The details of how a multi year U.S. Customs bonds works can be confusing since continuous bonds stay on file and renew automatically. But understanding how they work can help save you time and money.

For many years, Trade Risk Guaranty has innovated within the industry by offering billing cycles of 1, 2, 3, or 5 years for importers to choose from when placing their U.S. Customs Bond. These options help meet the needs of importers from any business size as they file their bond and pass on more savings directly to our clients.

However, introducing a new way of doing things can sometimes lead to confusion about how it all works. The following is meant to help clarify how multi year billing cycles work and dispel any remaining misconceptions.

Does a Multi Year U.S. Customs Bond Exist?

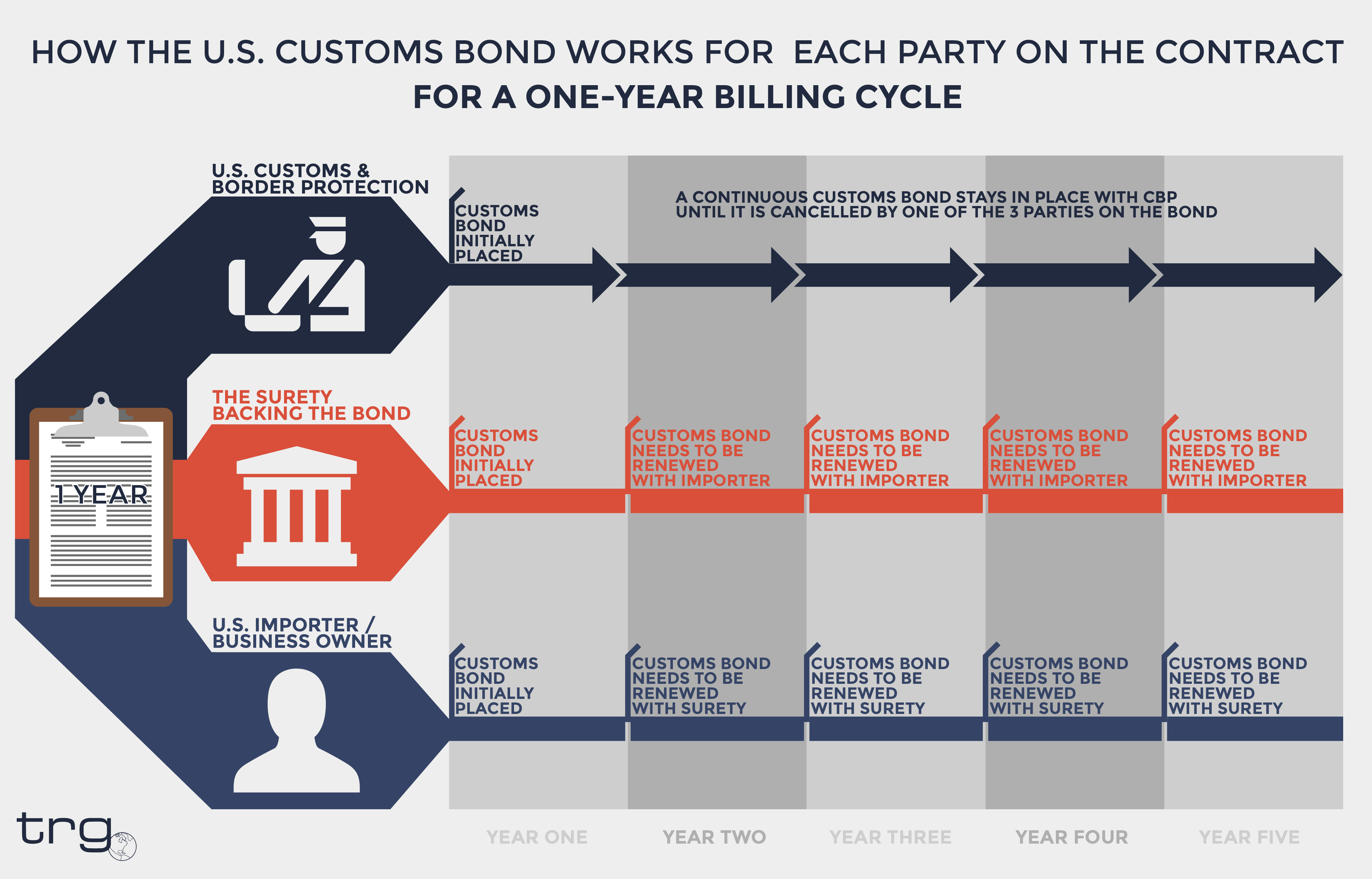

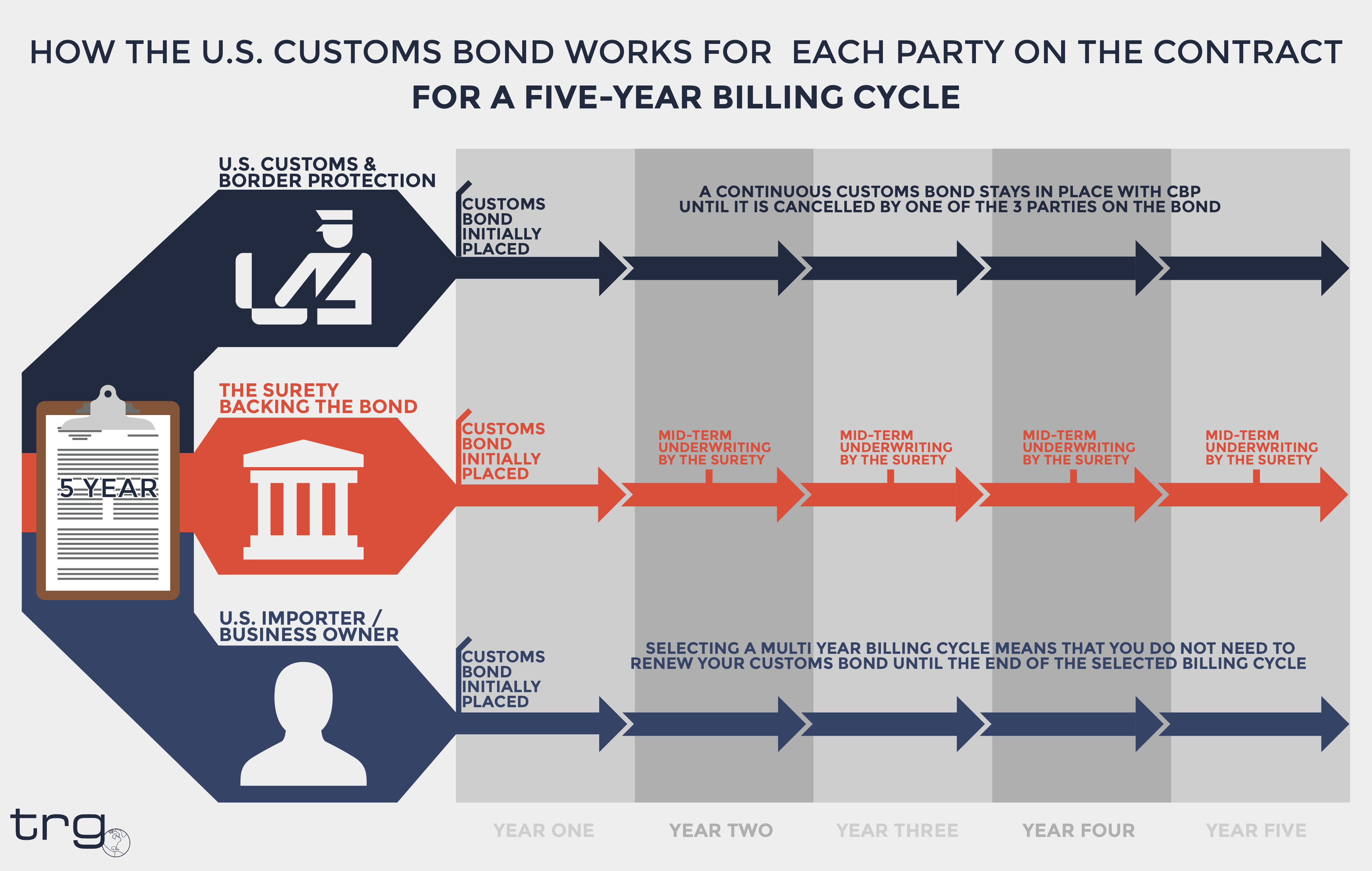

Within the lexicon of U.S. Customs and Border Protection, a multi year bond does not exist. In fact, an annual bond does not exist within CBP. This is due to the fact that a continuous U.S. Customs Bonds will auto-renew annually and remain on file with CBP until one of the 3 parties on the bond contract cancel it.

Therefore, in the eyes of CBP, the only two ways to purchase a bond is as a continuous bond or a single-entry bond. However, an importer would have to renew their U.S. Customs Bond annually with their Surety to ensure it stays on file with CBP.

What About TRG’S Multi Year U.S. Customs Bond Billing Cycles?

Trade Risk Guaranty’s Multi Year Pricing Structure allows a client to pay for multiple years of their required bond at one time. This typically results in cost savings for the importer and less paperwork as the bond does not have to be renewed every year.

In the eyes of the U.S. Customs and Border Protection, the continuous bond will remain on file as always. But now the importer can also benefit from the peace of mind that comes with knowing their U.S. Customs bond is in place throughout their selected billing cycle.

![[Webinar] How Could Changes to De Minimis Impact Your Company?](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2025/05/trg-how-de-minimis-impacts-customs-bond-webinar-400x250.png)