Marine Cargo Insurance Frequently Asked Questions

General Marine Cargo Insurance Questions

What is an All-Risk Cargo Insurance Policy?

Is Warehouse Coverage included in an Annual All-Risk Policy?

What is Domestic Cargo Insurance Coverage?

What is a Marine Cargo Insurance Buyer’s Contingency Policy?

What does Basis of Valuation CIF + 10% or 110% Valuation mean?

Questions about Your Current Providers

What if I already have a Cargo/Shipping Insurance Policy?

Doesn’t my Transportation Carrier pay my losses?

I always sell C & F or buy CIF, why should I change?

Why should I purchase through TRG Marine™ when I already purchase it through my Freight Forwarder?

Information about TRG Marine™ Policies

How is TRG Marine’s™ Quote so much lower than my current provider’s?

How do I get a quotation for an Annual All-Risk Cargo Insurance Policy?

Does a TRG Marine™ Policy have a Minimum Annual Premium Deposit?

What is a Standard Cargo Insurance Deductible?

What do I do in the event of a Cargo Insurance Claim?

More About Lloyd's of London

What is the Lloyd’s of London Marine Cargo Insurance Market?

What is TRG Marine’s™ relationship with Lloyd’s of London?

Concerns About Marine Cargo Insurance

My goods are not at risk so why should I get Marine Insurance?

What if Cargo Insurance is too expensive for my company to purchase?

What if I cannot find a company that will insure my type of risk?

What is an All-Risk Cargo Insurance Policy?

