U.S. Customs Bond Frequently Asked Questions

General Customs Bond Questions

What is a Customs Import Bond?

Is this the same Continuous Bond I already have?

How is my Customs Import Bond used?

The Cost of a Customs Bond

What is a Customs Import Bond?

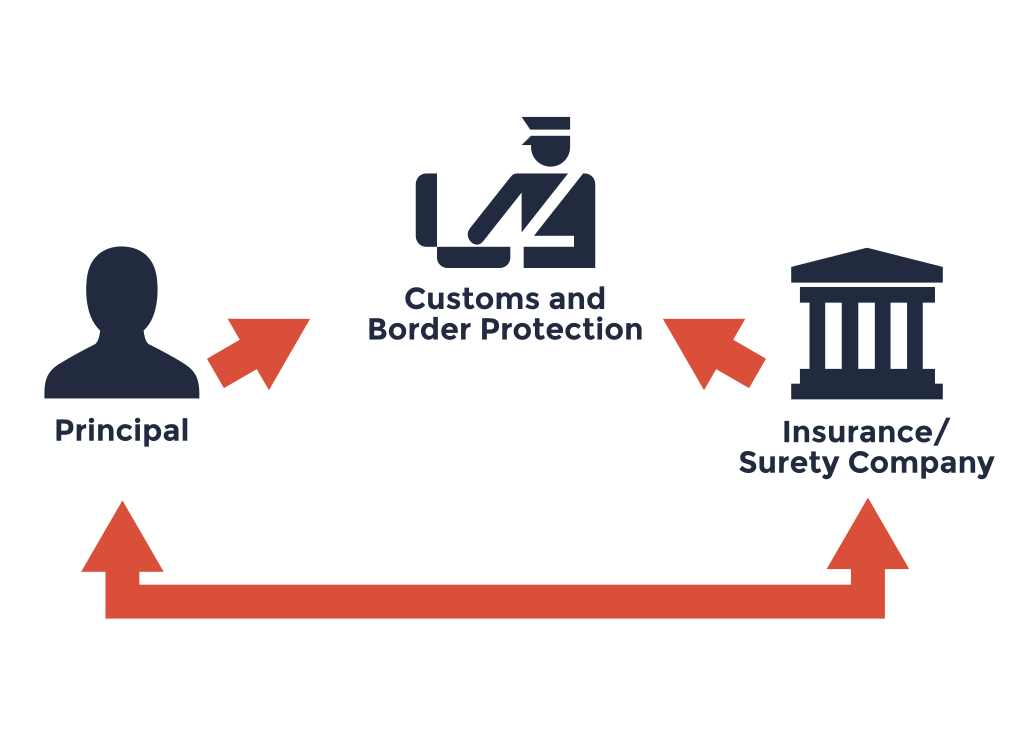

A Customs Import Bond is a financial guarantee between the Insurance/Surety Company issuing the Customs Bond, Importer of Record, and Customs & Border Protection (CBP). Per regulations, CBP requires all importers to file an Activity Code 1 - Import Bond in order to clear their entries, even if the goods are duty free. The Customs Import Bond guarantees CBP will collect all import duties, taxes, fines, or penalties from the importer. If the importer cannot pay, the Insurance/Surety Company who issued the bond will reconcile remaining costs. An importer may only have one Continuous Import Bond on file with CBP at a time. Learn more about the different types of Customs bonds.

Is this the same Continuous Bond I already have?

Customs Bonds are issued in a standardized format according to CBP regulations. All authorized issuers of continuous Customs Bonds employ the same bond format, parameters, conditions, and coverages. Anyone authorized to clear entries on behalf of the importer will be able to access the bond filed with TRG.

The only difference in purchasing a bond from one issuer to another is the strength of the insurance company issuing the policy. TRG issues Customs Bonds directly from insurance companies with very high S&P ratings which have been operating well over 100 years. This ensures dependable financial support to all Customs bonds issued by TRG.

