Looking at the number of insufficient Customs Bonds TRG has seen throughout 2025 provides a direct look into the impacts tariffs are having on importers.

In the typical importing climate, the U.S. Customs bond is a component of the importing process that a business can get secure and then not pay too much attention to during their day-to-day. However, during times of turbulence, suddenly there is a spotlight on the U.S. Customs bond as companies have to scramble to ensure they are properly bonded.

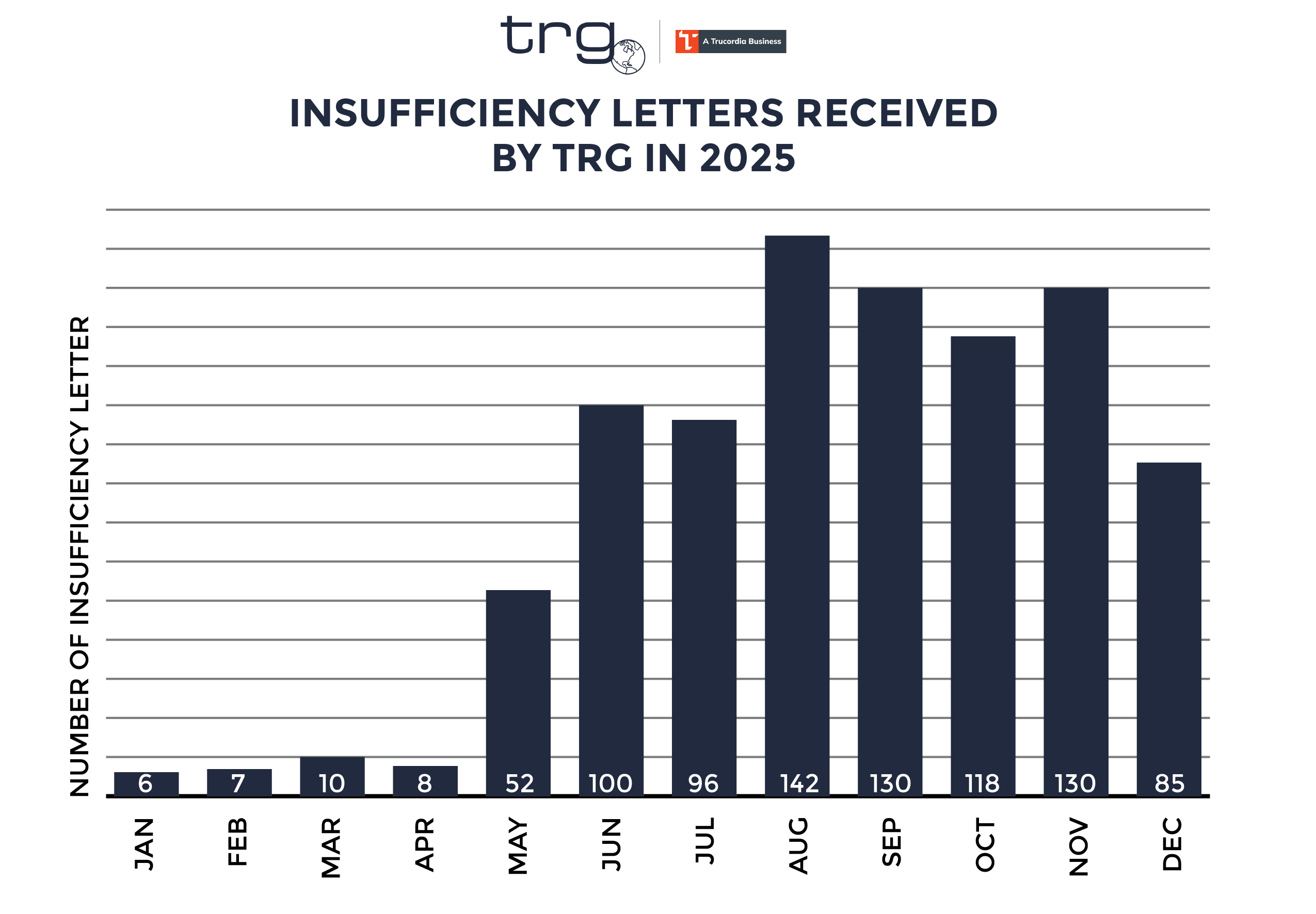

Possibly the best depiction of this turmoil is in the number of insufficiency letters TRG has received per month throughout 2025. In the graph below, you can plainly see the sharp increase in the number of letters in the second half of the year.

Why Did the Number of Insufficient Customs Bonds Increase in May 2025?

In April 2025, the first iteration of the reciprocal tariffs, also known as the IEEPA tariffs, went into effect. These higher duties rates had an immediate and wide-spread impact on the U.S. businesses. Not only were these businesses paying much more in duties, taxes, and fees, this increased duty rate was immediately impacting the sufficiency of their U.S. Customs bond.

When an importer goes over 100% of their bond sufficiency, U.S. Customs and Border Protection will sent out an insufficiency letter to each importer. This letter will let the importer know that they must increase their bond within a set timeframe (typically 30 days) or their bond will be deemed insufficient and they will no longer be allowed to import into the United States.

From there the cause and effect becomes very clear: tariffs go into effect which then means importers are paying more for their duties, taxes, and fees which then causes their current bond to be deemed insufficient and an insufficiency letter to be sent out.

The increase in the number of insufficiency letters sent out throughout 2025 is a directly result of the tariffs imposed and give clear snapshot of the increased pressure the trade industry is facing.

What To Do When Your Bond is Deemed Insufficient?

If you receive an increase letter from CBP, you must act quickly in order to get a new, sufficient bond in place. In the insufficiency letter itself, CBP will state the minimum bond amount they require your bond to be increased to. However, this amount may not be sufficient for the next 365 days of importing for your company.

As the importer of record, it is your company’s responsibility to ensure the bond size you choose will remain sufficient for a full calendar year. If this ‘new’ bond is then deemed insufficient within the next 365 days, you will, once again, be required to place a larger bond. This can lead to increased and unnecessary stacking liability which may result in the surety requiring collateral in order to place your bond.

Monitoring Your Bond Sufficiency

Although you are able to monitor your Bond Sufficiency by manually tracking the duties, taxes, and fees you paid on every entry in the past 365 days, it is much more accurate to be able to access your import data directly from CBP and/or your bond provider. This will allow you to keep a direct eye on the values CBP has on file for your entries.

Bond Sufficiency Report From Trade Risk Guaranty

At Trade Risk Guaranty we receive data directly from U.S. Customs and Border Protection on every bond that we hold. Not only does this allow us to provide claims monitoring and assistance but it also allows us to provide a comprehensive bond sufficiency report. Our Bond Sufficiency Report calculates the percentage of the bond capacity an importer has currently utilized. This report has helped importers monitor their bond sufficiency in real-time and properly prepare for an increase when necessary.

Want to access your Bond Sufficiency Report from TRG? Use the appropriate link below to gain access to your report!

- Not Currently a TRG Customer? Get a Quote on Your U.S. Customs Bond from TRG Today!

TRG can only provide data on the bonds we carry. Therefore, in order to access a complete Bond Sufficiency Report, you have a bond on file with TRG for a year. - Already a TRG Customer? Learn more about Eagle Eye ACE to access your Bond Sufficiency Report!

Additional cost may be required for full access to Eagle Eye ACE.

![[Webinar] How Could Changes to De Minimis Impact Your Company?](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2025/05/trg-how-de-minimis-impacts-customs-bond-webinar-400x250.png)