Stacking liability can have a drastic impact on an importer’s U.S. Customs bond and the collateral they may be required to place.

Stacking liability is a major concern for a Surety backing a U.S. Customs bond since the amount of open liability can increase exponentially and the tail of liability on a single bond can remain open over multiple years in some cases. For a business trying to ensure they have a U.S. Customs bond in place, stacking liability can become a major hurdle as it will often result in the bond provider requiring collateral or a deeper look into the company’s financials.

Understanding what stacking liability is can help a business monitor their open risk and be aware of how it might affect their importing practices before a problem arises.

What is Stacking Liability?

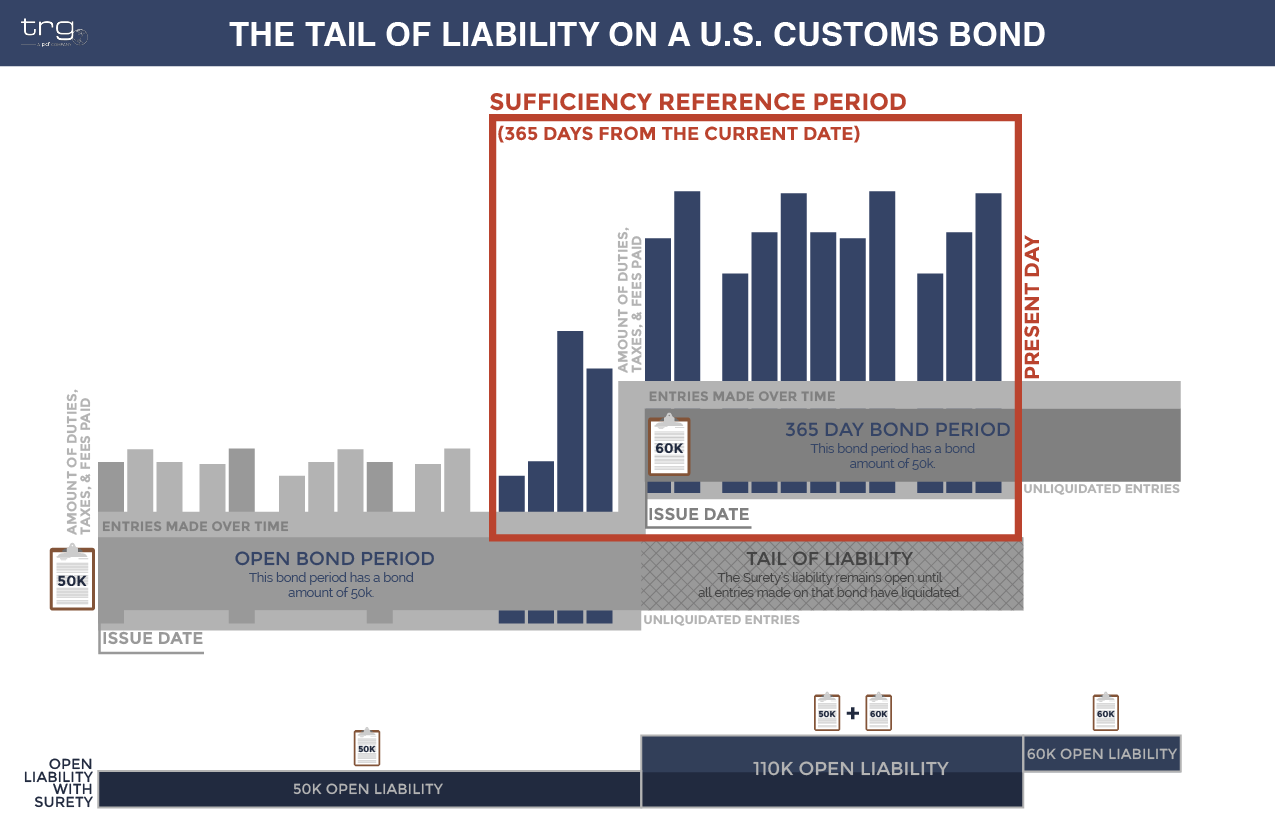

Stacking Liability occurs when a surety company has open exposure over multiple bond periods for a particular importer. The liability of the bond remains open as long as there are entries that were made during that bond term that remain unliquidated.

Stacking liability can be a major concern for the Surety backing the U.S. Customs bond since the amount of open liability can increase exponentially and the tail of liability on a single bond can remain open over multiple years in some cases.

The graphic above depicts a situation where an importer has placed a new Customs bond and has been making entries on that bond for almost a full 365 days. However, the entries made on the previous bond that remain unliquidated cause the tail of liability to remain open. This causes the open liability for the Surety backing the bond to stack as illustrated in the graphic.

What Happens When Your Customs Bond Liability Stacks?

