There are many dates associated with the placement and renewal of a U.S. Customs Bond, but one of the most important is the bond effective date.

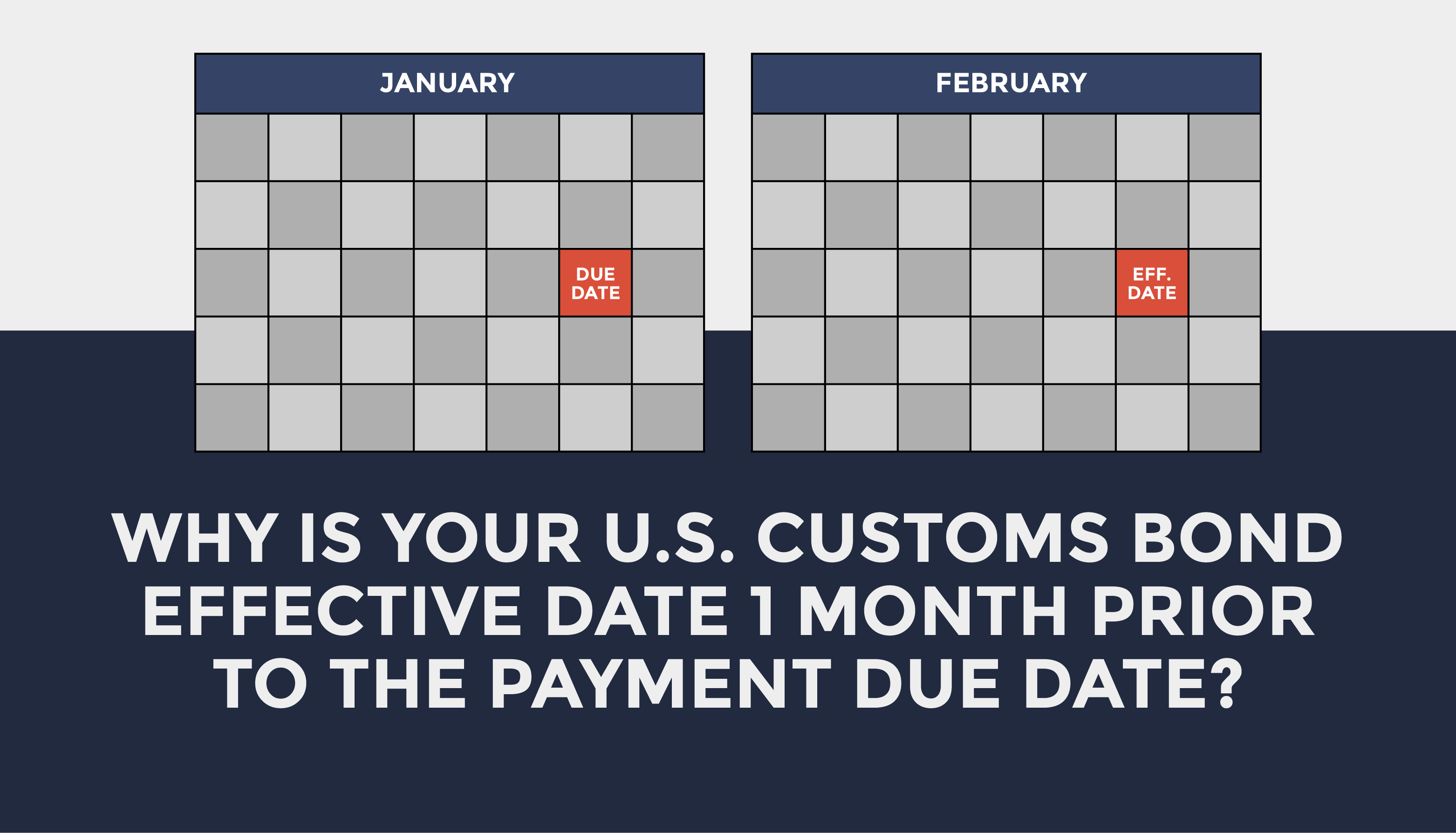

When the time has come for the renewal of your U.S. Customs Bond, many sureties, including Trade Risk Guaranty, will require payment to be made 1 month prior to the effective date of your bond. But why so early? And what is the difference between the bond effective date versus the payment due date?

Why is your U.S. Customs Bond Payment Due 1 Month Prior to the Bond Effective Date?

U.S. Customs Bond payments are due 1 month prior to the effective date in order to give your surety and U.S. Customs and Border Protection (CBP) enough time to process the placement or cancellation of your U.S. Customs Bond.

In the event that you choose to cancel your bond and move to another surety, CBP requires a minimum of 15 days notice of cancellation. This is why TRG requires a full month in order to allow time for any unforeseen issues. These issues could come in the form of government holidays or closures, bottlenecks within CBP, or further discussion of options between TRG and you.

