The process of importing in the United States can be a confusing process for young companies to navigate. TRG has created this introduction to help clarify the basics of importing.

Who are the CBP?

CBP stands for U.S. Customs and Border Protection, a branch of the United States government responsible for the security, compliance, and facilitation of international travel and trade. CBP provides guidance to the import community to increase compliance with domestic and international customs laws thereby safeguarding America’s borders. The department is organized into the following structure:

- Field Operations Offices: These 20 offices distribute key policies and procedures to CBP officers and importing staff around the country. They are also responsible for distributing updated CBP guidelines, policies, and procedures.

- Ports of Entry: The ports of entry are the level at which the CBP enforces import/export laws and regulations. Therefore, they are the face of the border for all cargo carriers and the most relevant level of interaction for importers.

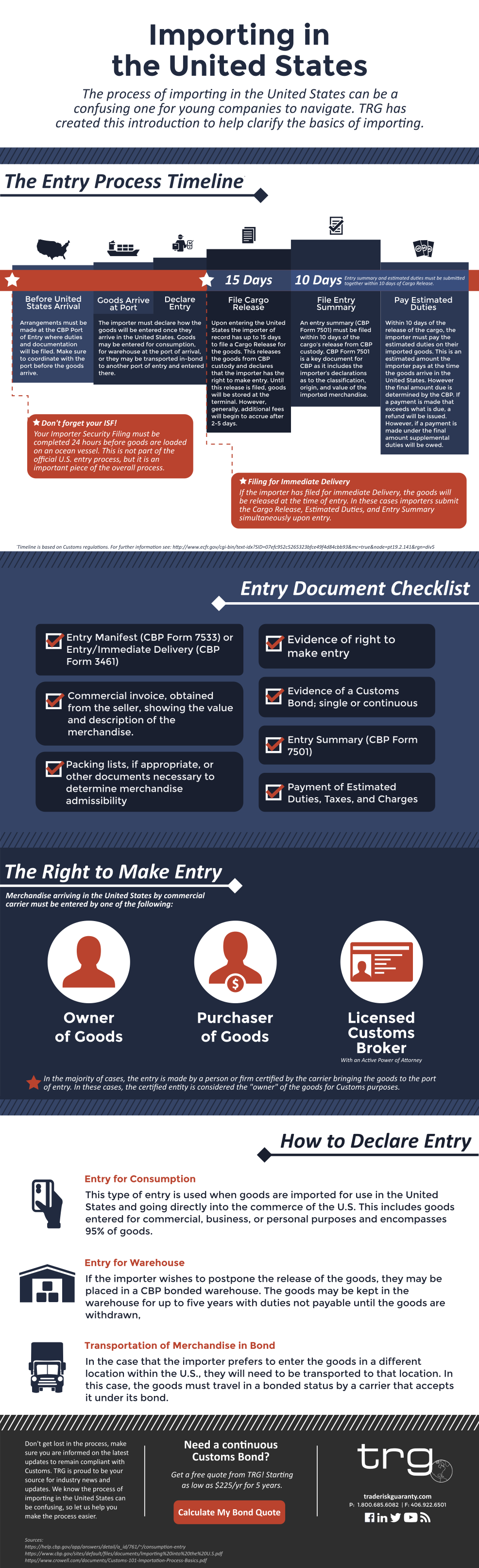

The Entry Process for Importing in the United States

When importing in the United States, the following steps must be taken to ensure your shipment can arrive safely and legally without resulting in CBP storage fees or damages.

- Make Arrangements at a CBP Port of Entry: Prior to arriving in the U.S. arrangements must be made for the goods at the CBP Port of Entry where they will arrive. This will also be where duties and documentation will need to be filed.

- Declare the Entry of Your Goods: Once your shipment has arrived in the United States the importer must declare how the goods will be entered once they arrive. Goods may be entered for consumption, entered for warehouse at the port of arrival, or they may be transported in-bond to another port of entry and entered there.

- File Cargo Release: Upon entering the United States the importer of record (this could be the owner or purchaser of the goods or a licensed customs broker designated by the owner/purchaser) has up to 15 days to file a Cargo Release for the goods. This releases the goods from CBP custody and declares that the importer has the right to make entry. Until this release is filed, goods will be stored at the terminal, however, additional fees will generally begin to accrue after 2-5 days.*If the importer has filed for Immediate Delivery, the goods will be released at the time of entry. In these cases, importers submit the Cargo Release, Estimated Duties, and Entry Summary simultaneously upon entry.

- File Entry Summary: An entry summary (CBP Form 7501) must be filed within 10 days of the cargo’s release from CBP custody. CBP Form 7501 is a key document for CBP as it includes the importer’s declarations as to the classification, origin, and value of the imported merchandise.

- Pay Estimated Duties: Within 10 days of the release of the cargo, the importer must pay the estimated duties on their imported goods. This is an estimated amount the importer pays at the time the goods arrive in the United States. However, the final amount due is subject to change upon liquidation (19 CFR 159). If a payment is made that exceeds what is due, a refund will be issued. However, if a payment is made under the final amount supplemental duties will be owed.

- Ensure Entry Documentation is Complete: Entry documentation will not be legally filed until the following have been completed and confirmed: shipment has arrived within the port of entry, delivery of the merchandise has been authorized by CBP, and estimated duties have been paid.

In the event that you have additional questions while making arrangements with the CBP, you should contact the appropriate agency for further information. For example, you should contact the Food and Drug Administration (FDA) for any questions you may have about products regulated by that department.

Below is a helpful infographic of the basics of importing in the United States from the team at TRG!

Click the image for a downloadable PDF

For further insight on the federal regulations for importing in the United States, refer to the fully written out codes provided by the U.S. Government Publishing Office.