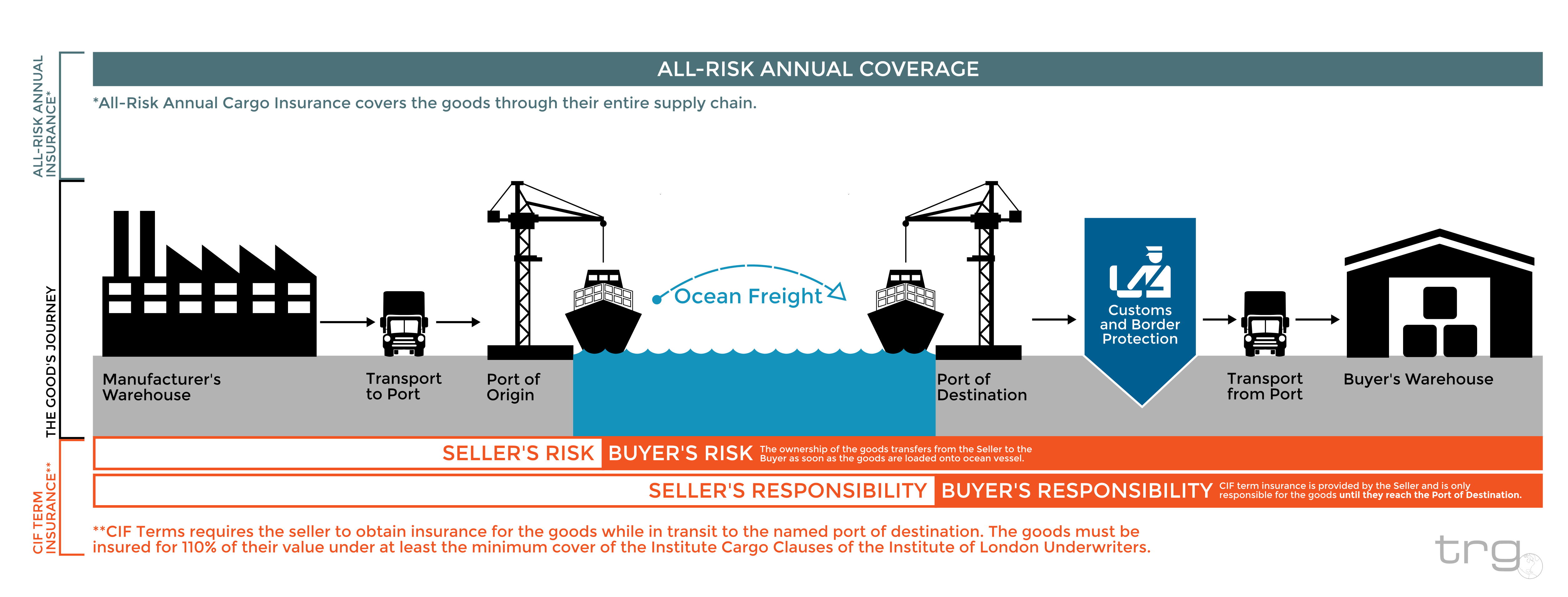

Purchasing cargo insurance on CIF terms can be a cheap option for a new importer. However, it is important to know what exactly this coverage is before making a final decision.

Entering the world of international trade can be extremely confusing with constant risks throughout the process. The best way to protect your business and your investment is with a Marine Cargo Insurance policy that can cover any loss that may occur while your goods are in transit. However, acquiring the right type coverage can become a burden to new and experienced importers alike.

One common method of insurance for ocean cargo is purchasing on CIF (Cost, Insurance, and Freight) terms, which often appears as a line item on the supplier’s bill to the importer. But many importers are not sure what this coverage is and how they are protected.

What is CIF Shipping Insurance?

With CIF Terms, the seller is required to obtain insurance for the goods while they are in transit to the named port of destination. Once the goods arrive at the port of destination, the responsibility for the goods transfers over to the buyer and the CIF term no longer applies.

The official definition of CIF terms states;

Click the image for a full PDF

5 Reasons Buying on CIF Terms May Not Protect Your Company

In most cases, buying Cost, Insurance, and Freight can seem like the easiest option that may provide adequate coverage for your ocean freight shipments. While purchasing on CIF terms is often the cheapest option, it is certainly not the one that provides complete coverage. In fact, this type of coverage can often leave an importer ‘high and dry’ in the event of a loss.

The following are a few points explaining why CIF term insurance may not be the best choice to protect your company when goods are in transit.

- Giving up control of your coverage. Since your supplier will be handling the purchase of the freight and the insurance, it is more than likely that they will choose to go with the cheapest possible option for both of these. This limits your options if you need to select an expedited or unique route.

- The supplier may be listed as the beneficiary of the insurance policy. When this is the case, the supplier would receive the payment when your goods are damaged and then have to reimburse you from the insurance payment.

- CIF only covers up to when the goods arrive at their port of destination. In the event that any additional fees are accrued at the port; such as demurrage or storage fees, the CIF policy may not cover these costs or may only cover the CIF price.

- CIF costs will be included in the Commercial Invoice. This means that the ocean transportation and insurance cost may be included in the sales price declared to Customs making them subject to duties and fees. Although Customs explicitly states: “Duty is not assessed on CIF charges”, rated Ocean/Air Bills of Lading are required as proof to substantiate any deductions to dutiable merchandise value.

- Higher overall costs. When insurance is purchased directly from the supplier, the final cost to the importer is typically at an inflated rate.

Protect Your Business with Your Own Marine Cargo Insurance Policy

The best way to ensure that your business is fully covered when importing goods via ocean vessel is to have your own marine cargo insurance policy. Having a policy in place will cover any losses that have accrued as a result of damage during transit and the insurance payment will go directly to you as the beneficiary on the policy.

Another beneficial part to having your own policy is the direct connection you will have to the insurance provider. in the event of a claim, you will be able to be in contact directly with your representative to get the claim filed and resolved.