In order to understand why Anti-dumping and Countervailing duties may apply to your goods, we must begin with understanding what they are and how they protect the United States economy.

Anti-dumping and Countervailing duties (ADCVD) can be a confusing part of the importing process especially if you haven’t had to deal with them in the past. Government agencies implement Anti-Dumping and Countervailing duties to stop exporting countries from selling products in the U.S. at a rate that is less than fair value. These duties have been a part of the U.S. importing industry since 1930 and have helped domestically-produced products stay competitive with imported commodities in the United States market.

Definition of Anti-Dumping and Countervailing Duties

Anti-Dumping

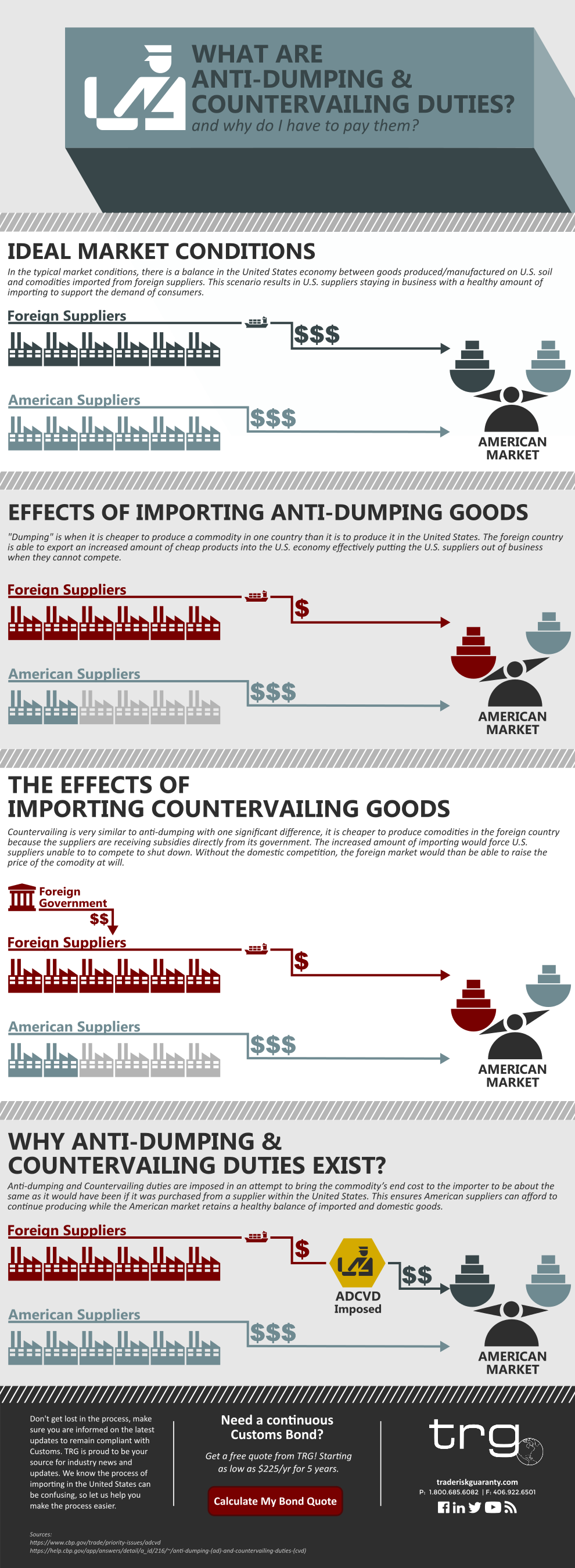

Dumping occurs when foreign manufacturers sell their goods in the United States at less than fair market value. This can cause injury to the U.S. industry manufacturing those goods by potentially putting them out of business when they cannot compete.

In order to prevent “dumping” from occurring, the U.S. government has established certain preventative measures, known as “anti-dumping”. Anti-dumping (AD) duties are imposed on certain goods in order to bridge the gap back to fair market value. AD cases may be manufacturer-specific or country wide

Countervailing

Countervailing is relatively similar to Anti-dumping with one significant difference. Countervailing Duties (CVD) are established when a foreign government provides assistance and subsidies to local exporting manufacturers, such as tax breaks. These benefits enable a foreign exporter to sell the goods in the United States cheaper than domestic manufacturers.

Countervailing duties are imposed to level the playing field for domestic producers by bringing the importer’s costs up to the fair market value as goods produced in the United States. CVD cases are country-specific, and deposit duties are calculated to compensate for the value of the subsidy/assistance.

Click the image for a downloadable PDF

Who can I Contact for More Information on AD/CVD?

The primary broker who is employed to file entries on behalf of the principal may have more information on a specific AD/CVD commodity and case. To access the AD/CVD search system, please visit the Anti-dumping and Countervailing Duty Online Search System.

Examples of Commodities Subject to Anti-Dumping and Countervailing Duties

Many commodities are subject to Anti-Dumping and Countervailing duties, below are some examples of these goods:

- Argentinian honey

- Belgian steel

- Canadian iron

- Chilean mushrooms

- Chinese aluminum

- German uranium

- Iranian pistachios

- Japanese ball bearings

- Norwegian salmon

For an updated list of goods subject to Anti-dumping or Countervailing duties, check the Department of Commerce website. There you will find a list, organized by country, and details on each of the commodities.

Editor’s Note: This post was originally published in January 2016 and has been edited to include updated information and graphics.