The Harmonized Tariff Schedule is a system used to classify goods entering the United States, but what do you need to know about this system. The following are 5 important characteristics of HTS codes.

When importing into the United States, you will have to know the official HTS Code for your imported commodity. The Harmonized Tariff Schedule (also known as an HTSUS code) is a system used to classify goods imported into the U.S. and is based on the global HS Code system used to classify goods worldwide.

For an indepth look at the differences between HS and HTS codes, see our previous blog post comparing the two classification methods.

5 Things to Know About the Harmonized Tariff Schedule

The following are five important things that every importer should know about the Harmonized Tariff Schedule. For a quick reference guide for this information, download the PDF.

- HTS codes are a global tool. The World Customs Organization (WCO) maintains the Harmonized Tariff Description and Coding Schedule (HTS). Over 170 countries participate in WCO’s HTS system. The first six digits of the HTS code identify all items in international trade and are the same for all countries that use the HTS. The last two or four digits are country specific; in the U.S. these last four digits provide the duty rate and balance of trade statistical reporting suffix for the imported goods.

- As an importer, you are responsible for establishing the correct HTS classifications used on your import entries and/or ISF security filings. This is why it is important to establish that accurate information about your products is reported to CBP and to not completely rely on third parties to guess about your products to provide HTS classifications on your behalf. It is the importer’s responsibility to supply sufficient information about the imported goods so that a customs expert may determine the proper classifications of those goods.

- You could be paying too much by using the wrong HTS code. The HTS is primarily a classification system to uniformly identify products and secondarily a tariff system on imported goods. Using the wrong HTS will result in an incorrect payment of duties whether too little or too much, this creates an issue for CBP in their revenue collection mission and may result in them issuing penalties for failure to provide correct and accurate information to CBP.

- If you have been using the wrong HTS codes, it is not too late to fix your mistake and avoid costly fines. If you find out you have been using the wrong HTS code and have been paying too much or too little, you can file a Post-Entry Amendment (PEA) to pay any additional owed duties or to request a refund for overpayment. If the entry has already been liquidated (usually 315 days after entry), an administrative protest can be filed up to 180 days after liquidation of the entry.

- HTS codes are not static. Worldwide the HTS is being updated and changed to allow for new product innovations and technology. In addition, governments are evaluating new revenue sources and seeking to balance their trade with other countries. In the U.S. when an HTS code is created, it has an expiration date to allow for updates. Because of this, it is important to constantly ensure that the codes you are using are valid. The correct classification of imported goods is an ongoing project, and the HTS codes used should be reviewed at minimum, on an annual basis.

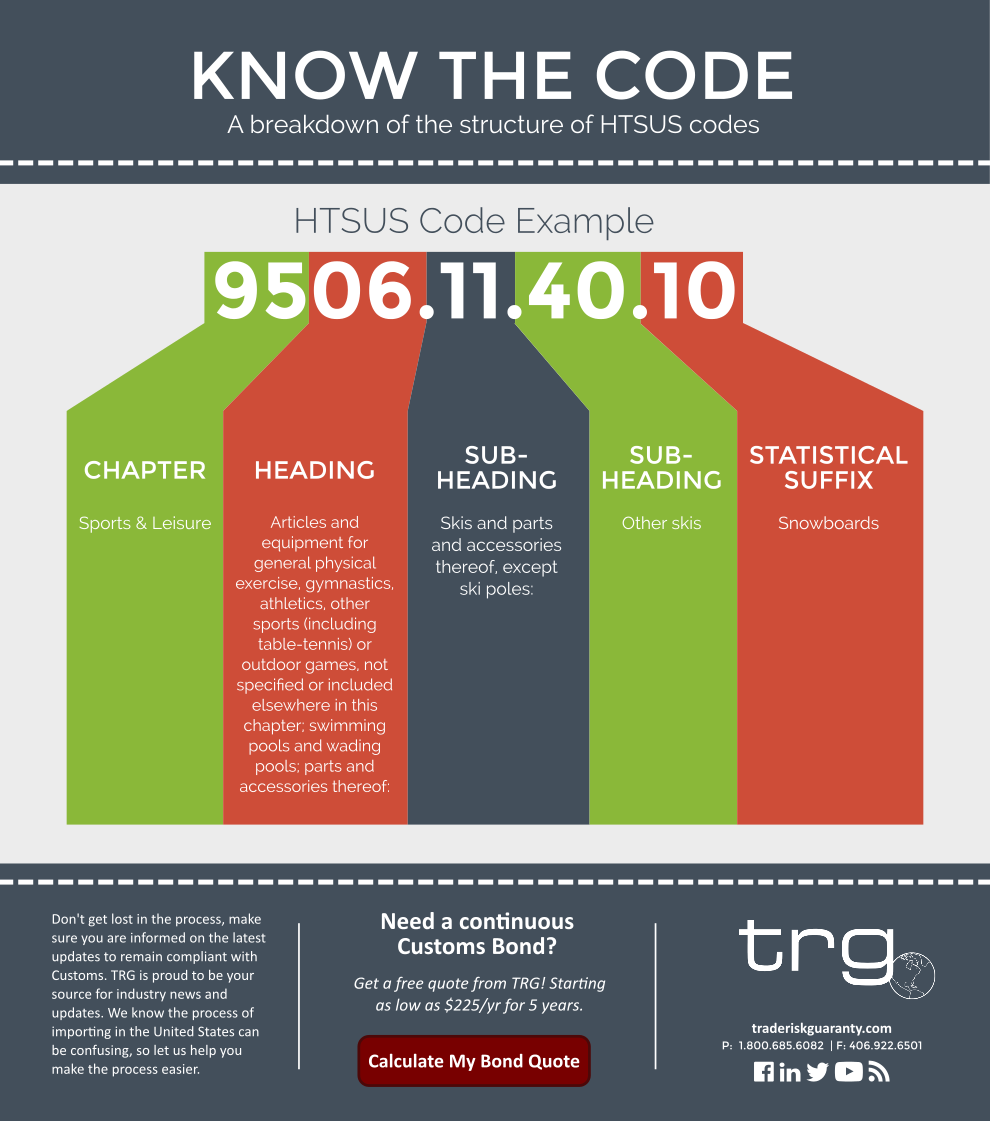

A Breakdown of an HTS Number

HTS codes can be confusing to understand, but the interesting thing about them is that each two-number pairing in the code stands for another layer of information. When strung together, these numbers provide a specified classification of the commodity being imported. The following graphic shows an example of this breakdown when classifying the commodity ‘Snowboards’.

Click the image to download a PDF of this graphic.

In order to look up other HTS codes in order to get a better understanding of their classification structure, use the government HTS Code search tool.

Editor’s Note: This post was originally published in February 2011 and has been edited by Meredith Lambert to include infographics and updated information.

![[Webinar] How Could Changes to De Minimis Impact Your Company?](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2025/05/trg-how-de-minimis-impacts-customs-bond-webinar-400x250.png)

![[Webinar] United States Reciprocal Tariffs – The What, Why, and How](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2025/04/trg-webinar-reciprocal-tariffs-400x250.png)