Understanding your invoice is the first step when looking for way to save money on the U.S. Customs Bond required to import into the United States.

At Trade Risk Guaranty, we believe in transparency. Whether it is peeling back the curtain on a new international trade regulation or making sure our customers understand how their billing works. We want to make sure your questions are answered.

What Are ASI Fees on Your U.S. Customs Bond?

When placing your U.S. Customs Bond you will notice a fee on your invoice called “ASI Fee”, but what is this fee and why is it being charged?

ASI stands for Automated Surety Interface and it is in place for the maintenance of your Customs Bond. This includes any administrational changes and underwriting needed on your bond throughout its effective term. TRG also uses this tool to track liquidations, manage bond claims for the benefit of the bond principal and the insurance company, and provide supplemental reports to bond principals at no additional charge.

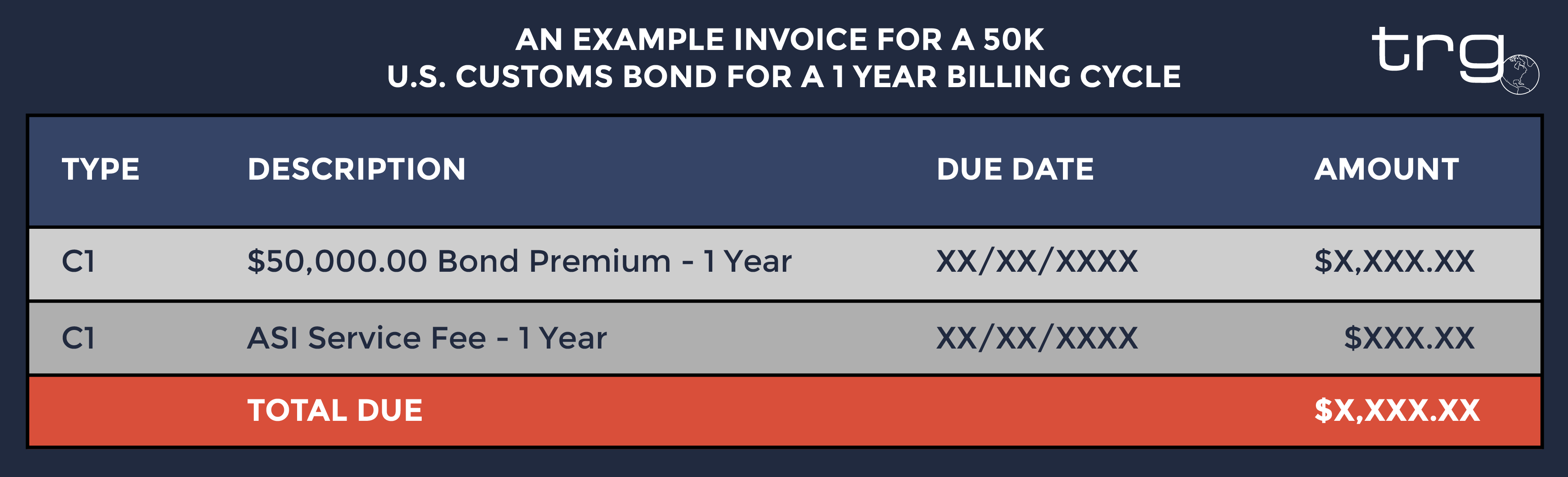

For clarity, the ASI fee is separated from the bond premium on the invoice you receive from TRG. The following is an example of how the ASI fee looks on an invoice for a 1 year billing cycle of a 50k C1 bond:

Can You Save Money on This ASI Fee with TRG?

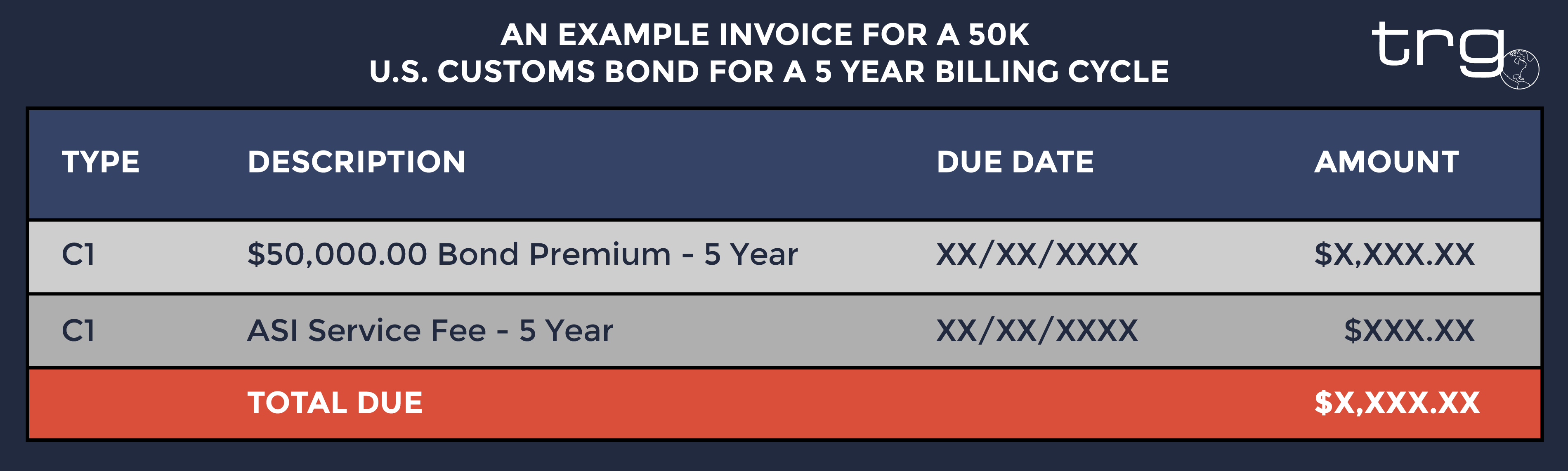

While the ASI is a required part of every TRG invoice, selecting a multi year billing cycle can save you money on this fee as well. This is due to the fact that the fee will only be charged once, at the time of billing.

Therefore, if you select a 5 year billing cycle, you will only pay the ASI fee once for that 5 year period. Instead of having to pay it annually if you are billed every year with a 1 year billing cycle.

And don’t forget! if you need to cancel the bond early, all multi-year options with Trade Risk Guaranty provide a risk-free prorated refund of premium for all unopened bond periods, if the bond is cancelled for any reason after just the first year. For more information, read our detailed refund policy.

![[Webinar] How Could Changes to De Minimis Impact Your Company?](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2025/05/trg-how-de-minimis-impacts-customs-bond-webinar-400x250.png)