The threat of tariffs is currently in the news, but how do increased tariffs impact your U.S. Customs Bond?

Since 2018, the Section 301 tariffs have been imposed on goods imported from China. These increased tariffs had a significant impact on U.S. importers when they were imposed and continue to affect the industry today. Despite the changes the industry has made, it looks like the tariffs are here to stay. In fact, there is now the threat that more tariffs may be imposed on good from other countries like Vietnam.

As an business that imports into the United States, you must consider the impact another round of tariffs will have on your business. One area many importers do not take into consideration is how increased tariffs impact the U.S. Customs Bond they have on file in order to make entry.

The Basics of Your U.S. Customs Bond

Before getting into the impact tariffs have on your U.S. Customs Bond, We must have a little refresher on Customs Bonds.

What is a U.S. Customs Bond?

A U.S. Customs bond is a financial guaranty between the Bond Principal, the Surety issuing the bond, and U.S. Customs & Border Protection (CBP). The Customs bond guarantees that any money owed to U.S. Customs & Border Protection by the Principal will be paid. Having a U.S. Customs bond on file is required to import into the United States.

Learn more of the basics of U.S. Customs Bonds.

What Size Customs Bond Do You Need to Have?

The penal sum of the bond is determined by the obligee and the type of surety bond it is. In this case we are only talking about the C1 – Importer Bond. The minimum amount an importing business must be bonded is ultimately determined by U.S. Customs and Border Protection.

The following formula is used to calculate the minimum bond amount you must have on file with U.S. Customs: [Your Annual Duties, Taxes, and Fees] X 10% = [Your Minimum Bond Amount]* *This amount must be rounded up to the nearest $10,000, above $100,000 it is rounded to the nearest $100,000

Learn more about calculating your bond amount.

What Else is Included When Calculating the Bond Amount?

There are some specific components included in the ‘annual duties, taxes, and fees’ portion of the Bond Amount calculation. These include, but are not limited to, the following:

- Duties, Taxes, & Fees

- Antidumping Duties

- Countervailing Duties

- Imposed Tariffs (301, 232, etc.)

- Harbor Maintenance Fees

- Merchandise Processing Fees

- Excise Taxes

The Impact Increased Tariffs Have on Your U.S. Customs Bond

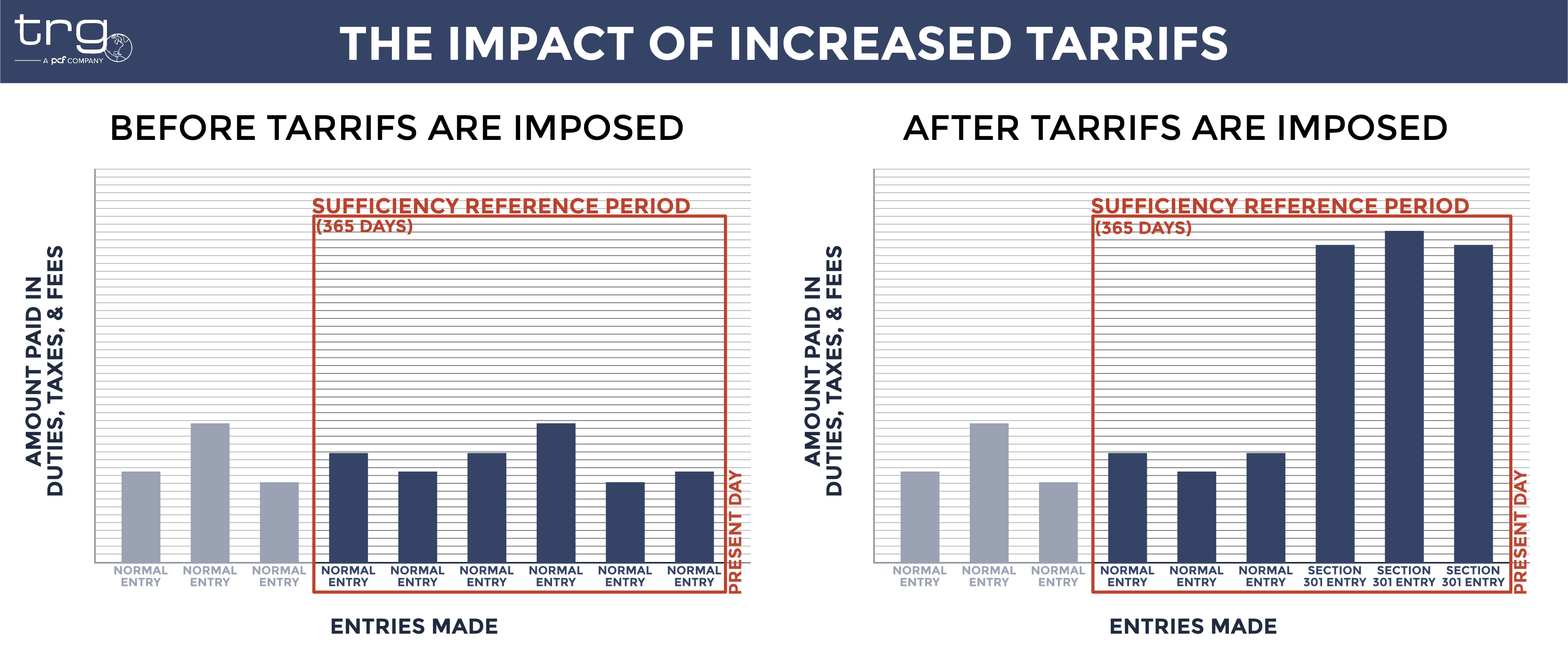

Once you understand the elements U.S. Customs uses when determining the size of your Customs bond, it becomes a lot clearer how increased tariffs impact the bond you have on file. The simple answer is increased tariffs result in increased bond amounts.

An increase in tariffs can result in importers paying more in duties, taxes, and fees. This results in U.S. Customs and Border Protection requiring a larger bond on file to protect the larger amount the importer is paying within a 365-day period. If a larger bond is not placed, U.S. Customs can deem your bond insufficient and stop you from being able to import altogether.

Learn more about U.S. Customs Bond sufficiency.

What Can You Do To Protect Your Business

Unfortunately, there is a lot you are unable to control when tariffs are increased. Businesses that import into the United States have very little options when it comes to contesting these regulations, but they are expected to meet all the requirements as soon as they are imposed.

The best way to protect your business from the volatile nature of tariffs is to be vigilant by closely monitoring your entries and the duties, taxes, and fees, paid on them. It is particularly powerful if you are able to monitor your bond sufficiency on a consistent basis. This will help you know in advance if U.S. Customs is going to require a larger bond be placed and prevent you from having to pause your entries while you place it.

Track Your Import Data with Trade Risk Guaranty

TRG has developed a way to explore and analyze your import data. This software includes reporting as well as our proprietary Importer Score which offers a way to gauge your level of compliance with U.S. Customs & Border Protection at a single glance.

Some of the reports included are bond sufficiency, entry history, claims data and analysis, unliquidated entries, and etc. This reporting is currently only available to importers that have placed a bond with TRG. Learn more about our compliance software to sign up and start tracking your data.

![[Webinar] How Could Changes to De Minimis Impact Your Company?](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2025/05/trg-how-de-minimis-impacts-customs-bond-webinar-400x250.png)