A CF-28 is the first step towards a claim from Customs.

After you have imported goods into the United States, there is a chance that you may receive a Customs Form 28 (CF-28) concerning the entry you made. If you receive a CF-28 from Customs and Border Protection, don’t panic, but do take it seriously.

What is Customs Form 28 (CF-28)?

A CF-28 is a formal request for information from Customs that typically arises during the process of Liquidation. When reviewing entry paperwork, CBP sometimes finds incomplete, inaccurate or insufficient information. When the information is deemed insufficient, CBP cannot make a decision and will send a Customs Form 28 to importers.

Customs will request more information pertaining to the specifics of what was imported. The form may give the importer an opportunity to add additional information, clarify what was provided, or provide a sample of the imported product. Whatever Customs asks for, honesty is the best policy.

The Process of Receiving a CF-28

Reasons to receive a CF-28 include HTS code classification, intellectual property rights (trade names, copyright, etc..), valuation, related parties, or antidumping . Ignoring a CF-28 is not an option, as it can lead to bigger problems:

- At the time of the entry or shortly thereafter, if Customs believes the entry has been misclassified or is uncertain of other details, it will issue a CF-28 requesting additional information.

- If Customs does not receive the information timely or the information is marginal or incomplete, they will make a determination and issue a CF-29 informing the importer of the action that will be taken.

- Depending on what the CF-29 states, a Supplemental Duty Bill may be issued.

Timeline of a CF-28

The timeline of a CF-28 is quick and gives importers little time to respond to customs:

- An importer has 30 days after the issue date to respond, in writing, to Customs.

- If a response is not received within the timeframe, Customs will make a determination with the information available.

- Oftentimes, Customs presumes the least favorable interpretation of the facts, leaving the importer in a financial disadvantage.

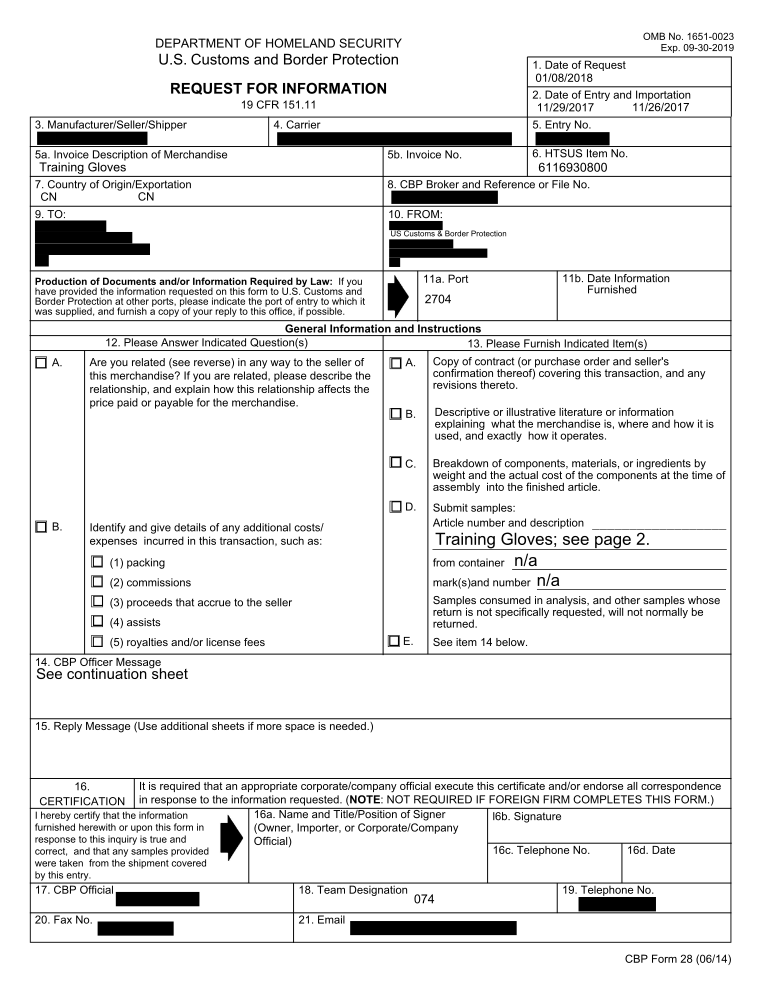

Example of a CF-28

A CF-28 will ask you to fill out a series of checkboxes and describe or improve on details that Customs is looking for. One important feature of the document is at the bottom where a signature is required to certify that information is correct. Whoever signs this document can be held liable if Customs disagrees with the information provided.

How To Avoid a CF-28

There are some simple practices to abide by which should help you avoid future CF-28s:

- Review your current HTS classifications to ensure accuracy

- Never let a foreign supplier classify your goods

- Work honestly with Customs

- Correctly fill out all paperwork during the entry process

What To Do With a CF-28

It is important to react fast and efficiently with a CF-28. Some good tactics to use when dealing with a CF-28 are:

- Have an action plan for receiving a CF-28

- Respond immediately

- Call Customs about their inquiry

- Talk with your Customs Broker

- Fully answer all parts of the CF-28

![[Webinar] How Could Changes to De Minimis Impact Your Company?](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2025/05/trg-how-de-minimis-impacts-customs-bond-webinar-400x250.png)

![[Webinar] United States Reciprocal Tariffs – The What, Why, and How](https://traderiskguaranty.com/trgpeak/wp-content/uploads/2025/04/trg-webinar-reciprocal-tariffs-400x250.png)