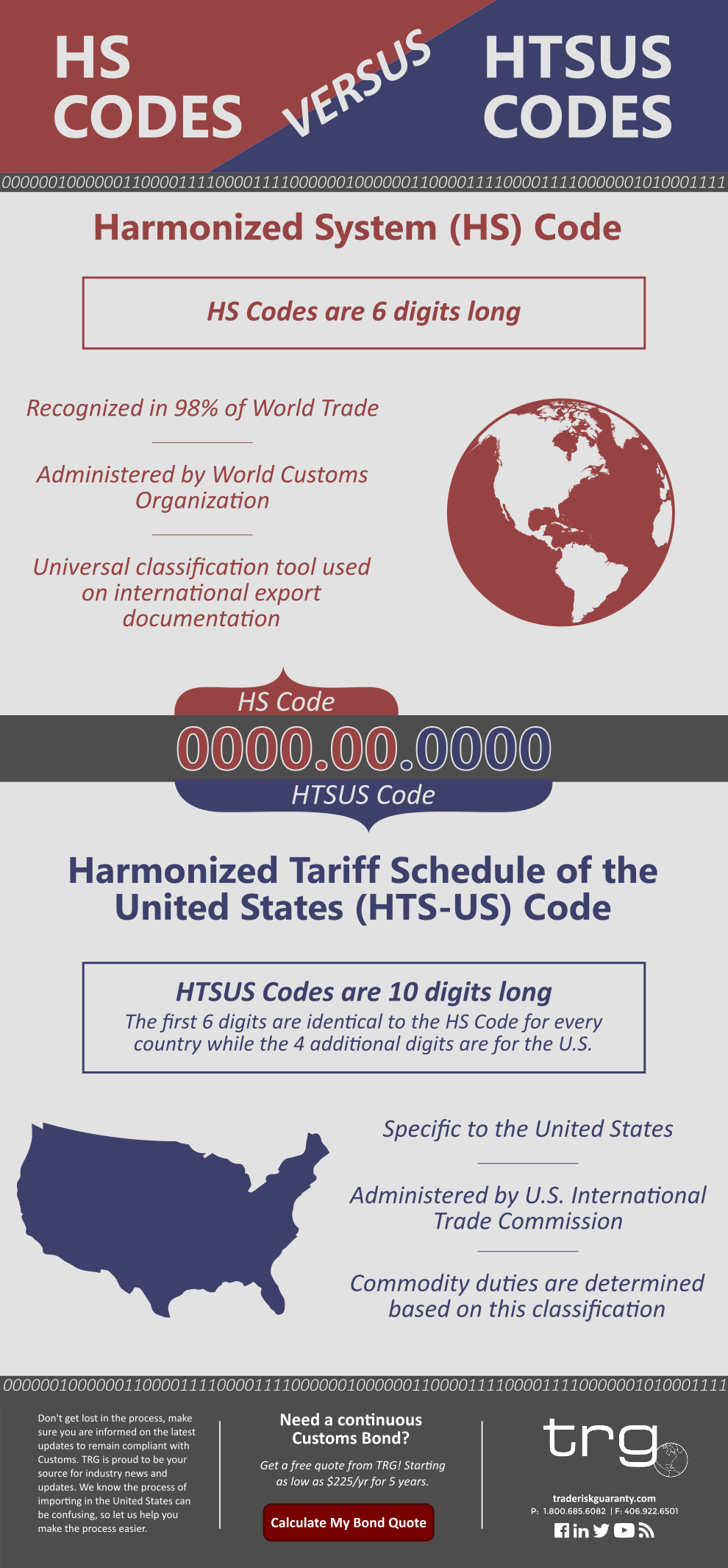

Harmonized System Code – HS Codes

‘HS’ stands for Harmonized System and this refers to a global system of numeric codes used to classify goods being shipped overseas. Each digit in the code is used in conjunction with the others in order to achieve an unambiguous classification regarding the contents of a shipment of goods.

The following are true of HS Codes:

- There are 6 digits in an HS Code

- HS Codes are recognized in 98% of World Trade

- They are administered by World Customs Organization

- These codes are a universal classification tool used on international export documentation

Harmonized Tariff Schedule of the United States Code – HTS-US Codes

‘HTSUS’ stands for Harmonized Tariff Schedule of the United States Code and they are quite similar to an HS code. The primary difference between HTSUS codes and HS codes are that HTSUS codes are specific to the United States of America.

The following are true of HTSUS Codes:

- There are 10 digits in an HTSUS Code

- HTSUS Codes are specific to the United States

- These codes are administered by U.S. International Trade Commission

- Commodity duties are determined based on commoditiy’s HTSUS classification

Due to their different number of digits. it can be relatively easy to determine whether a code is an HTSUS code or an HS code; simply count the digits. However, the first 6 digits of an HTSUS code are identical to the commodity’s HS code, but with 4 additional digits.

Why are HTSUS Codes and HS Codes Important?

HTS and HS classification is an integral component of the modern global supply chain. All goods entering U.S. ports are classified in this manner and importers are responsible for correctly classifying their goods well before they reach U.S. soil.

Keeping up with contemporary terms and acronyms relating to global trade is integral to maintaining a higher level of customs compliance because it’s next to impossible to comply with the unknown. Keep checking back to TRG Peak for more detailed analyses and explanations of international trade jargon, and stay ahead by staying informed.

![[Webinar] How Could Changes to De Minimis Impact Your Company?](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2025/05/trg-how-de-minimis-impacts-customs-bond-webinar-400x250.png)

![[Webinar] United States Reciprocal Tariffs – The What, Why, and How](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2025/04/trg-webinar-reciprocal-tariffs-400x250.png)