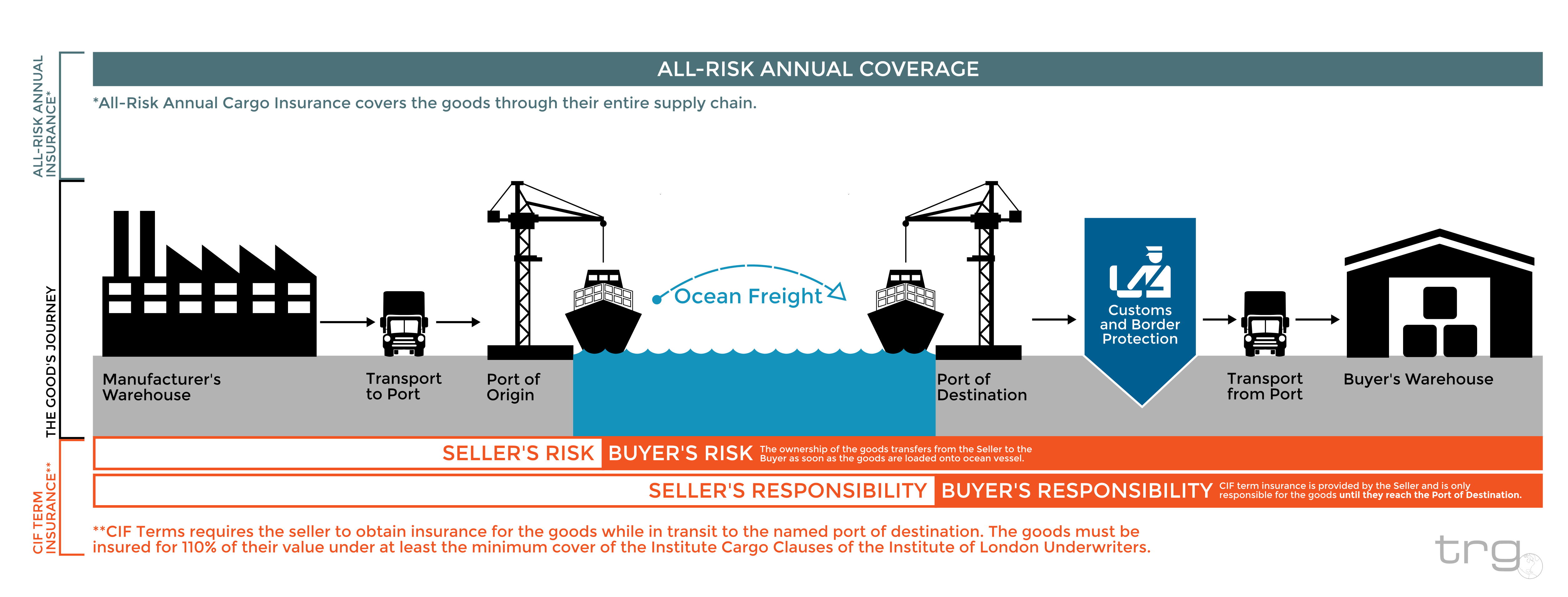

An all-risk cargo insurance policy is the most comprehensive shipping insurance available. Any physical loss/damage from any external cause will be covered under this policy, and any exclusion not covered will be listed on the policy. These exclusions can be added to the policy as an additional clause. An annual open cargo policy automatically insures your shipments on set terms, conditions, and rates without the need to contact your insurance broker or company. Learn more about the different types of shipping insurance.

Is Warehouse Coverage included in an Annual All-Risk Policy?

In regards to warehouse coverage, an annual all-risk shipping policy extends to goods temporarily stored during normal course of transit. However, if the goods are stored outside the normal course of transit, like an importer’s warehouse before shipment to customer, warehouse coverage must be added to insure the goods.

Contact a Marine Specialist

Contact a TRG Marine Specialist today about Warehouse Coverage or for answers to any of your Marine Cargo Insurance questions.

What is Domestic Cargo Insurance Coverage?

Domestic cargo insurance coverage pertains to goods on a bill of lading that were split during the normal course of transit and continued to separate end destinations.

What is a Marine Cargo Insurance Buyer’s Contingency Policy?

When the terms of sale include insurance coverage up to the title transfer of goods, the buyer may purchase additional insurance from the provider known as a contingency policy. A contingency policy will provide insurance coverage for the goods once the title has transferred and the goods are no longer covered under the seller’s insurance policy. If goods are damaged upon arrival to the buyer and the title has transferred, the policy would pay the damage and the buyer’s insurance company would subrogate against the seller’s insurance. TRG Marine™ can write contingency policies.

What does Basis of Valuation CIF + 10% or 110% Valuation mean?

Basis of Valuation CIF + 10% or 110% Valuation means the standard valuation for both annual volume reporting and payment of cargo insurance claims, unless otherwise requested, is 110%. The total premium owed is calculated using the policy rate times 110% of the total cost of goods. Any covered losses are paid at 110% of the cost of goods, including freight and insurance premium of the shipment less deductible amount.

Watch our Marine Cargo Insurance webinar for a deeper look at why you need to be protected.

What if I already have a Cargo/Shipping Insurance Policy?

If you already have a cargo/shipping insurance policy, chances are it lacks the broad coverage that is offered by TRG Marine™. We negotiate very favorable terms with our cargo insurance carriers and would be pleased to offer you a free, no obligation comparison. By arranging cargo/shipping insurance in volume, our rates and terms are very competitive. Also, TRG Marine™ helps handle your claims and acts as your insurance department. Give us a try, again there’s no obligation and it’s free!

Get a Quote for Your Marine Cargo Insurance

Contact a TRG Representative today about Marine Cargo Insurance for a free, no obligation quote.

Doesn’t my Transportation Carrier pay my losses?