U.S. Customs Bond Effective Date Versus Due Date

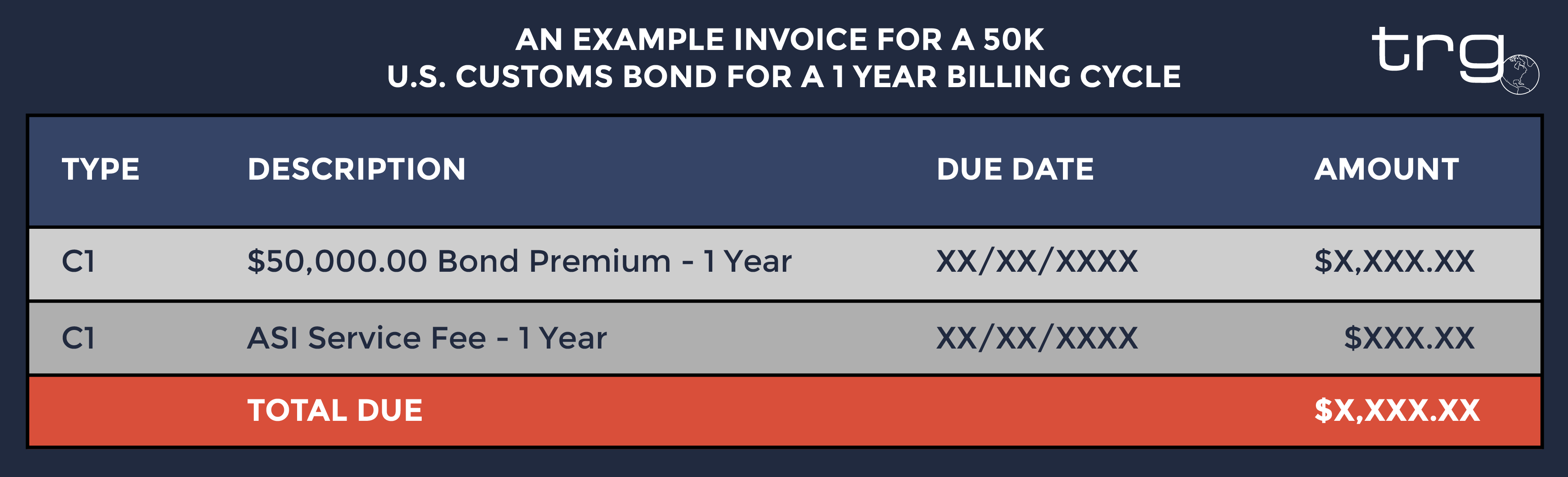

When it comes to renewing your U.S. Customs bond, there are two important dates to consider; the bond effective date and the bond payment date. These will vary depending on when you originally placed your bond, if you selected a multi year billing cycle, and what surety is placing your bond.

Customs Bond Effective Date

The effective date of your U.S. Customs Bond is the date the your business can begin using that bond to clear shipments with U.S. Customs and Border Protection. This is also the date that the bond will renew with CBP every year.

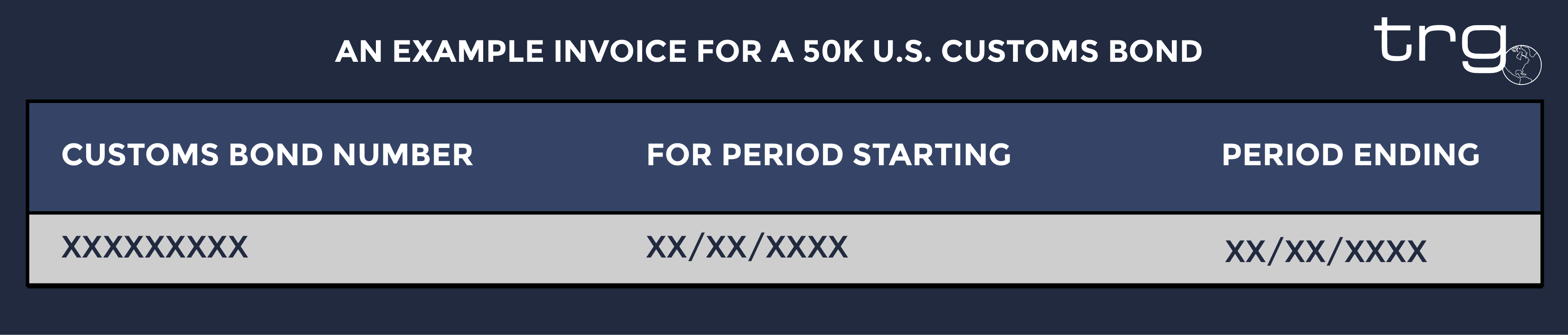

On an invoice from Trade Risk Guaranty, the effective date can be found on under the heading “For Period Starting”.

Customs Bond Payment Due Date

The due date is primarily seen on the invoice from your bond provider and it is the date payment is due. If you have a bond from TRG, this date will be 1 month prior to the effective date of the bond for the reasons stated above.

Reduce your annual paperwork with TRG’s Multi Year Pricing Structure. With 1, 2, 3, or 5 year billing cycle options, it allows you to pay for multiple years of your required bond at one time. Selecting a multi year billing cycle will also typically save you money as you will not have to renew your bond every year. Talk to a TRG Expert to learn more today.

![[Webinar] How Could Changes to De Minimis Impact Your Company?](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2025/05/trg-how-de-minimis-impacts-customs-bond-webinar-400x250.png)