Recieving a liquidated damages claim notice from Customs and Border Protection can be intimidating for small and medium-sized businesses, but taking the right next steps can save your business money.

Liquidated damages claims are issued as a result of breaching a condition of your U.S. Customs Bond. As the principal on the bond, an importer is agreeing to the 13 different Customs bond conditions outlined in the Code of Federal Regulations (19CFR§113.62). These are included in every Customs bond for basic importation and entry, single transaction bonds and continuous bonds alike. A breach of one of these conditions results in receiving a Liquidated Damage, which is a type of claim on your bond.

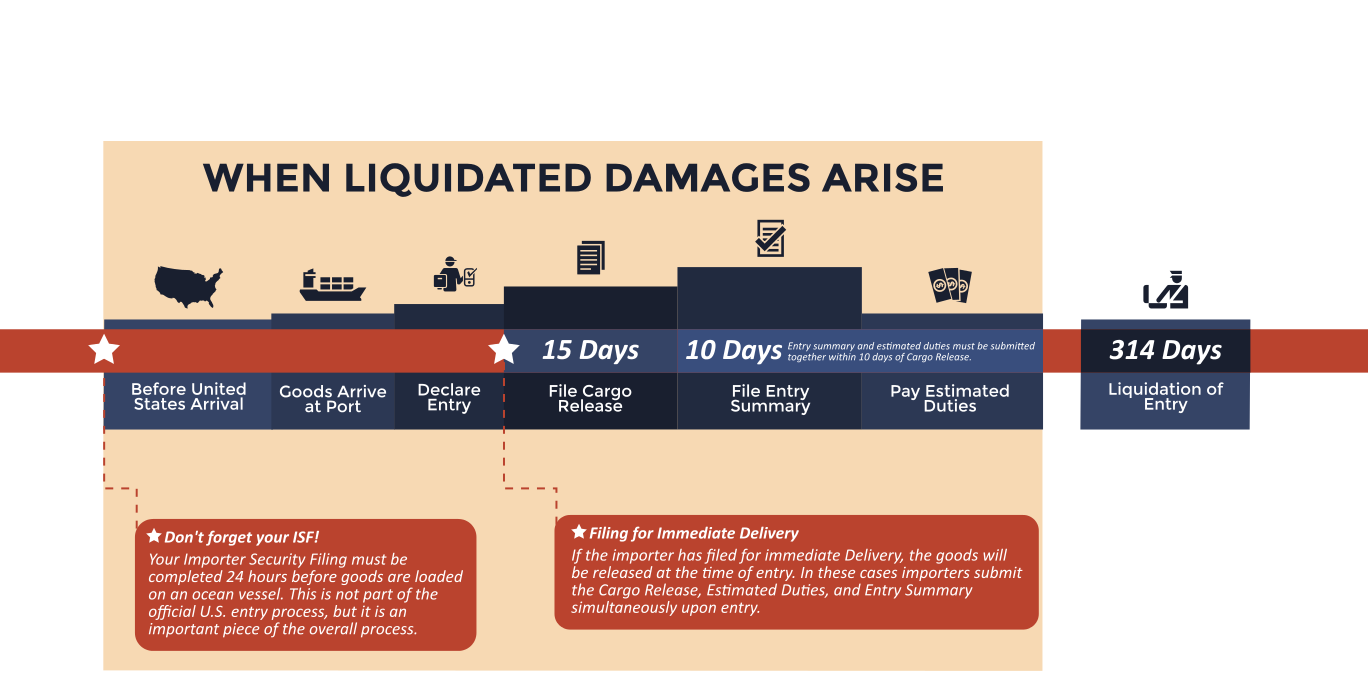

Going back to our entry process timeline from our introduction to entering goods into the United States, we can see where in the process a liquidated damages claim can arise.

What To Do When A Liquidated Damages Claim Arises

The timeline for a liquidated damages claim is fairly simple, the principle on the bond has 60 days to either pay the claim amount or to petition the claim. Either of those actions is seen as ‘resolving the claim’ since they would either stop or pause the 60-day timeline. However, if the petition is declined by Customs and Border Protection, the bond principle would then have to submit payment for the liquidated damages claim.

How to Resolve a Liquidated Damages Claim

- Pay the Claim Amount

When you pay the claim amount within the 60-day timeline, the claim is considered resolved. Making a timely payment will ensure that your company does not begin to owe interest on the claim and will keep you from facing further action from Customs and/or the surety backing the Customs Bond. Keep in mind, when you pay a liquidated damages claim, you forfeit the right to petition. - File a Petition

If the principle on the bond feels there are extenuating circumstances that should result in relief on the claim, they can file a petition for relief with Customs and Border Protection. This petition must be filed within 60 days from the date the notice was mailed to the bond principal. Relief will be granted by Customs only if the petition demonstrates the violation did not occur or was the result of Customs’ error. The degree to which Customs will allow mitigation is completely determined by Customs’ guidelines and the circumstances of the specific case.

Get Help With Your Liquidated Damages Claim from TRG

When filing a petition for relief, it is a good idea to consult a professional with expertise in handling claims and working with Customs and Border Protection. At TRG, our claims team specializes in helping our bond costumers mitigate any claims that may be issued and monitor the progression of the mitigation process. TRG costumers also have the added benefit of our claims team receiving their notices directly from Customs. This way action can be taken immediately and efficiently when a claim arises.

![[Webinar] TRG Talks U.S. Customs Bonds with Star USA](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2024/07/trg-star-webinar-customs-bonds-tariffs-400x250.png)