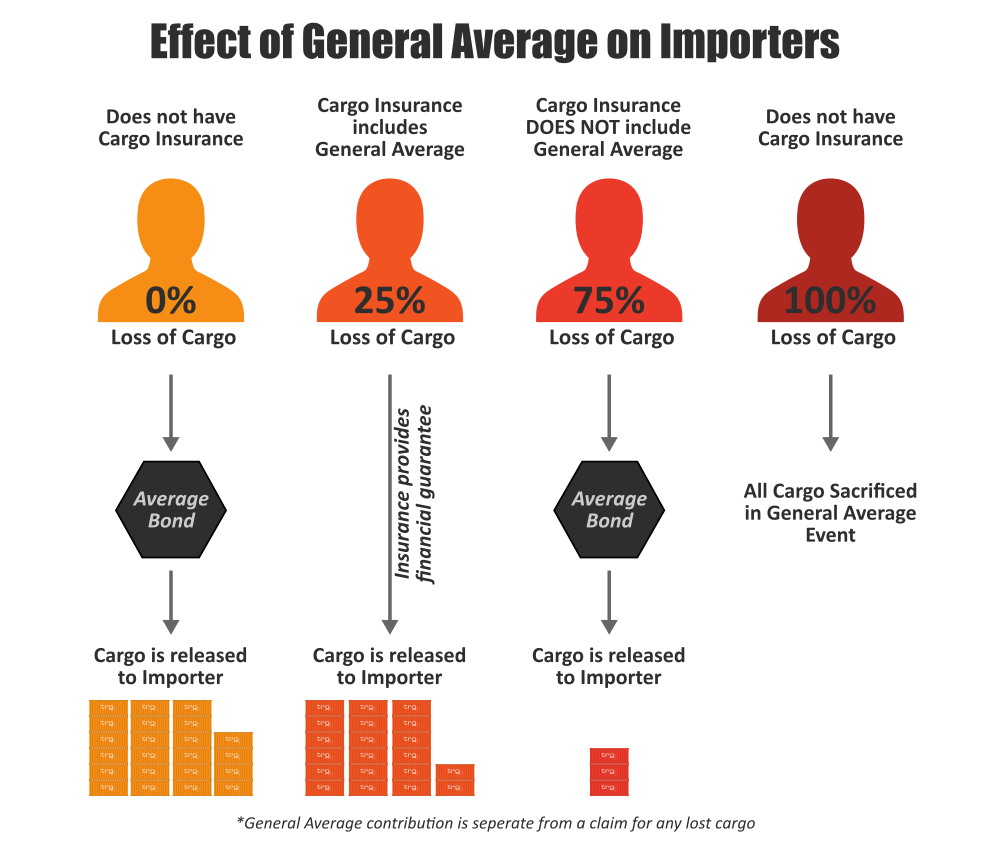

Your transportation carrier will pay your losses only if you purchase specific cargo insurance from them, in these cases the coverage is provided. However, this coverage is usually insufficient and can end up costing you more, as they are not obligated to pay for your losses that occur beyond their control (such as in the case of a General Average Claim).

Also, international law limits the liability of ocean carriers to a minimum of $500 per package. Air carriers similarly limit their liability; truckers, rail carriers, and warehouse owners also limit their liability for loss according to their tariff.

I always sell C & F or buy CIF, why should I change?

You should consider changing because there are some major issues with buying on CIF terms. The first problem with buying on CIF terms is the importer has to deal with an overseas insurance company when a cargo insurance claim occurs.

Chances are you are not a valued client of that insurance company, and even if language barriers are not a problem, which they often are, it’s challenging getting the insurance company’s attention. Secondly, foreign insuring terms are frequently inferior to US terms. Also, if you sell goods C.& F, you have title and responsibility for the goods until they are loaded onto the ship or aircraft.

Why should I purchase through TRG Marine™ when I already purchase it through my Freight Forwarder?

When you purchase through a freight forwarder often times the policy is on limited insuring terms (sometimes referred to as perils only) and isn’t sufficient for your needs. Also, in almost every case the premium rates are higher when acquired through your freight forwarder. These agencies typically mark up their rate for you to create an additional corridor for themselves. Keep in mind freight forwarders are logistics experts, not insurance experts, and cannot provide the best advice and services when it comes to your Marine Cargo Insurance. Furthermore, a freight forwarder’s house policy is generic because they handle a multitude of customers. At TRG Marine™ we are able to build a Marine Cargo Insurance Policy that will fit your needs and drastically reduce your costs.

How is TRG Marine’s™ Quote so much lower than my current provider’s?

TRG Marine’s™ quote is so much lower than your current provider’s because Lloyd’s of London has been around for over 300 years. This experience brings greater understanding, further market relations, and added intelligence to your specialized risk.

