A Notice of Action is an alert that you paid the incorrect amount of duties and fees when entering your goods into the United States.

After an importer receives a Customs Form 28 (CF-28), Customs and Border Protection will send a follow-up document known as a Customs Form 29. A CF-29 is no warning, it is a Notice of Action.

Receiving a CF-29

By the time an importer receives a CF-29, they have already received a CF-28. Either CBP was not satisfied with the response to the CF-28, they did not receive a response to the CF-28 or CBP believes that they already have all the information they need to take action.

Either way, Customs believes that you as the importer paid a different amount in duties than what is owed. Note that Customs might actually want you to pay less, all Customs wants is correct information on file and if that means they owe you a refund, it will be issued.

What is a CF-29?

When Customs believes that a mistake has been made and you, as the importer, may need to pay additional duties for that entry. On a different note, Customs might actually owe you a refund, Customs is primarily concerned with having correct information on file and if that means they owe you a refund, it will be issued.

- Action Taken: Customs in indicating that action has been taken and they have begun the liquidation process. This could be an increase or decrease in the duties owed. Any increase can only be addressed via protest or 520 claim.

- Action Proposed: When Customs indicates action proposed, the importer is given 20 days to convince Customs that the increase or change in classification is unfounded. If after 20 days there has been no response, CBP will assume the importer is in agreement with the proposed action and will begin the liquidation process and asses additional duties.

Because any decision from Customs will have an impact on the way business is conducted, importers should carefully respond to any Notices of Action.

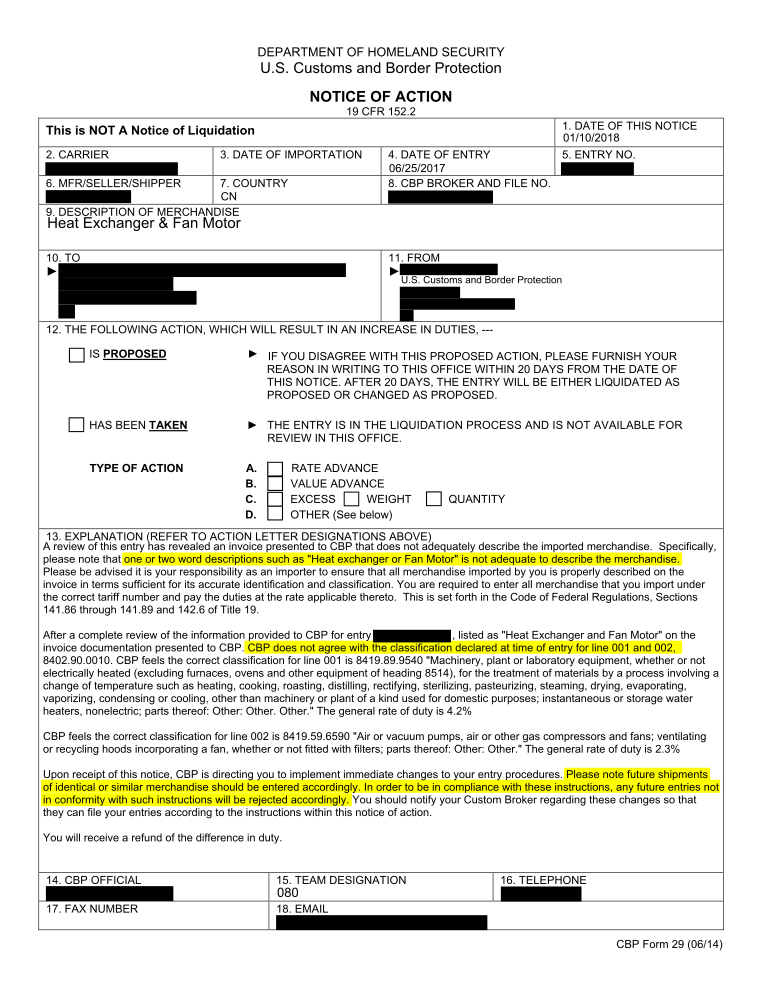

Example of a CF-29

A CF-29 is a fairly straightforward official document. The form will walk you through CBPs logic in changing the duties on your import and provide the accurate duty amount. See the highlighted portion which states that “CBP does not agree with the classification declared at the time of entry”. It will also tell importers how to proceed with similar future shipments.

Advice From Experts on How to Handle CF-28s and CF-29s

The following are a few pieces of advice from the experts at TRG on how to handle CF-28s and CF-29s and how to prevent getting them.

Review Your Current HTS Classifications to Ensure Accuracy

- Now is the time to roll up your sleeves and check the accuracy of your products’ classification.

- Never let a foreign supplier classify your goods.

Have a Clear Action Plan For When a CF-28 is Received

- Establish a standard operating protocol and make sure others in your company are aware of it.

- CF-28s and CF-29s are date specific so acting fast is imperative to the process.

Audit Your Broker

- Not all 28s and 29s are centered around classification so audit the potential causes of the issue.

- It’s important to ensure that your broker is submitting accurate information.

- Make sure that you are providing accurate information to your Broker.

![[Webinar] How Could Changes to De Minimis Impact Your Company?](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2025/05/trg-how-de-minimis-impacts-customs-bond-webinar-400x250.png)

![[Webinar] United States Reciprocal Tariffs – The What, Why, and How](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2025/04/trg-webinar-reciprocal-tariffs-400x250.png)