The U.S.T.R. announced more Section 301 exclusions granted for List 1. This new round of exclusions comes in addition to the two previous announcements.

On April 18, 2019, the United States Trade Representative released an official announcement to the Federal Register with a third round of exclusions to List 1 of the Section 301 tariffs on goods from China. These exclusions are effective for goods entered for consumption, or withdrawn from warehouse for consumption, on or after 12:01 a.m. eastern daylight time on July 6, 2018. Therefore, the exclusion will be retroactive and remain in place for one year after the date of publication in the Federal Register of the exclusion determination. These exclusions are in addition to those granted in Round 1, Round 2, Round 4, Round 5, and Round 6.

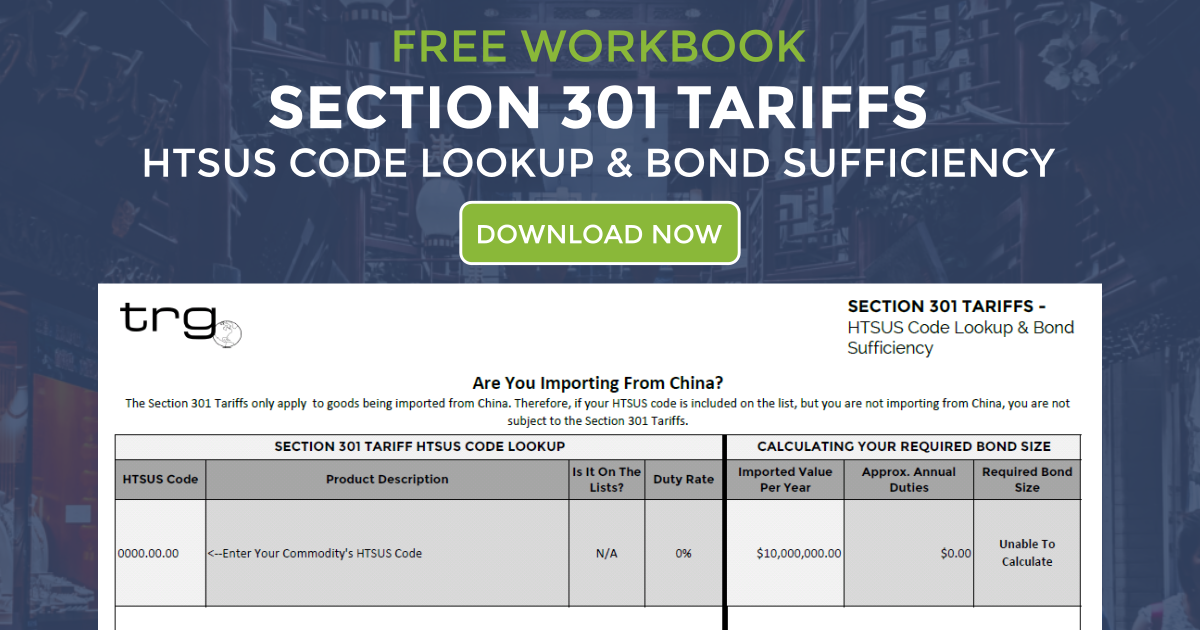

These Section 301 exclusions must be claimed using the new HTSUS subheading 9903.88.07. And are available for any product that fits the product description regardless of if the importer was the one to file the exclusion.

What is Included in the Section 301 Exclusions for List 1 Round 3?

The third round of exclusions for List one include the following specified product descriptions (described in the corresponding statistical reporting numbers). They reflect 348 separate exclusion requests.

- pumps for countertop appliances for serving beer (HTSUS 8413.19.0000)

- roller machines designed for cutting, etching, or embossing paper, foil, or fabric (HTSUS 8420.10.9080)

- water oxidizers and chlorinators (HTSUS 8421.21.0000)

- ratchet winches designed for use with textile fabric strapping (HTSUS 8425.39.0100)

- continuous-action elevators and conveyors designed to convey mineral materials (HTSUS 8428.33.0000)

- counterweight castings of iron or steel designed for use on forklift and other works trucks (HTSUS 8431.20.0000)

- tines, carriages, and other goods handling apparatus and parts designed for use on forklift and other works trucks (HTSUS 8431.20.0000)

- parts of drill sharpening machines (HTSUS 8466.93.9885)

- outer shells of hydraulic accumulators (HTSUS 8479.90.9496)

- parts of mechanical awnings and shades (HTSUS 8479.90.9496)

- certain parts of metal shredders (HTSUS 8479.90.9496)

- steering wheels designed for watercraft (HTSUS 8479.90.9496)

- pressure regulators of brass or bronze (HTSUS 8481.10.0090)

- pipe brackets of aluminum designed for installation into air brake control valves (HTSUS 8481.90.9040)

- push pins and C-poles of steel designed for use in variable force solenoid valves (HTSUS 8481.90.9040)

- ball bearings of a width not exceeding 30 mm (HTSUS 8482.10.5032)

- inductor baseplates of aluminum (HTSUS 8504.90.9690)

- parts of soldering irons and soldering machines (HTSUS 8515.90.4000)

- motor vehicle gear shift switch assemblies (HTSUS 8536.50.9065)

- pressure switches designed for use in heat pumps and air-conditioning condensers (HTSUS 8536.50.9065)

- instruments for measuring or checking voltage or electrical connections (HTSUS 9030.33.3800)

To see a full list of the HTSUS codes from List 1 that have been granted an exclusion in all three rounds, view this PDF from Trade Risk Guaranty.

![[Webinar] How Could Changes to De Minimis Impact Your Company?](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2025/05/trg-how-de-minimis-impacts-customs-bond-webinar-400x250.png)