As new tariffs get announced and begin to go into effect, it is not always clear how these tariffs impact your entry summary when importing into the United States.

When you make entry into the United States, you are required to file form CBP 7501, also known as your entry summary. Every single entry that is made into the U.S. has a corresponding 7501 and it is important to understand the different elements included in the entry summary. Amoung other things, the entry summary declares what goods are being imported, the country of origin of those goods, the value those goods represent, and the estimated duty amount that is being paid at the time of entry.

Most importers rely on their U.S. Customs Broker to file their entry summary on their behalf as part of the process of importing into the United States. However, the liability still falls on the importer themselves to ensure that the information included on their CBP Form 7501 is accurate and complies with any regulations that are currently in place. So when new regulations are being enforced in a very short timeline, it is in an importer’s best interest to stay informed about how U.S. Customs and Border Protection wants these changes to be filed.

What do Tariffs Look Like on a CBP 7501 Entry Summary?

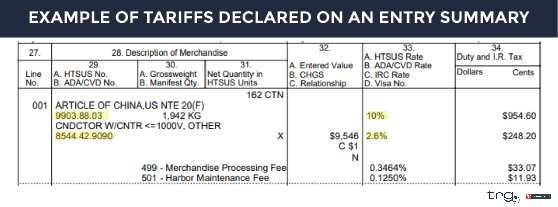

One of the primary components of your Entry Summary is declaring the correct HTSUS code for the commodities you are importing into the United States. Then, depending on what HTSUS code is used, that will inform what duty rate is being paid at the time of entry.

When an additional tariff on goods from a certain country start being enforced, you (or your Customs Broker) must use an additional filing code to classify your goods. This additional code declares to CBP that your entry has a particular Country of Origin and is subject to the additional duty rate.

We first saw this additional duty rate begin to be widely used back in 2018 when the first tariffs were imposed on goods imported from China. Below is an example of an entry summary from that time period using the addition 99 HTSUS code that applied to their imported commodity.

This example also illustrates the fact that these tariffs are IN ADDITION to the normal duty rate due for that commodity.

![[Webinar] How Could Changes to De Minimis Impact Your Company?](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2025/05/trg-how-de-minimis-impacts-customs-bond-webinar-400x250.png)