Do You Import Goods Subject to Antidumping and/or Countervailing?

Secure the Same Import Bond

While Freeing Up Cash Flow

*Pending underwriting review and approval. Pricing depends on your import history. To get the process started contact our Trusted Risk Advisors

Do You Import Antidumping or Countervailing Goods and Not Feel Heard?

The majority of U.S. importers today encountered at least one shipment of goods associated with Antidumping and Countervailing duties. In most cases, these importers are labeled as high risk importers and a broad, generalized approach is applied by the bond provider.

However, not every antidumping/countervailing commodity represents the same risk portfolio. Therefore, not every antidumping/ countervailing importer should have the same requirements when securing their U.S. Customs Bond.

Trade Risk Guaranty's Antidumping and Countervailing Program takes an importer's unique situation into consideration and provides an individualized option. This custom solution is often at a lower overall cost to the importer, saving them money year-over-year and freeing up cash flow so they can continue to focus on what's important: growing their business.

Providing importers with customized options while saving them money

Why is Importing Antidumping/Countervailing Risky?

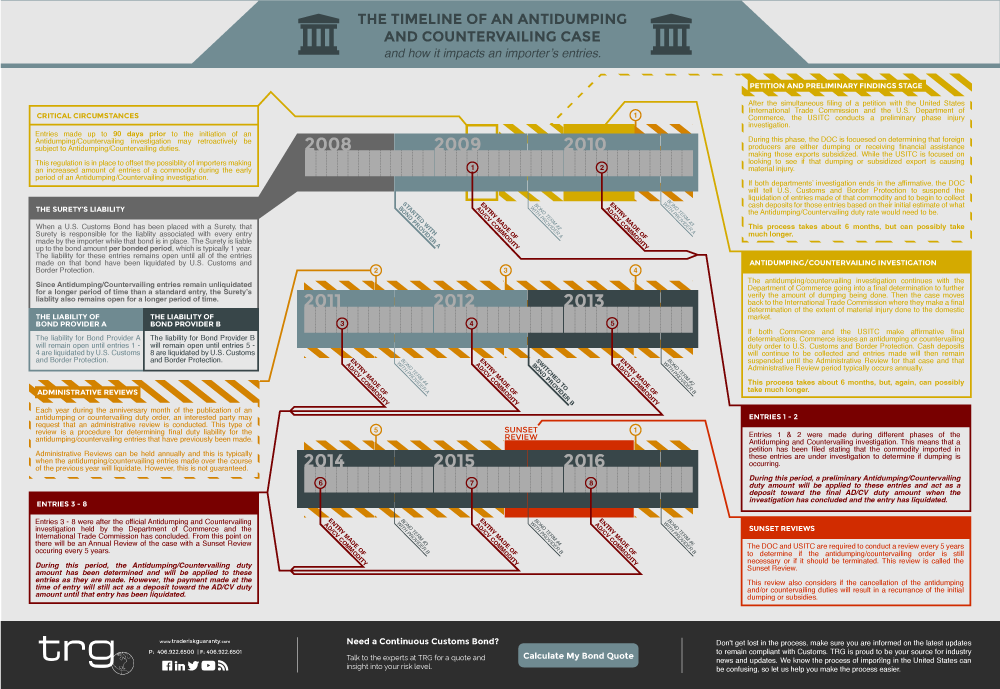

While every situation is unique, there is an increased amount of risk associated with importing goods subject to antidumping and/or countervailing (ADCV). This increased risk is primarily due to the increased time these entries take to liquidate and the fact that there is no cap to how high the increased duty can be determined to be.

Antidumping and countervailing entries do not liquidate within the normal timeframe and can often remain unliquidated for multiple years. This is due to the length of time it takes for the antidumping investigation. The best way to keep track of your open liability is to keep track of the specific antidumping and countervailing investigation case number your goods are subject to. This can help you keep track of your open liability and give you a better idea of when an entry may liquidate.

Ultimately, your importing practices are unique to your business. The way you secure your U.S. Customs Bond should be too. Don't get thrown into a general bucket, learn about your customized options today.

Reach Out To An Expert Today To Discuss Your Needs

Get the peace of mind that your business has the coverage it needs when it needs it.

Why Trade Risk Guaranty?

TRG is the world's largest client-direct supplier of U.S. Customs Bonds and Cargo Insurance. Our partnership with PCF enables TRG to offer additional lines of insurance with the same high level of knowledge and customer service. Including Cyber Security, Group Health Benefits, General Liability, Auto Insurance, Commercial, and so many more.