With the diversity of the cargo insurance market, many insurance agents scramble to find a policy to “fit within a box.” At TRG Marine™ our cargo insurance specialists don’t work “inside of the box,” allowing them to find a custom solution and deliver very competitive rates. Get a quote for your shipping insurance to see what they can do for you.

How do I get a quotation for an Annual All-Risk Cargo Insurance Policy?

Getting an annual all-risk cargo insurance policy quote is simple. All you have to do is fill out a quote application either online or over the phone. We can help you through the process, and once the application is complete, it only takes 2-3 business days for us to respond with our rates.

Does a TRG Marine™ Policy have a Minimum Annual Premium Deposit?

Yes, the minimum annual premium with annual adjustment available on a TRG Marine™ policy is $750. As the insured, you will be required to make an annual deposit upon binding of a policy.

What is a Standard Cargo Insurance Deductible?

The standard deductible is $1,000, however, options are available upon request for rate adjustments. Please be sure to allocate your deductible on the designated field within your request for a shipping insurance quote.

What do I do in the event of a Cargo Insurance Claim?

In the event of a cargo/shipping insurance claim, TRG Marine™ works as a liaison between you and the insurance company. With years of experience and dedication to assisting our customers, you can be sure to have excellent claim support and guidance. To learn more, read TRG Marine’s™ guide to claims mitigation.

What is the Lloyd’s of London Marine Cargo Insurance Market?

Serving over 200 countries and territories, Lloyd’s of London is known as the premier marine, truck, rail, and air cargo insurer in the World. Lloyd’s is not an insurance company ─ it’s a society of members who underwrite in syndicates on behalf of investment institutions, specialist investors, international insurance companies, and individuals.

In the 1600’s, Lloyd’s came into existence, as its founders realized the cargo insurance needs of international traders. Today, the Lloyd’s Market insures some of the largest and most complicated risks, and provides 44% of its business in the United States and Canada. From celebrity body parts to plasma televisions, from sporting events to financial firms, millions of people are in one way or another covered by Lloyd’s of London.

What is TRG Marine’s™ relationship with Lloyd’s of London?

TRG Marine™ has a relationship with Vectura Underwriting, one of Lloyd’s cover-holders, giving you direct access to the insurance power, capacity, and expertise of Lloyd’s of London. As a cover-holder of Lloyd’s, Vectura Underwriting specializes in niche insurance sectors, working on our behalf to negotiate competitive terms and conditions for TRG Marine™ cargo insurance policy holders. TRG Marine™ works hard to present you with a policy ─ offering the best coverage at the lowest price.

State Regulations & Licensing: TRG Marine™ is a trade name of the Corporation for International Business – dba Boomerang Freight Solutions Insurance Agency in the state of CA, dba Corporation for International Business, Inc. in the states of CT/MA/MO/NM, and dba CIB Insurance Agency, Inc. in the states of FL/MD/NH.

My goods are not at risk so why should I get Marine Insurance?

Although it’s possible that your goods are less prone to loss or damage, you should still have a marine insurance policy in place. Your cargo always runs the risk of a ship sinking, a plane crashing, or some other catastrophic event.

You are also vulnerable to General Average losses. In a recent study, it was concluded that a shipper will be involved in a General Average incident once every eight years. Without a cargo insurance policy in place, this type of incident could potentially lead to a business ending situation.

Get a Quote for Your Marine Cargo Insurance

Contact a TRG Representative today about Marine Cargo Insurance for a free, no obligation quote.

What if Cargo Insurance is too expensive for my company to purchase?

Chances are cargo insurance is not too expensive for your company to purchase, but before this can be properly answered we would need to take a look at your volume by having you fill out an application for a shipping insurance quote. Then, utilizing our buying power, we can come up with cost estimates. At the very least, if you currently have a policy, we can review it and suggest ways it could be improved. It costs you nothing to obtain a quote or advice from TRG Marine™.

What if I cannot find a company that will insure my type of risk?

If you cannot find a company that will insure your type of risk, chances are you haven’t reached out to TRG Marine™. Our volume is much greater than yours, giving us the ability to arrange contracts that you may not be able to. Call us and find out, it costs nothing to get a quote for your shipping insurance.