How is my Customs Import Bond used?

A Continuous Import Bond is good at any U.S. port and can be used by any Customs Broker or Freight Forwarder to clear entries.

When a bond is placed CBP issues it a unique bond number, tying the bond to the company’s Importer Number/Tax ID.

The Customs Broker or Freight Forwarder files the import documents, providing the bond number upon entry. The Continuous Import Bond remains on file as a policy of the surety and there is no ownership of the bond by a third party, regardless of where the bond is purchased.

How much does a Customs Bond cost?

TRG offers a Multi-Year Pricing structure unique to the industry. Clients will get access to 1, 2, 3, or 5 year payment structures for their Continuous Import Bonds. This reduces service costs for the bond and ultimately reduces the out-of-pocket expenses for our clients.

Unlike other Customs Brokers or Freight Forwarders, Trade Risk Guaranty acquires the bond directly from Customs instead of purchasing and reselling bonds to clients. This means bonds filed with TRG will have more flexibility and a lower cost.

When will a Customs Bond renew?

When a surety agency or a 3rd party billing service, such as a Customs Broker or Freight Forwarder, sends a notice of renewal, it will also notify the client of the upcoming payment for the bond term. This process simply means the insurance company, from which the Customs Broker/Freight Forwarder purchases the bond and resells it to the importer, will ask for payment on the bond to remain in effect.

However, a renewal with a TRG Bond means clients will have direct access to a Multi-Year Pricing Structure and billing cycle of 1, 2, 3, or 5 years, which is unique in the industry: offering competitive pricing, unmatched customer service, and no middle man. With a Multi-Year option in place, it also means that the client will not have to deal with a yearly bill and can rest assured that their required Customs bond is in place for the full term of their selected billing cycle.

How do I apply for a U.S. Customs Bond?

The application process for a Customs Bond with TRG is simple. All TRG requires is an officer of the company to fill out and sign a one-page application and a power of attorney form. From that point, TRG’s underwriting team will evaluate the account and may request additional documentation for approval.

Once approved, the bond will be filed with CBP prior to the current bond's effective date (if a bond for the previous year was already in place). The bond’s new effective date will remain unchanged, ensuring there will be no lapse in coverage. TRG issues the Customs bond in accordance with CBP requirements and will promptly deal with any necessary changes at no additional charge.

Locate Your Bond Information

TRG's interface with U.S. Customs and Border Protection allows us to query their database, delivering the most up-to-date information about your Customs Bond straight to your inbox.

How long does it take to put a Continuous Bond in place with TRG?

The length of a bond filling period is primarily determined by CBP. Although this time varies, the common $50,000 Continuous Import Bonds typically require 15 calendar days to become active. Other types of Customs Bonds or bonds of different amounts could require more notice and take longer to put in place.

What else does TRG offer with the Import Bond?

All TRG Bond™ customers are automatically enrolled in our Loyalty Program which includes in-house claims support, manifest confidentiality assistance, and other specialty discounts. TRG clients will also have unlimited access to a Customer Loyalty Advocate, an individual who brings excellence to every client interaction and will assist with any additional needs.

Additionally, and most importantly, clients have access to one of TRG’s biggest assets: our knowledgeable staff. Among the TRG personnel are individuals who understand the various levels of Customs compliance. TRG’s staff exemplifies a wide range of backgrounds from Underwriting Specialists to Licensed Customs Brokers and New Business Experts to Client Loyalty Specialists.

What is the TRG experience?

Since 1991, TRG has built a team of Customs Bond experts to provide unparalleled customer service in this unique market. When it comes to bonding needs, it is imperative to have someone working with the clients’ individual needs in mind to get the best price, service, and benefits available. Although Customs Brokers and Freight Forwarders play an important role in assisting importers with the import document process, they do not concentrate on the niche business of international insurance. TRG Bond™ Solutions Experts are licensed insurance agents trained to offer the best client experience to meet anyone’s Customs Bond needs.