Antidumping and countervailing’s impact on Customs bond sufficiency can have a lasting affect on the bond size an importer is required to have on file.

In recent years, it has become more and more important for a business that imports into the United States to understand and to keep track of their U.S. Customs Bond Sufficiency throughout the year. This increased awareness is largely due to the affect the Section 301 tariffs had on bond sufficiency, particularly when they were first implemented. However, there are many factors that can impact bond sufficiency, including: the general volume of entries made throughout a 365 day period, any outstanding claims with U.S. Customs and Border Protection, and the importation of goods subject to antidumping and/or countervailing.

What is Customs Bond Sufficiency?

When a business imports goods into the United States, they are required to pay any and all duties, taxes, and fees due on that entry. This includes those due at the time of entry and any that U.S. Customs may determine are owed after the entry has been made.

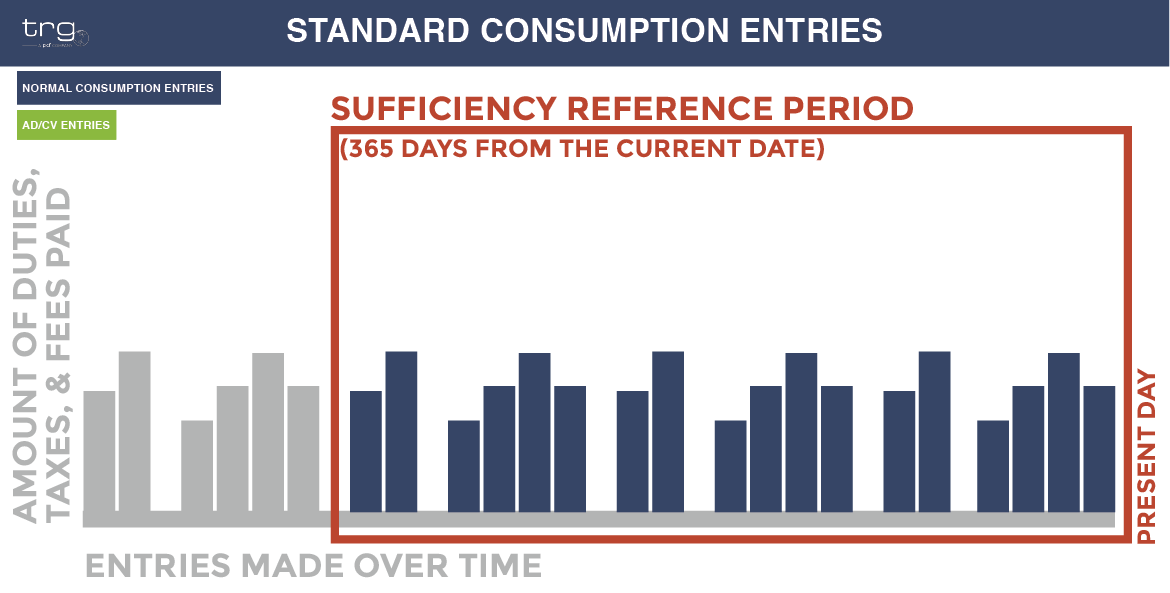

Bond sufficiency refers to whether or not the bond amount is adequate to protect U.S. Customs’ revenue and ensure compliance with laws and regulations. Since the bond amount is determined based on an approximation of the amount of duties, taxes, and fees that will be owed within the coming 365 day period, if this amount ends up being too low of an estimation, the bond will not be sufficient.

Remember, U.S. Customs considers a period of the past 365 days from the current date, on a rolling basis, when calculating bond sufficiency. For a full understanding of bond sufficiency, watch our short video explanation answering What is Bond Sufficiency?

Antidumping and Countervailing’s Impact on Customs Bond Sufficiency

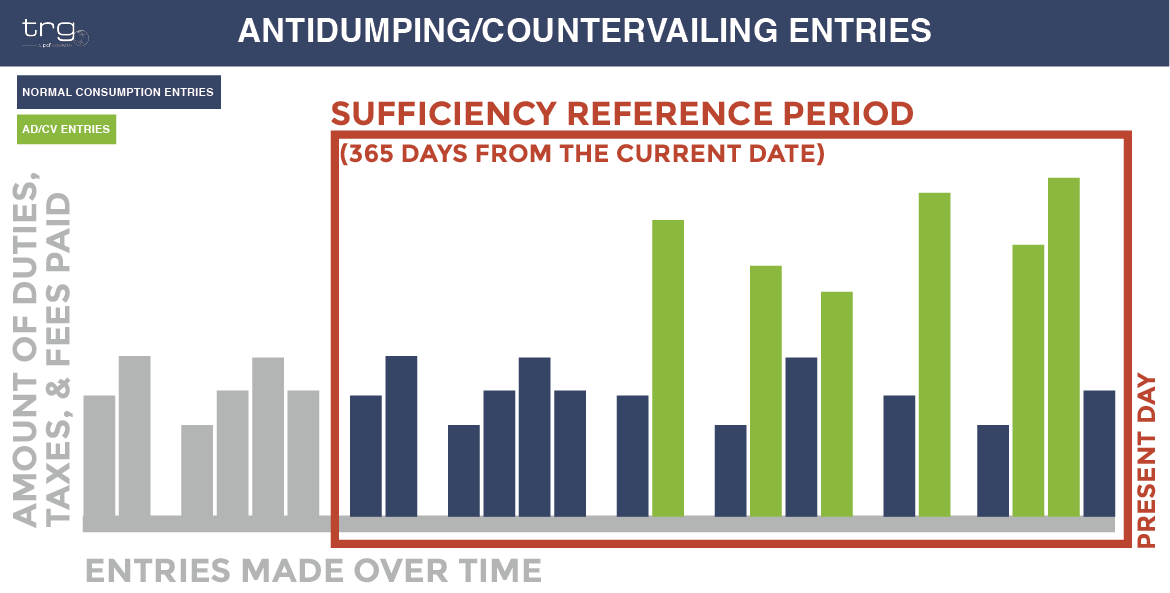

When a business imports goods that are subject to antidumping and/or countervailing into the United States, there is a high level of risk associated with those entries. One of those risks is the high duty rate associated with antidumping/countervailing goods. There is no cap on antidumping/countervailing duty rates and they have reached over 100% for certain imported commodities in the past.

Also, the antidumping/countervailing duty rate is an additional duty owed to U.S. Customs. That means that the importer must still pay the standard duty rate due for the entry and then pay the antidumping/countervailing duty rate as well.

Since bond sufficiency is directly tied to the duties, taxes, and fees an importer pays within a 365 day period, it is clear how antidumping and countervailing can have a direct impact on Customs bond sufficiency. If the importer begins importing goods subject to antidumping, the amount of duties/taxes/fees they pay within a 365 day period will increase and will, therefore, threaten to make their bond insufficient over the course of the next 365 days.

Keep Track of Your Bond Sufficiency with Data From U.S. Customs

Many businesses have found that keeping track of their bond sufficiency helps them maintain their level of compliance with U.S. Customs and Border Protection while also ensuring that they do not need to increase the size of their bond. The best way to do this is to have access to your U.S. Customs data and a system that can help you analyze that data.

Trade Risk Guaranty has developed a new reporting software that provide comprehensive and up-to-date reports directly to TRG clients any time they login. This new reporting software is called Eagle Eye ACE and it uses the data TRG receives from U.S. Customs and Border Protection to put together analysis and reports of your entry interactions with U.S. Customs. These reports help you understand your data and stay compliant with CBP.