The U.S.T.R. announced the first round of Section 301 List 3 exclusions granted. These items will be excluded from the 25% tariff imposed on September 24, 2018.

On August 7, 2019, the United States Trade Representative released an official announcement to the Federal Register with the first round of exclusions to List 3 of the Section 301 tariffs on goods from China.

These exclusions are effective for goods entered for consumption, or withdrawn from warehouse for consumption, on or after 12:01 a.m. eastern daylight time on August 7, 2019. Therefore, the exclusion will be retroactive to September 24, 2018 and remain in place for one year after the date of publication in the Federal Register of the exclusion determination. The USTR is also continuing to accept exclusion requests for List 3 goods until September 30, 2019.

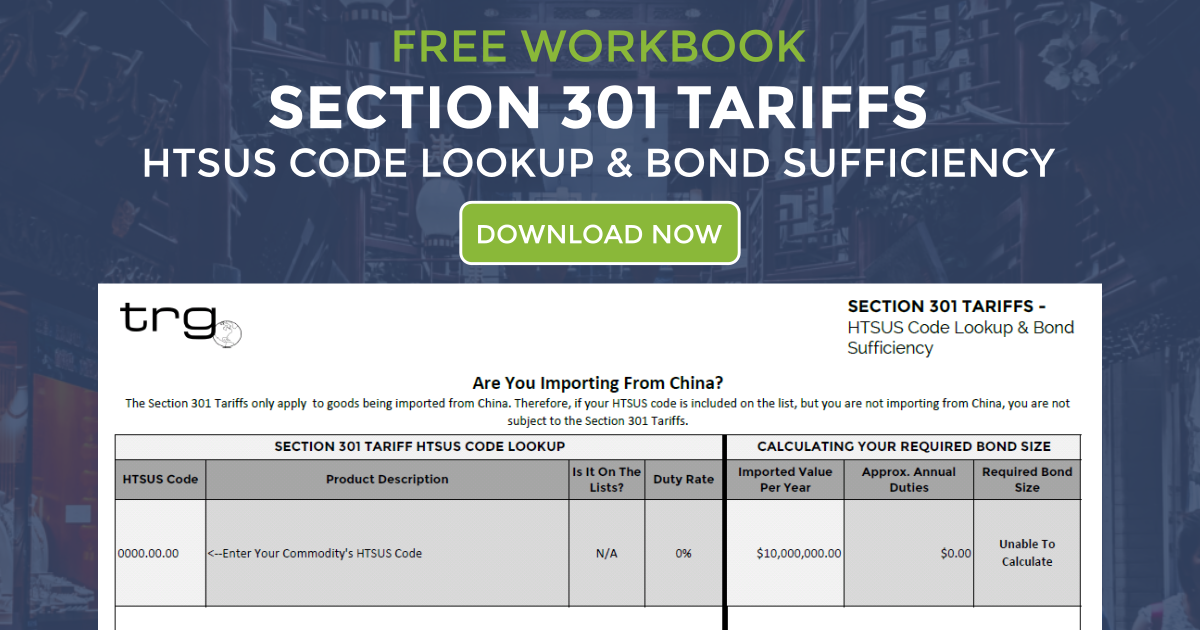

These Section 301 exclusions must be claimed using the new HTSUS subheading 9903.88.13. And are available for any product that fits the product description regardless of if the importer was the one to file the exclusion.

What is Included in the Section 301 List 3 Exclusions Granted in Round 1?

The first round of List 3 exclusions granted includes 10 goods excluded from the 25% tariff rate. These exclusions cover specially prepared product descriptions (described in the corresponding statistical reporting numbers) that reflect 15 separate exclusion requests:

- Plastic tubs and lids configured or fitted for the conveyance, packing, or dispensing of wet wipes (HTSUS 3923.10.9000)

- Injection molded polypropylene plastic caps or lids designed for dispensing wet wipes (HTSUS 3923.50.0000)

- Kayak paddles, double-ended, with shafts of aluminum and blades of fiberglass reinforced nylon (HTSUS 3926.90.3000)

- High-tenacity polyester yarn not over 600 decitex (HTSUS 5402.20.3010)

- Nonwovens weighing more than 25 g/m2 but not more than 70 g/m2 in rolls, not impregnated, coated, or covered (HTSUS 5603.92.0090)

- Steel pet cages (HTSUS 7323.99.9080)

- Carts of the kind used for household shopping (HTSUS 8716.80.5090)

- Truck trailer skirt brackets (HTSUS 8716.90.5060)

- Inflatable kayaks, canoes, and other boats with over 20 gauge polyvinyl chloride (HTSUS number 8903.10.0060)

To see a full list of the HTSUS codes from all the list that have been granted an exclusion in all rounds, view this PDF from Trade Risk Guaranty.

![[Webinar] 2023 Q2 International Trade Update](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2023/08/2023.07_Q2-International-Trade-Update_Page_01-400x250.png)

![[Webinar] 2023 Q1 International Trade Update](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2023/03/trg-2023-q1-international-trade-update-webinar-400x250.png)