The Crude Oil trade is one of the largest in the world. Learn about data and trends behind the United States crude oil imports.

Since the many uses of Crude Oil were discovered well over 100 years ago, the substance has been highly sought after in the United States as well as the rest of the world. Although the U.S. holds a considerable amount of oil, there is still the need to import from other countries. The tradition of importing oil has grown since the middle of the 1960s.

A Brief History of Crude Oil in the United States

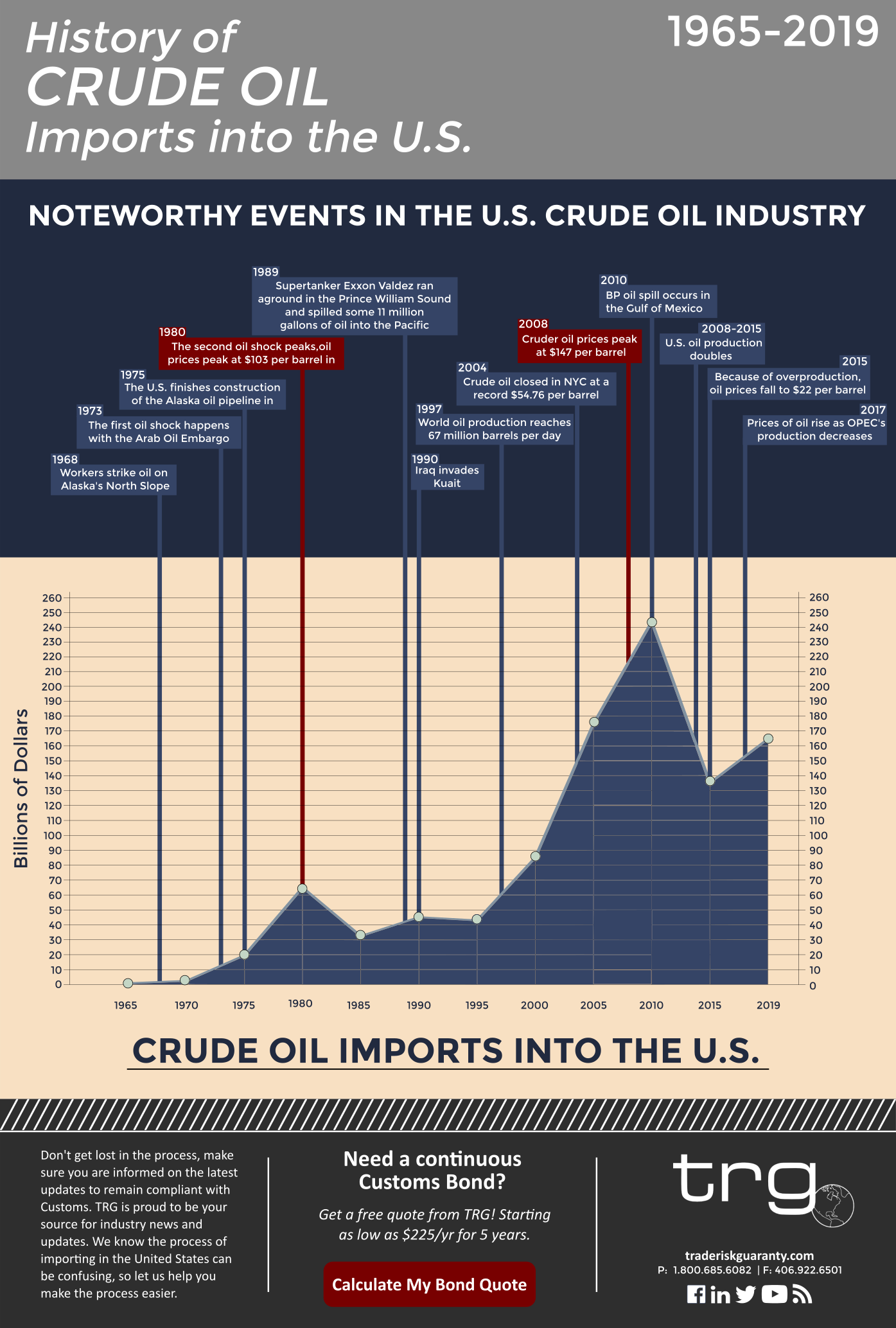

The price of Crude Oil has always been volatile and dependent on changing geopolitical relations. Historical events have played a large role in the change in the price of oil, this can be depicted in our infographic below.

- By 1960, the need for crude oil had been firmly solidified. However, the U.S. was still producing almost all of their oil instead of importing it so the United States crude oil imports were minimal at this time. Around this time the 3rd world countries where many of these oil fields were located in took control of their countries natural wealth. In 1960 the Organization of Petroleum Exporting Countries (OPEC) was formed to control the production and price of oil.

- The demand for foreign oil grew immensely through the 1970s, spending on imports increased tenfold in this decade. In 1973 OPEC retaliated against the U.S. providing support to Israel. The Arab Oil Embargo raised oil prices and caused panic across the United States. Cars lined up outside gas stations in fear that fuel would run out.

- In 1980, due to the Iranian Revolution, the price of oil spiked at $103 per barrel and spending on oil spiked. In turn, overproduction drove the price of oil down significantly by 1981. This spike in price can be depicted in the graph below.

- To reduce the need for imported Crude Oil, the U.S. created the Alaska oil pipeline to provide some stability in the market. Oil was first found in Alaska in 1968 and the U.S. began production on the Alaska oil pipeline in 1975. The pipeline caused the U.S. to import less oil.

- In the 2000s spending on oil increased at an alarming rate. Attributed to various geopolitical reasons and a shortage of supply, the price of oil peaked at a record high in 2008 at $147 per barrel. In response, production again increased and the US doubled oil production after 2008.

United States Crude Oil Imports Data

From the graphic, it is apparent that spending on Crude Oil increases as the price of oil increases. Two spikes, in 1980 and 2008 represent the highest oil prices relative to the years surrounding them. When there is a large excess of Crude Oil, overall spending decreases drastically.

Click the image for a downloadable PDF

The Current Crude Oil Industry in the United States

In 2018 $129 Billion worth of Crude Oil was imported into the United States, this made up 6% of all imports in 2018. This is drastically lower than the $335 Billion of oil brought into the States in 2008. This number is due to a decreased price of oil and an increase in the production of U.S. oil.

Currently, oil is not part of the continuing trade war and there are no tariffs on oil imports into the U.S. It is very likely that oil will not play a part in this trade war. The main country that brings Crude Oil into the U.S. is Canada, which supplies the U.S. with around 43% of total Crude Oil imports.

U.S. imports of OPEC oil reached a 30 year low earlier this summer in June 2019, slowly the U.S. has weaned itself of its dependence to OPEC oil.