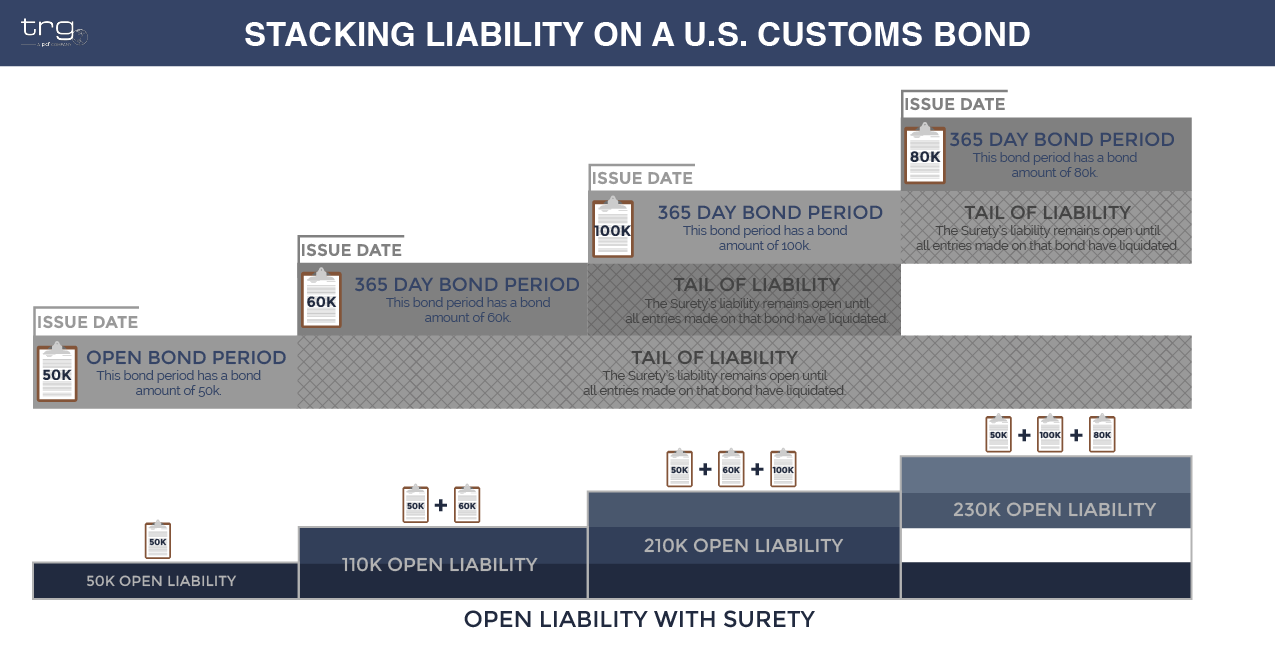

The open liability on a bond can stack over the course of many bond periods and bond amounts. This stacking can become particularly problematic when a past bond term remains open over the course of multiple years. This can occur when an entry was made on that bond and it remains unliquidated for one reason or another.

As you can see in the graphic example above, the original 50K bond was replaced with a 60K, 100K, and then an 80K bond. The 60K and 100K bond periods were opened and then closed within a typical timeframe. Since a consumption entry typically liquidates between 314 – 365 days after the entry date, the bond period open when those entries were made would stay open about one year after the bond has been terminated (or until the last entry liquidates).

However, the 50K bond’s tail of liability has remained opened through multiple years most likely due to an unliquidated entry made on that bond. The entry may have been suspended by Customs which would extend the typical liquidation timeline. While there is some predictable liability stacking as bond terms open and close, the Surety’s liability on the 50K bond will remain open and continue stacking with other open bond liability until the unliquidated entry (or entries) liquidate.

How to Avoid Stacking Liability on Your U.S. Customs Bond

In order to avoid unnecessary stacking liability, it is best to wait until the end of the current bond term to terminate a bond and replace it with a new one whenever possible. An importer must begin this process with their Surety at least 15 calendar days before the effective date of their bond. However, TRG would recommend starting the process as early as 60 days in advance of a necessary increase in order to allow for time to place collateral and ensure that there is no lapse in coverage.

In the event that U.S. Customs and Border Protection requires an importer to increase their U.S. Customs bond in the middle of their current bond term, the importer must get a new bond in place at the increased bond size as soon as possible in order to remain sufficient.

It is important to remember that the insufficiency letter sent out by CBP will state the MINIMUM bond amount for the increase. An importer needs to forecast their importing practices for the upcoming year in order to determine the appropriate bond amount.

In the event that an importer only increases to the minimum and then quickly exceeds that new bond’s capacity, Customs will deem the new bond insufficient and require a larger bond to be placed. This can lead to unnecessary stacking of liability and cause the Surety to require mandatory placement of collateral when placing the new bond.

![[Webinar] How Could Changes to De Minimis Impact Your Company?](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2025/05/trg-how-de-minimis-impacts-customs-bond-webinar-400x250.png)