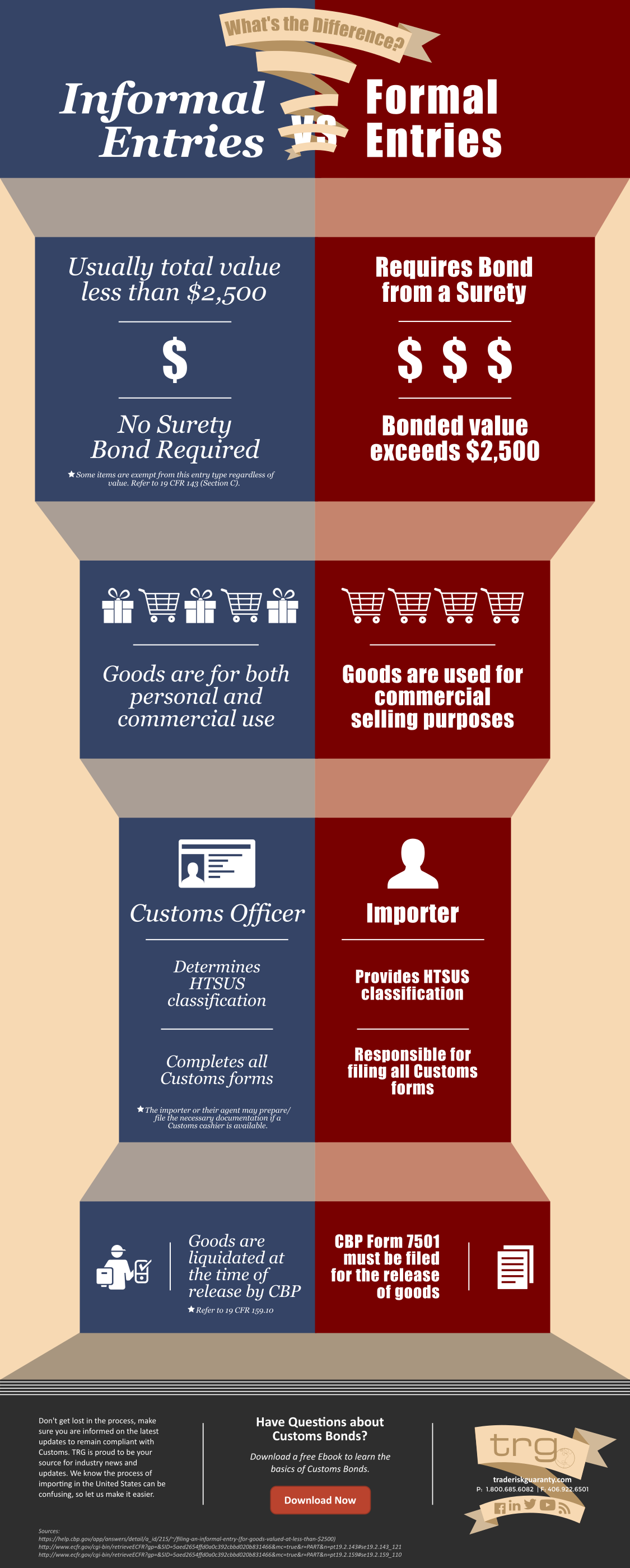

There are many elements that come into play when determining the difference between Formal and Informal Entries. Knowing the differences will help you stay compliant and maintain an efficient trade process.

Learning more about the different types of entries will give you an advantage when deciding how you want your goods to come into the country. When it comes to Formal and Informal Entries, knowing the difference between the two will help you stay on top of your importing responsibilities.

What is a Formal Entry?

Formal entries are defined as the process of importing commodities, which are typically used for commercial selling purposes, covered by an entry bond with a total value that usually exceeds $2,500.

How do I file a Formal Entry?

In order to properly file a Formal Entry, an importer must identify which port the goods will be entering. Then, they must contact a Commodity Specialist Team member at the port of entry regarding the type of goods they’re importing and ask them for the following:

- HTSUS Tariff Classifications

- Duty Rates

- Applicable Regulations

- Bond Type

Next, sometime between one week before and 15 days after the arrival of goods, the importer must file 5106 & 7501 Forms as well as a Release Document with Customs. Then, these documents must be submitted for review to an entry specialist at the port of entry. With an accurate invoice, packing list, and shipping documents the importer will submit the reviewed documents along with a check, drawn on a U.S. Bank or cash, for estimated duties and fees to Customs.

Once all of the paperwork has been approved and filed at the port of entry, the documents will be released with either an Officer’s signature authorizing the release of the goods or a stamp dictating further examination. Any shipments that require examination will be carted under bond to an inspection site at the importer’s expense.

For a full breakdown of the importing process, see the infographic about Importing in the United States.

What are some exceptions to Formal Entries?

There are a few exceptions when it comes to filing goods under a Formal Entry. These primarily apply to instruments of international traffic such as:

- Container Ships

- Freight Cars

- Railway Locomotives

- Other Vessels Transporting Goods

In addition to this list, many kinds of Undeliverable Articles are exempt also exempt from Formal Entries. These include the following:

- Goods that are intended to be exported to a foreign country

- Imports being returned within 45 days of departure from U.S.

- Commodities that did not leave the custody of carrier or foreign customs

- imports returned to U.S. as undeliverable from a foreign country

What is an Informal Entry?

Unlike the lengthy and detailed process of filing a Formal Entry, Informal Entries are relatively simple. Informal Entries are defined as the process of importing commodities, typically used for personal enjoyment, with a total value less than $2,500. As these goods will typically not enter into U.S. commerce, the filing process is quite simple. No bond is required to import these commodities and once the goods have cleared, they are immediately liquidated.

Click the Image for a Full PDF

These are the primary differences between a Formal and Informal Entry. Now that you know more about the main differences between Formal and Informal Entries, get out there to evaluate your importing practices and make sure you’re being efficient and compliant.

Editor’s Note: This post was originally published in September 2015 and has been edited to include infographics and updated information.

![[Webinar] How Could Changes to De Minimis Impact Your Company?](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2025/05/trg-how-de-minimis-impacts-customs-bond-webinar-400x250.png)